The Singapore CPF Contribution is a cornerstone of the nation’s social security framework, designed to provide citizens and permanent residents with financial support throughout their lives. As we approach 2025, understanding the CPF contribution rates becomes increasingly important, particularly with new adjustments aimed at enhancing CPF savings and retirement. These contributions not only assist in building a robust savings plan but also extend to crucial areas like healthcare and housing, ensuring comprehensive financial well-being. By effectively calculating CPF contributions, individuals can maximize their savings potential while maintaining a balance between immediate financial demands and long-term security. This integrated approach to financial planning embodies Singapore’s commitment to fostering economic resilience and empowering its workforce for a sustainable future.

When discussing Singapore’s Central Provident Fund (CPF), it’s essential to recognize its role as an extensive social security system that encourages disciplined savings among its citizens and permanent residents. The CPF contribution framework encompasses a collaborative effort between employers and employees, aiming to build financial security through structured savings for healthcare, housing, and retirement needs. As we look ahead to the new contribution rates effective in 2025, understanding how to calculate CPF contributions becomes crucial for effective financial management. This systematic approach not only aids in accumulating necessary funds but also aligns with Singapore’s vision of promoting economic stability and fostering a financially literate society. Thus, the CPF system remains a vital instrument in ensuring individuals are prepared for their future financial obligations.

Overview of Singapore CPF Contribution Rates 2025

In 2025, Singapore’s CPF contribution rates will reflect a progressive approach designed to enhance the financial well-being of its citizens and residents. With the introduction of new tiered rates, both employees and employers can better manage their contributions while ensuring adequate savings for retirement, healthcare, and housing. The revised structure is expected to cater to the diverse needs of the workforce, particularly as it adapts to the changing economic landscape. This initiative not only aims to boost the savings potential of individuals but also promotes a sustainable model for social security in Singapore.

For those looking to understand how these changes affect their financial planning, it’s essential to familiarize oneself with the specific contribution rates applicable based on age and income levels. The new framework emphasizes inclusivity, ensuring that even lower-wage workers benefit from a robust support system. As the CPF continues to play a pivotal role in Singapore’s social security strategy, understanding these rates will empower employees to make informed decisions about their financial futures.

How to Calculate CPF Contributions for Maximum Benefits

Calculating your CPF contributions accurately is crucial for maximizing your benefits under the CPF system. To begin, aggregate your Ordinary Wages (OW) and Additional Wages (AW) to arrive at the total wages. This figure is then used to determine the applicable contribution rate based on your age and income bracket. It’s important to note that contributions are capped at a monthly wage of $7,400, meaning higher earners will need to strategize to ensure they’re making the most of their CPF contributions.

After determining your total wages, apply the correct contribution rate to find out how much will go into your CPF accounts. Remember to follow the rounding rules for precision, especially when calculating the employer’s share. By understanding and effectively calculating your CPF contributions, you can ensure that you have adequate savings for healthcare, housing, and retirement, thereby securing a stable financial future.

The Role of CPF in Singapore’s Social Security System

The Central Provident Fund (CPF) serves as a cornerstone of Singapore’s social security framework, providing essential financial support for citizens and permanent residents throughout their lives. By mandating contributions from both employers and employees, the CPF system fosters a culture of saving, ensuring individuals are equipped to handle their basic needs, including healthcare and housing. This dual contribution mechanism not only helps in building personal wealth but also strengthens the economy by promoting responsible financial habits.

As Singapore evolves, the CPF’s role continues to expand, adapting to the changing demographics and economic conditions. The government’s focus on enhancing CPF contributions and benefits demonstrates a commitment to social welfare and financial resilience. Through educational initiatives and resources, the CPF system encourages individuals to take charge of their financial futures, leading to a more secure and prosperous society.

Benefits of CPF Savings for Healthcare and Housing

CPF savings play a vital role in managing healthcare costs, particularly through the MediSave account, which allows individuals to set aside funds for medical expenses such as insurance premiums and hospital bills. This proactive approach alleviates financial burdens during health emergencies, ensuring that citizens can access necessary care without incurring crippling debts. Furthermore, the CPF system is designed to adapt to the evolving healthcare landscape, providing support that aligns with the needs of Singapore’s aging population.

In addition to healthcare, CPF funds are instrumental in facilitating home ownership. Singaporeans can utilize their CPF savings to pay for housing loans or purchase HDB flats, which is crucial for achieving stability and fostering a sense of community. This dual-purpose functionality of CPF savings not only supports individual aspirations but also contributes to the overall economic stability of the nation.

Understanding Ordinary and Additional Wages in CPF Contributions

To fully grasp how CPF contributions are calculated, it’s important to differentiate between Ordinary Wages (OW) and Additional Wages (AW). OW refers to the regular salary an employee earns, while AW encompasses bonuses and any non-recurring payments. Both types of wages are subject to different contribution rates, affecting how much individuals can accumulate in their CPF accounts over time. Understanding these distinctions helps employees plan their finances more effectively and ensures they are making the most of their CPF contributions.

The tiered contribution system means that employees need to be aware of their total earnings each month, as this directly impacts their contributions. By leveraging both OW and AW strategically, employees can optimize their CPF savings, thereby enhancing their financial security for the future. Additionally, employers must also be diligent in their calculations to ensure compliance with CPF regulations, thus fostering a transparent and accountable workplace.

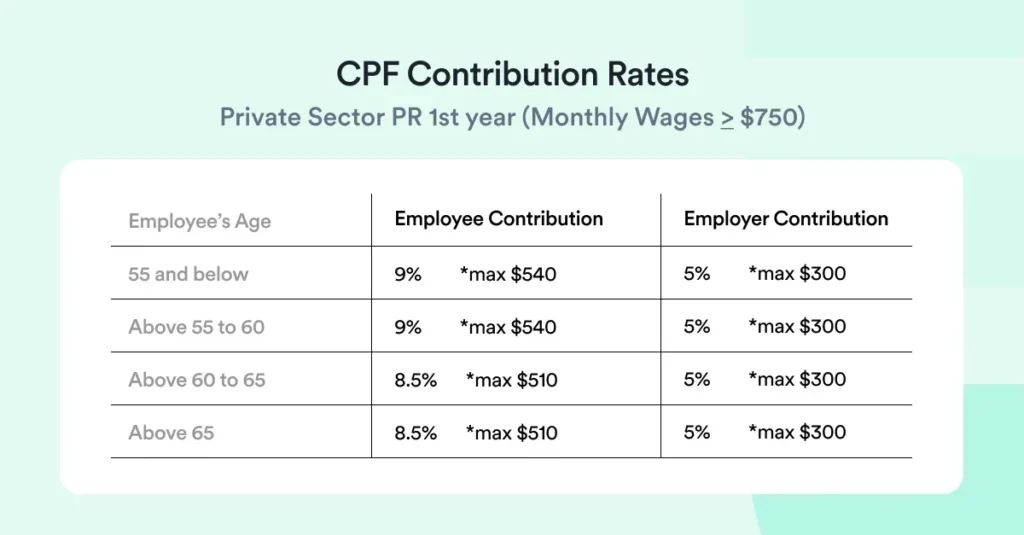

The Impact of Age on CPF Contribution Rates

Age is a critical factor in determining CPF contribution rates, as the system is designed to provide varying levels of support throughout an individual’s career. For instance, younger employees typically have higher contribution rates, which gradually decrease as they age. This structure not only supports employees in their early working years but also ensures that those approaching retirement can still accumulate significant savings. The rationale behind this approach is to promote financial stability at every life stage, allowing employees to build a robust foundation for their retirement.

Understanding how age affects CPF contributions can lead to better financial planning. Younger employees should focus on maximizing their contributions early on to take advantage of compound interest and grow their CPF savings. Conversely, older employees need to be mindful of their retirement goals and adjust their savings strategies accordingly. By recognizing the impact of age on CPF contributions, individuals can make informed decisions that align with their long-term financial objectives.

Future Trends in CPF Contributions and Social Security in Singapore

As Singapore continues to evolve, so too will its CPF system and contribution rates. The government is committed to reviewing and adjusting these rates regularly to reflect the changing economic landscape and demographic needs. This proactive approach ensures that the CPF remains relevant and effective in providing social security for all Singaporeans. Trends indicate a growing emphasis on increasing flexibility in CPF usage, allowing individuals to tailor their contributions and withdrawals to better suit their personal financial situations.

Moreover, with the rise of digital solutions and fintech innovations, CPF contributions will likely become more accessible and easier to manage. Enhanced transparency and real-time tracking of contributions can empower individuals to take more control over their financial well-being. As Singapore moves forward, the adaptability of the CPF system will be crucial in addressing the diverse needs of its workforce while maintaining the core objective of ensuring financial security for all.

The Importance of Financial Literacy in Managing CPF Contributions

Financial literacy plays a pivotal role in managing CPF contributions effectively. With a solid understanding of how the CPF system operates, individuals can make informed decisions regarding their savings and investments. This knowledge enables them to optimize their contributions based on their earnings, ensuring they are maximizing their benefits from the CPF system. Additionally, being financially literate allows employees to comprehend the implications of different contribution rates and how they affect their long-term financial goals.

Furthermore, as the CPF system evolves, individuals equipped with financial knowledge are better prepared to adapt to changes in contribution rates and policies. They will be able to assess how these changes impact their retirement planning, healthcare needs, and housing aspirations. Encouraging financial education across the workforce will not only empower individuals but also contribute to a more robust economy, as people become more proactive in managing their financial futures.

Strategies for Maximizing CPF Savings for Retirement

Maximizing CPF savings for retirement requires a strategic approach that considers both current contributions and future needs. One effective strategy is to contribute more than the mandatory amount when possible, especially during peak earning years. This additional contribution can significantly boost long-term savings, providing a more substantial safety net during retirement. Employees should also remain informed about their account balances and the interest rates applicable, as these factors play a crucial role in the growth of their CPF savings.

Another essential aspect is understanding the various CPF accounts available and how they can be utilized effectively. For instance, allocating savings to the Special Account (SA) can yield higher interest rates, which is beneficial for retirement planning. Additionally, utilizing the CPF Investment Scheme allows individuals to further grow their savings through investment options. By employing these strategies, individuals can ensure they are well-prepared for a financially secure retirement.

Frequently Asked Questions

What are the CPF contribution rates for 2025 in Singapore?

The CPF contribution rates for 2025 vary by age group. For employees aged 55 and below, the total contribution rate can go up to 37%. For those aged 55 to 60, it’s 32.5%, while for employees aged 60 to 65, the rate is 23.5%. These rates are designed to enhance savings for retirement, housing, and healthcare.

How do I calculate my CPF contributions in Singapore?

To calculate your CPF contributions, first determine your total wages by adding your Ordinary Wages (OW) and Additional Wages (AW). Then, apply the relevant contribution rate based on your age. For accuracy, follow the rounding rules and remember to separate the employee’s share from the employer’s share.

What role does the Singapore CPF system play in social security?

The Singapore CPF system is a cornerstone of the nation’s social security framework, providing financial support for retirement, housing, and healthcare needs. It encourages disciplined savings among citizens and residents, ensuring they can meet essential needs throughout their lives.

How do CPF contributions affect my retirement savings in Singapore?

CPF contributions significantly impact retirement savings by accumulating funds over time. The contributions, which include both employee and employer shares, are invested and grow tax-free, ensuring that individuals have a steady income post-retirement for financial security.

Can CPF contributions be used for healthcare expenses in Singapore?

Yes, CPF contributions can be utilized for healthcare expenses through the MediSave account, which helps cover insurance premiums and medical costs. This feature alleviates financial burdens during health emergencies, making CPF contributions vital for healthcare planning.

What is the significance of CPF contributions for housing in Singapore?

CPF contributions play a crucial role in housing affordability in Singapore. They can be used to pay for HDB loans or purchase flats, promoting homeownership and stability for citizens and residents, which is essential for long-term financial planning.

Are there any changes to CPF contribution rates in 2025?

Yes, CPF contribution rates will see adjustments in 2025, aimed at enhancing savings potential for employees while being affordable for employers. These changes reflect the evolving needs of the workforce and focus on promoting long-term financial security.

| Age Group | Monthly Wages | Total Contribution Rate | Employee’s Share | Employer’s Share |

|---|---|---|---|---|

| 55 and Below | ≤ $50 | Nil | Nil | Nil |

| 55 and Below | $50 – $500 | 17% | Nil | 17% |

| 55 and Below | > $750 | 37% | 20% | 17% |

| 55 to 60 | > $750 | 32.5% | 17% | 15.5% |

| 60 to 65 | > $750 | 23.5% | 11.5% | 12% |

Summary

Singapore CPF Contribution is a critical component of the nation’s social security framework, designed to provide financial security for its citizens and permanent residents. The CPF system encourages disciplined saving for essential needs such as healthcare, housing, and retirement. With the introduction of new contribution rates in 2025, the CPF aims to enhance savings potential while balancing affordability for both employers and employees. This tiered contribution structure reflects a commitment to catering to the diverse needs of Singapore’s workforce, promoting long-term financial stability and resilience.