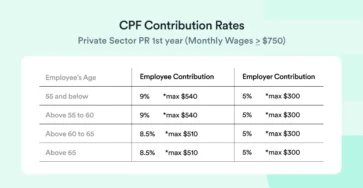

The Singapore CPF Contribution is a cornerstone of the nation’s social security framework, designed to provide citizens and permanent residents with financial support throughout their lives.As we approach 2025, understanding the CPF contribution rates becomes increasingly important, particularly with new adjustments aimed at enhancing CPF savings and retirement.

CPF contribution rates 2025

CPF Contributions: Updates and Details for 2025

In Singapore, CPF contributions play a pivotal role in securing financial stability for employees, as mandated by the Central Provident Fund (CPF) system.This mandatory social security savings scheme ensures that both employers and employees contribute to various CPF accounts, which are essential for retirement, healthcare, and housing needs.