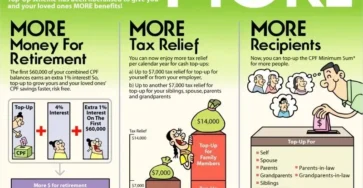

CPF retirement planning is a vital aspect of securing financial stability for Singaporeans as they approach their golden years.The Central Provident Fund (CPF) system not only provides a solid framework for retirement savings but also adapts to the evolving needs of retirees, especially with the CPF updates for 2024.

CPF

Singapore Employment Fraud: Eleven Arrested for Deceptions

Singapore employment fraud has emerged as a pressing issue, particularly highlighted by the recent arrest of eleven individuals accused of supplying the Ministry of Manpower (MOM) with false employment information.These suspects, including directors of several construction companies, allegedly manipulated hiring quotas for foreign workers by inflating the number of local employees through deceitful Central Provident Fund (CPF) contributions.

Singapore January $1,080 Payment: Overview and Eligibility

In January 2025, Singapore will distribute its much-anticipated quarterly payment of up to $1,080 under the Silver Support Scheme, reinforcing the nation’s dedication to senior citizens support.This initiative is designed to provide financial assistance for seniors who may be facing challenges due to limited savings or income, ensuring a dignified retirement.

Workfare Income Supplement Singapore: Benefits for Workers

The Workfare Income Supplement Singapore (WIS) program is a crucial initiative aimed at supporting lower-income individuals, particularly in the growing gig economy.As Singapore gears up for the WIS eligibility 2024, platform workers will benefit from significant enhancements that address their unique challenges, such as inconsistent income and lack of job security.

Medisave Payment February 2025: What to Expect

The Medisave Payment in February 2025 is set to provide significant financial support to many Singaporeans.Beginning on February 11, eligible individuals will receive an automatic top-up of S$150 credited directly into their CPF Medisave accounts as part of the Assurance Package Medisave initiative.

Vibrant Group Lawsuit Victory Against Former Executives

In a significant turn of events, the Vibrant Group lawsuit victory marks a pivotal moment in corporate accountability, as the High Court of the Republic of Singapore ruled in favor of the company against former executives Peng Yuguo and Tong Chi Ho of Blackgold Australia.The court found that these individuals had falsified accounts and inflated sales figures, leading to substantial financial losses for Vibrant Group.

Singapore Pension Reforms 2025: Key Changes Explained

The Singapore Pension Reforms 2025 are poised to reshape the landscape of retirement security for many citizens, addressing critical needs in today’s dynamic socio-economic environment.With a focus on improving pension payouts, expanding retirement eligibility, and introducing flexible retirement options, these reforms aim to provide a more sustainable and equitable system for all.

Armenia Country Partnership Framework: A New Initiative

The Armenia Country Partnership Framework represents a significant commitment by the World Bank to address the pressing issues facing the nation over the next five years.With a focus on poverty reduction Armenia, the framework aims to create sustainable development Armenia by fostering job creation Armenia and enhancing human capital.

Country Partnership Framework: A New Era for Pakistan

The Country Partnership Framework (CPF) is a pivotal initiative launched by the World Bank aimed at fostering economic stability in Pakistan.This landmark $20 billion collaboration, developed over a decade of strategic partnership, seeks to enhance employment opportunities and promote digital transformation across various sectors.

CPF Special Account Closure Affects 1.4 Million Members

The recent CPF Special Account closure has significant implications for approximately 1.4 million CPF members aged 55 and above.As of January 19, 2025, these members no longer maintain a Special Account, as the CPF Board has streamlined their account structure to include an Ordinary Account (OA) and a Retirement Account (RA).