The GST Vouchers Payment 2024 is a significant initiative by the Singapore government aimed at easing the financial burden on its citizens amid rising living costs. Designed to support lower- and middle-income households, this program offers various forms of assistance, including cash payouts, MediSave contributions, utility rebates, and service charge help. As part of the revised scheme for 2024, eligible Singaporeans can expect increased payouts, making it easier to manage everyday expenses. Understanding the eligibility for GST Voucher, the new payout amounts, and how to apply for GST Voucher will be crucial for those seeking financial relief. Additionally, familiarizing oneself with the GST Voucher payment methods ensures a seamless experience in receiving these benefits.

In 2024, the GST Vouchers Payment program represents an essential support mechanism for Singaporeans facing economic challenges. This financial aid scheme, aimed at lower- and middle-income residents, has been updated to enhance the assistance provided through various channels, including cash benefits, healthcare subsidies, and household utility rebates. Citizens interested in accessing these funds will need to confirm their eligibility for the GST Voucher, which considers factors such as age and income. Furthermore, understanding the different payout amounts and application processes can significantly impact how effectively individuals can utilize this program. To maximize the benefits, residents must also explore the different payment methods available, ensuring they receive their aid in a timely manner.

Understanding GST Vouchers Payment 2024

The GST Vouchers Payment 2024 is an essential initiative by the Singapore government aimed at alleviating the financial burden on lower- and middle-income households. As the cost of living continues to rise due to inflation, these vouchers provide a vital lifeline, ensuring that citizens can manage their expenses more effectively. This year, the government has made significant enhancements to the voucher amounts, reflecting the increasing needs of the population. With a focus on direct cash assistance, healthcare support through MediSave, and rebates for utilities, the GST Voucher scheme remains a critical component of Singapore’s social support framework.

In 2024, the GST Vouchers Payment will not only increase in amount but also broaden its reach to encompass more households. Eligible citizens can expect a cash payout that varies based on their income and property value, with an emphasis on supporting those most in need. By distributing these vouchers annually, the government ensures that financial assistance is timely and relevant, helping citizens navigate the challenges posed by rising prices in essential goods and services.

Eligibility for GST Voucher in 2024

To qualify for the GST Voucher in 2024, applicants must meet certain eligibility criteria that focus on age and income levels. Specifically, individuals must be Singaporean citizens aged 21 years or older by the end of 2023. Additionally, seniors who wish to benefit from the MediSave component must be at least 65 years old in 2024. The income threshold is also a critical factor, with individual taxpayers limited to an annual income of $34,000 and households capped at $68,000. This careful structuring ensures that the most vulnerable segments of the population receive the support they need.

Moreover, the eligibility assessment also considers property ownership, which may affect the application process based on the property’s Annual Value (AV). This multi-faceted eligibility approach aims to ensure that the GST Voucher scheme is targeted effectively to those who require financial assistance the most, reinforcing the government’s commitment to supporting lower-income households in Singapore.

GST Voucher Payout Amounts for 2024

The payout amounts for the GST Voucher scheme in 2024 have been significantly increased to provide greater financial relief to eligible Singaporeans. Cash payouts now range from $450 to $850, depending on the applicant’s income level and property value. This increase from previous years highlights the government’s responsive measures to the escalating cost of living. The changes in payout amounts are designed to ensure that those with lower incomes and property values receive the maximum benefit, thereby enhancing their ability to cope with rising expenses.

Additionally, the MediSave component offers tailored support based on age, with seniors receiving between $250 to $450 depending on their age group. The U-Save rebates for households also provide substantial quarterly relief, further easing utility costs. Collectively, these adjustments illustrate the government’s proactive stance in providing comprehensive financial support through the GST Voucher scheme, ensuring that all eligible participants can receive meaningful assistance.

How to Apply for the GST Voucher

Applying for the GST Voucher in 2024 is a straightforward process designed to facilitate access for all eligible citizens. Those who meet the eligibility criteria can submit their applications through the Gov Benefits Portal, which serves as the primary platform for government financial assistance. The online application process is user-friendly and allows applicants to upload necessary documents quickly.

For individuals who have previously registered for government payouts, the process is even more streamlined, as their information will be automatically retrieved, ensuring a hassle-free experience. This efficient system encourages all eligible citizens to take advantage of the GST Voucher scheme, enabling them to receive the financial support they need without unnecessary delays.

Payment Methods for GST Voucher 2024

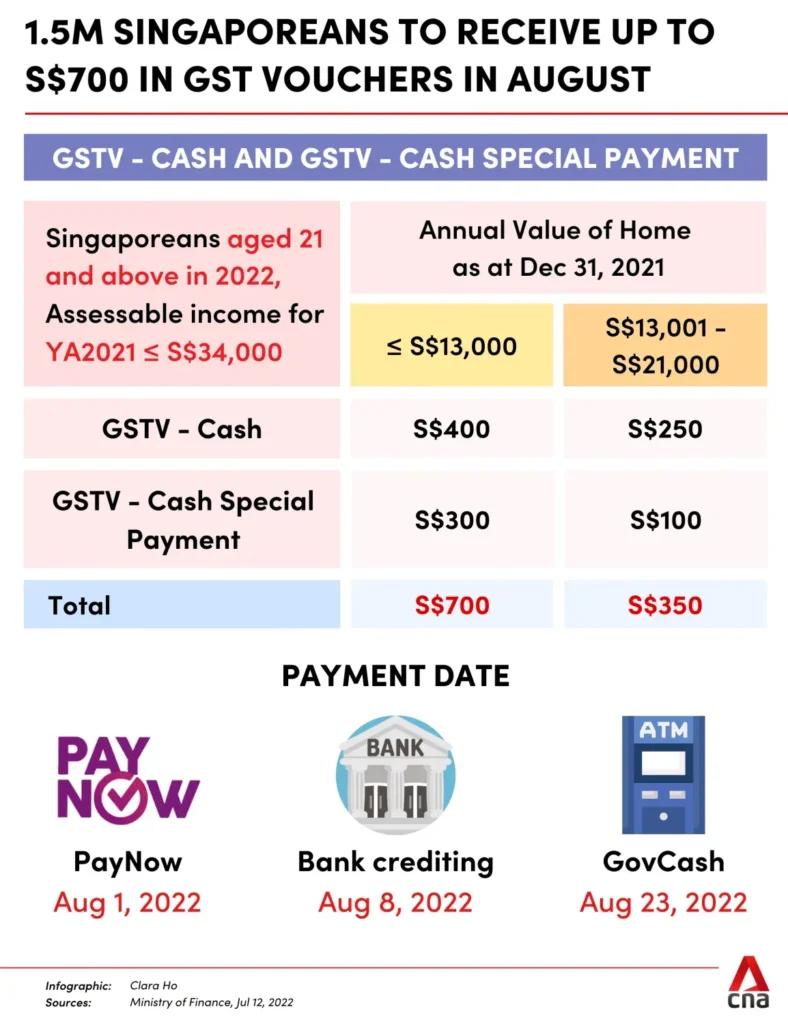

The convenience of receiving the GST Voucher 2024 payout is highlighted by the multiple payment methods available to eligible citizens. The government has streamlined the payout process, providing options such as PayNow, Bank Transfer, and GovCash. For those who have linked their NRIC to PayNow, payments will be credited directly to their bank accounts, offering immediate access to funds.

Individuals who have registered their bank details in advance will also benefit from direct bank transfers, ensuring that the payout reaches them securely and promptly. For those without a linked bank account, the GovCash system provides an alternative method to receive their payments, ensuring that no eligible citizen is left without access to their entitled support. This variety of payment options reflects the government’s commitment to making the GST Voucher scheme accessible and user-friendly.

Checking Your GST Voucher Status

Once you have applied for the GST Voucher, it is essential to keep track of your application status. Citizens can easily check the status of their GST Voucher payouts at any time using the Singpass app. This app provides a secure platform for users to log in and view their details, including application status and payout amounts.

The ability to monitor your GST Voucher status online not only enhances transparency but also allows citizens to plan their finances accordingly. By providing real-time updates through the Singpass app, the government ensures that all eligible participants are informed about their benefits, reinforcing the importance of this assistance in managing the rising cost of living.

Understanding the Components of GST Vouchers

The GST Voucher scheme comprises four key components designed to address various financial needs. The cash component provides immediate monetary support to low-income individuals, while the MediSave portion specifically aids seniors with their healthcare expenses. Additionally, the U-Save rebates help reduce household utility bills, and the Service and Conservancy Charges (S&CC) rebate assists with maintenance costs for public housing estates.

Each component of the GST Voucher is tailored to meet the distinctive needs of different demographic groups within Singapore. By offering a multifaceted approach to financial support, the government ensures that all aspects of living expenses are considered, making the GST Voucher scheme a comprehensive safety net for those who need it most.

Impact of GST Vouchers on Cost of Living

The GST Voucher scheme plays a crucial role in mitigating the impact of rising living costs for Singaporeans. By providing direct financial assistance, the government helps citizens cope with inflation and the increasing prices of essential goods and services. The enhanced payouts for 2024 are particularly significant, as they reflect a responsive approach to the ongoing economic challenges faced by lower- and middle-income households.

Furthermore, the various components of the GST Voucher, including cash payments, MediSave contributions, and utility rebates, collectively contribute to a substantial reduction in financial strain. This holistic support system is vital for maintaining the quality of life for many Singaporeans, especially in times of economic uncertainty, demonstrating the government’s commitment to social welfare and economic stability.

Future of GST Vouchers in Singapore

As Singapore continues to evolve, the GST Voucher scheme is likely to adapt to changing economic conditions and the needs of its citizens. The government’s ongoing review of the scheme ensures that it remains relevant and effective in providing support to those who need it most. Future enhancements may include further increases in payout amounts or adjustments to eligibility criteria to encompass a broader range of households.

Moreover, the integration of technology in the application and payment processes signifies a shift towards a more efficient and user-friendly system. As more citizens become familiar with digital platforms, the government can leverage these tools to improve outreach and accessibility, ensuring that all eligible Singaporeans can benefit from the GST Voucher scheme in the years to come.

Frequently Asked Questions

What is the GST Vouchers Payment 2024 in Singapore?

The GST Vouchers Payment 2024 is part of Singapore’s government initiative designed to assist lower- and middle-income households with the rising cost of living. The scheme offers cash payouts, MediSave contributions, utility rebates, and service charge rebates, with enhanced payouts for 2024.

What are the eligibility criteria for the GST Voucher in 2024?

To be eligible for the GST Voucher in 2024, applicants must be Singaporean citizens aged at least 21 years as of December 31, 2023, and meet specific income criteria, with annual income not exceeding $34,000 for individuals and $68,000 for households.

What are the GST Voucher payout amounts for 2024?

In 2024, the GST Voucher payout amounts have increased, with cash rebates ranging from $450 to $850, depending on income and property value. Additional payouts include MediSave amounts based on age and U-Save rebates for different HDB flat types.

How can I apply for the GST Voucher in 2024?

Eligible citizens can apply for the GST Voucher 2024 through the Gov Benefits Portal. If you are already registered for previous government payouts, the application process will be automatic.

What payment methods are available for GST Vouchers Payment 2024?

For the GST Vouchers Payment 2024, citizens can receive their payouts through various methods: PayNow for direct bank credits, bank transfers for those with registered bank details, and GovCash for individuals without linked bank accounts.

How can I check my GST Voucher status for 2024?

To check your GST Voucher status for 2024, you can use the Singpass app, which allows you to securely log in and view your profile details, including the status of your GST Voucher payouts.

| Key Component | Description | Eligibility Criteria | Payout Amounts |

|---|---|---|---|

| Cash | Immediate financial assistance for lower-income Singaporeans. | Age: At least 21; Income: ≤ $34,000 (individual) or ≤ $68,000 (household). | $450 to $850 depending on income and property value. |

Summary

GST Vouchers Payment 2024 provides crucial financial relief for Singaporean citizens in light of rising living costs. The initiative, which began in 2012, has been updated to benefit even more households, especially those with lower and middle incomes. In 2024, the vouchers offer increased payouts across various components, including cash assistance, MediSave contributions for seniors, utility rebates, and help with service charges. To qualify, applicants must be Singaporean citizens aged 21 and above with specific income limits. The streamlined payment methods, including PayNow and bank transfers, make it easier for eligible individuals to receive their vouchers, ensuring that the support reaches those who need it most.