The Workfare Income Supplement (WIS) program is a vital initiative designed to provide financial support to eligible workers in Singapore, particularly those earning below $3,000 monthly. Starting in March 2025, recipients can benefit from annual payments of up to $3,267, significantly aiding their financial stability. This program not only supports lower-income individuals but also encourages consistent employment and savings for healthcare through CPF contributions. With an emphasis on inclusivity, the WIS program is particularly beneficial for older workers and those engaged in the gig economy. As Singapore continues to adapt to changing workforce dynamics, such financial assistance reflects its commitment to ensuring a resilient and sustainable economy for all residents.

The enhanced Workfare Income Supplement, often referred to as the WIS scheme, represents a strategic effort by the Singaporean government to bolster financial security among its workers. This support mechanism is particularly aimed at individuals navigating the challenges of the gig economy, providing essential financial aid and fostering savings for future healthcare needs. As Singapore evolves, the initiative aligns with broader goals of promoting economic inclusivity and ensuring that lower-income workers receive the help they need. By addressing the unique circumstances of diverse employment types, this program underscores the importance of adapting financial support to meet the needs of today’s workers. Overall, the WIS initiative is a testament to Singapore’s dedication to enhancing the livelihoods of its citizens.

Understanding the Workfare Income Supplement (WIS) Program

The Workfare Income Supplement (WIS) program is a significant initiative by the Singapore government aimed at providing financial support to lower-income workers. This scheme not only offers monetary assistance but also encourages employment among citizens, particularly those who may struggle to make ends meet. Through WIS, eligible individuals can receive up to $3,267 annually, which is designed to enhance their financial stability and aid in long-term financial planning. By ensuring that workers have a reliable source of income, the program helps foster a productive workforce that contributes positively to the economy.

Moreover, the WIS program is particularly beneficial for those in the gig economy, where income can fluctuate significantly. By extending support to individuals engaged in platform work, such as delivery riders and private-hire drivers, the program acknowledges the evolving nature of the workforce in Singapore. This inclusivity is essential in addressing the unique challenges faced by gig workers, ensuring that they have access to the same financial support as traditional employees.

Eligibility Criteria for the WIS Payment

To qualify for the Workfare Income Supplement, applicants must meet several key criteria. Firstly, individuals must be at least 30 years old and possess Singapore citizenship. This age requirement ensures that the program targets those who are more likely to be settled in their careers yet may need additional financial support. Additionally, applicants must have a monthly income of less than $3,000, which helps focus the assistance on lower-income earners who are most in need.

Another important aspect of eligibility is property ownership. Individuals must reside in a property valued at $21,000 or less annually and own no more than one property. This condition ensures that the benefits are directed towards those who truly require financial assistance, preventing wealthier individuals from exploiting the program. Furthermore, if married, the combined income of spouses must not exceed $70,000 annually, reinforcing the program’s focus on supporting lower-income families.

How Much Financial Support Can You Expect?

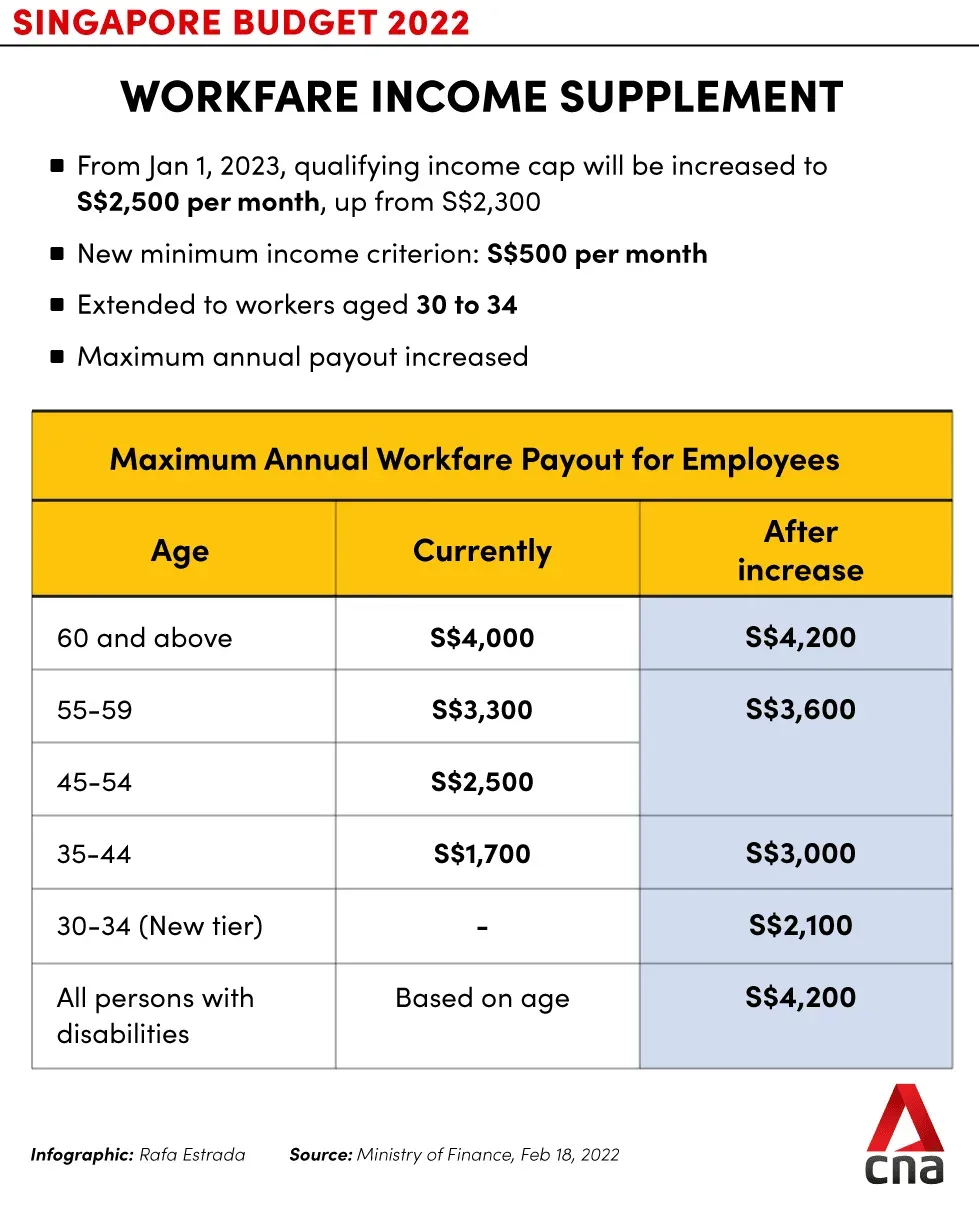

The financial support under the WIS program varies depending on the age of the recipient and their specific circumstances. For instance, younger workers aged 30 to 34 can expect a maximum annual payment of $1,633, while those aged 60 and above can receive up to $3,267. This tiered payment structure acknowledges the different financial needs of workers at various stages of their careers, particularly as older workers often face greater challenges in maintaining stable income.

Additionally, it’s important to note that the payments are structured to provide a balance between immediate cash assistance and long-term savings. With 10% of the payment disbursed in cash and 90% deposited into the MediSave account, the WIS program encourages recipients to save for future healthcare expenses. This approach not only provides immediate financial relief but also promotes a culture of savings, which is essential in ensuring long-term financial health.

Payment Disbursement and Schedule

The disbursement of WIS payments is designed to be straightforward and efficient, with payments commencing in March 2025. Eligible workers will receive their payments monthly, ensuring a consistent flow of financial support. For instance, payments for January 2025 will be disbursed by the end of March 2025, while those for February will follow at the end of April 2025. This regular payment schedule allows recipients to plan their finances more effectively.

To facilitate smooth transactions, the WIS program utilizes the PayNow system for cash payments. This means that beneficiaries can have their payments credited directly to their PayNow-linked NRIC or bank accounts, ensuring quick and secure transfers. The remainder of the payment is deposited into the MediSave account, providing workers with the necessary funds to cover future healthcare needs.

Ensuring Accurate CPF Contributions for Payment Eligibility

For individuals to successfully receive their WIS payments, it is crucial that their Central Provident Fund (CPF) contributions are accurately recorded. The CPF system serves as a vital component of Singapore’s social security framework, and ensuring that contributions are correctly deducted is essential for eligibility. Workers should regularly verify their CPF statements and ensure that their employers are fulfilling their obligations regarding contributions.

If discrepancies are found in the CPF contributions, it is important to report these issues to the CPF Board without delay. Prompt action can help resolve any potential problems that might hinder payment eligibility, ensuring that workers receive the support they are entitled to. Additionally, keeping personal records updated, including linking the PayNow account to the NRIC, further streamlines the payment process.

Frequently Asked Questions About WIS

As the rollout of the Workfare Income Supplement program approaches, many individuals may have questions regarding its operation and eligibility criteria. Common queries include concerns about income fluctuations and how they affect eligibility. It is important to note that eligibility is based on the average monthly income over the past 12 months, meaning that workers can still qualify even if their income exceeds $3,000 in individual months.

Another frequent question revolves around self-employment and eligibility. Self-employed individuals can indeed qualify for the WIS payments, provided they are contributing to their MediSave accounts. This inclusion ensures that all workers, regardless of employment status, have access to essential financial support, reflecting Singapore’s commitment to fostering an inclusive economy.

Supporting Singapore’s Gig Economy through WIS

The enhanced Workfare Income Supplement program is particularly relevant in the context of Singapore’s growing gig economy. As more individuals turn to platform work for their livelihoods, the WIS program aims to provide much-needed support that addresses the unique challenges these workers face. By offering financial assistance to gig workers, the government acknowledges the need for stability in an often unpredictable income landscape.

In addition to providing direct financial support, the WIS program encourages gig workers to contribute to their CPF and MediSave accounts, promoting financial security and long-term health savings. This approach not only benefits individual workers but also contributes to the overall resilience of the workforce, ensuring that all segments of society can thrive in a rapidly changing economic environment.

Impacts of the WIS Program on Financial Planning

The introduction of the Workfare Income Supplement program represents a significant step towards improving financial literacy and planning among lower-income workers in Singapore. By providing structured financial support, the WIS program enables recipients to better manage their budgets and plan for future expenses. This assistance is crucial in helping individuals break the cycle of poverty and build a more secure financial future.

Furthermore, the emphasis on MediSave contributions as part of the WIS payment structure encourages recipients to think long-term about their healthcare needs. By integrating immediate financial support with savings for healthcare, the program fosters a holistic approach to financial planning that can lead to improved well-being for workers and their families.

Future Developments in the WIS Program

As the WIS program evolves, there are ongoing discussions about potential enhancements that could further benefit eligible workers. Stakeholders are assessing the impact of the current changes and considering how to improve the program’s reach and effectiveness. This includes exploring additional support mechanisms for workers in the gig economy and ensuring that the program remains responsive to the changing economic landscape.

In addition, the government is committed to monitoring the effectiveness of the WIS program and making necessary adjustments to ensure that it meets the needs of Singapore’s workforce. This proactive approach to policy development reflects a dedication to maintaining financial stability and support for lower-income workers, ensuring that no one is left behind in Singapore’s economic growth.

Frequently Asked Questions

What is the Workfare Income Supplement (WIS) program in Singapore?

The Workfare Income Supplement (WIS) program is a government initiative designed to provide financial support to lower-income workers in Singapore. It aims to enhance their earnings and encourage consistent employment, offering up to $3,267 annually. The payments consist of a cash portion and a contribution to the MediSave account, promoting financial security and healthcare savings.

Who is eligible for the Workfare Income Supplement payments in Singapore?

To be eligible for the Workfare Income Supplement (WIS) payments, individuals must be Singapore citizens aged 30 and above, with a monthly income below $3,000. They must also meet specific criteria regarding property ownership and, for married couples, spousal income limits. This ensures that the support targets those who need it the most.

How much can I receive from the Workfare Income Supplement program?

The amount you can receive from the Workfare Income Supplement (WIS) program varies by age group. Workers aged 30-34 can receive up to $1,633, those aged 35-44 can get $2,333, workers aged 45-59 may receive $2,800, and individuals aged 60 and above can receive the maximum of $3,267 annually.

When will the Workfare Income Supplement payments start?

Payments under the enhanced Workfare Income Supplement (WIS) program will commence in March 2025. Payments will be disbursed monthly, ensuring timely financial support for eligible workers in Singapore.

How are the Workfare Income Supplement payments disbursed?

The Workfare Income Supplement (WIS) payments are disbursed in two parts: 10% will be credited in cash to your PayNow-linked account or bank account, while 90% will be deposited into your MediSave account to support future healthcare expenses.

What should I do to ensure I receive my Workfare Income Supplement payment?

To ensure you receive your Workfare Income Supplement (WIS) payment, verify that your CPF contributions are accurately recorded and deducted by your employer or platform operator. Additionally, report any discrepancies to the CPF Board and maintain updated banking details linked to your NRIC.

Are self-employed individuals eligible for the Workfare Income Supplement?

Yes, self-employed individuals can be eligible for the Workfare Income Supplement (WIS) program, provided they meet the income criteria and make the necessary contributions to their MediSave account as part of their financial obligations.

How can I check my eligibility for the Workfare Income Supplement program?

You can check your eligibility for the Workfare Income Supplement (WIS) program by visiting the CPF Board’s official website. They provide personalized information based on your income and other relevant criteria.

What is the purpose of the Workfare Income Supplement program in relation to the gig economy?

The Workfare Income Supplement (WIS) program aims to support gig economy workers, such as delivery riders and private-hire drivers, by providing them with financial assistance that enhances their earnings and offers long-term security. This reflects Singapore’s commitment to adapting to the evolving workforce and ensuring financial stability for all workers.

Can I receive Workfare Income Supplement payments if I have multiple jobs?

Yes, you can receive Workfare Income Supplement (WIS) payments if you have multiple jobs, as long as your combined average monthly income does not exceed $3,000 over the past 12 months, meeting the eligibility criteria.

| Key Point | Details |

|---|---|

| Payment Amount | Up to $3,267 annually |

| Eligibility Criteria | Aged 30 and above, monthly income below $3,000, Singapore citizenship, specific property ownership |

| Payment Breakdown | 10% cash, 90% MediSave deposit |

| Disbursement Dates | Payments start in March 2025 (monthly) |

| Age Group Payment | 30–34: $1,633; 35–44: $2,333; 45–59: $2,800; 60+: $3,267 |

| Payment Process | 10% in cash via PayNow; 90% in MediSave |

| How to Ensure Payment | Verify CPF contributions, report discrepancies, keep records updated |

Summary

The Workfare Income Supplement (WIS) is designed to support lower-income workers in Singapore, providing crucial financial assistance of up to $3,267 annually. This enhanced program, starting in March 2025, targets workers aged 30 and above with monthly incomes below $3,000, ensuring they receive consistent support. By focusing on comprehensive eligibility criteria and a structured payment system, WIS aims to promote financial stability and encourage long-term savings for healthcare, reflecting Singapore’s commitment to fostering an inclusive workforce.