The Singapore EAM sector is rapidly emerging as a pivotal player in the realm of wealth management in Asia, attracting significant attention from external asset managers and family offices alike. With its robust regulatory framework and strategic geographical positioning, Singapore serves as a lucrative hub for independent wealth firms, which are rethinking Singapore investment strategies to cater to the evolving demands of high-net-worth clients. The vibrant scene is brimming with opportunities, as innovative strategies from new entrants challenge traditional models, leading to the maturation of services across the industry. Furthermore, the rise of Asian family offices has amplified the need for tailored solutions that prioritize agility and fiduciary responsibility. Overall, the dynamic landscape of the Singapore EAM sector is set to redefine wealth management practices throughout the region and beyond, with firms increasingly focusing on delivering bespoke investment advice and capital management.

The external asset management landscape in Singapore is characterized by a diverse array of players vying for influence in the competitive wealth management arena across Asia. As the sector evolves, independent wealth firms in Singapore are increasingly redefining their approaches to asset management, utilizing innovative strategies that resonate with the unique needs of affluent clients and family offices. This burgeoning industry is not just about managing wealth but encompasses a nuanced understanding of the multifaceted demands of various investors, leading to a variety of Singapore investment strategies. As newer firms rise to prominence alongside established names, the depth and breadth of options available to investors significantly expand, highlighting a shift towards personalized and conflict-free financial advice in the heart of Asia.

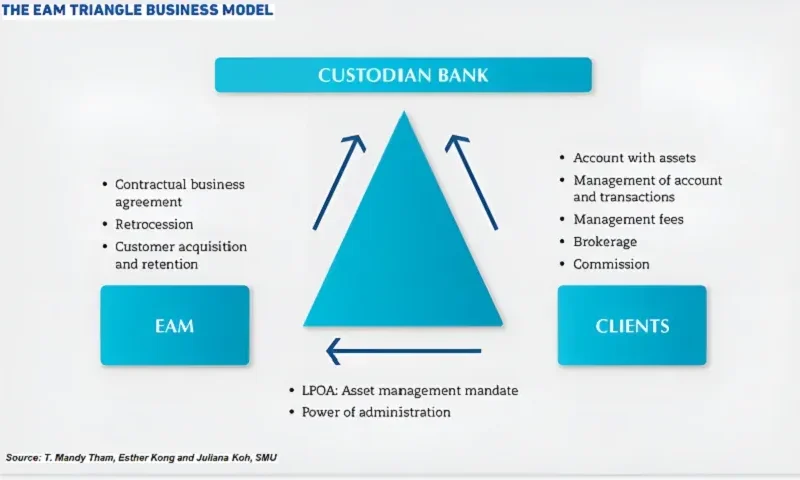

The Growth of External Asset Managers in Singapore

The external asset managers (EAMs) sector in Singapore has experienced unprecedented growth over recent years. This surge can largely be attributed to the increasing demand for personalized wealth management solutions amidst the ongoing complexities of the global financial landscape. Wealthy individuals and families are seeking more agile and independent management structures, leading to a flourishing market where EAMs can provide tailored strategies that meet the distinct needs of HNW and UHNW clients. As a significant hub for wealth management in Asia, Singapore offers a robust environment for these independent wealth firms to thrive.

Notably, Singapore’s strategic position as a gateway to Asia’s vast wealth creates unique opportunities for EAMs. Established firms and newcomers alike are capitalizing on this by developing innovative investment strategies that respond to diverse market conditions. The establishment of the Variable Capital Company (VCC) structure has further propelled this growth, allowing EAMs greater flexibility in fund management. By leveraging the regulatory advantages and the sheer volume of assets managed, Singapore’s EAM sector is set to redefine wealth management practices and frameworks well into the future.

Wealth Management Trends Shaping Singapore’s EAM Landscape

The wealth management landscape in Singapore is evolving rapidly, influenced by a myriad of factors that are reshaping the EAM industry. As multi-generational wealth begins to assume greater prominence, the approach to managing assets is shifting from traditional transactional models to more fiduciary-based strategies. This fundamental change is driven by a rising expectation from clients for conflict-free, independent financial advice. EAMs are now more inclined to offer bespoke solutions that not only address investment performance but also encompass estate planning, tax strategy, and philanthropic endeavors.

Moreover, technology’s role in transforming the wealth management experience cannot be overstated. EAMs in Singapore are increasingly adopting advanced digital tools to enhance transparency and efficiency in their operations. The integration of technology not only streamlines processes but also improves client engagement efforts, allowing firms to provide real-time portfolio updates and insights. As the demand for independent wealth management solutions continues to skyrocket, EAMs are compelled to stay ahead of emerging trends in client preferences and technological advancements.

Challenges Facing EAMs Amidst Compliance Pressures

Despite the promising growth and innovations within Singapore’s EAM sector, compliance remains a significant challenge for asset managers. The stringent regulations imposed by the Monetary Authority of Singapore (MAS) require EAMs to navigate complex anti-money laundering (AML) controls, which can slow down client onboarding processes significantly. Many EAMs have voiced concerns over prolonged compliance checks that can frustrate high-net-worth clients, who expect rapid, seamless service without compromising regulatory standards.

Additionally, as the financial landscape becomes increasingly competitive, EAMs are compelled to invest more in compliance technologies and staff training to ensure they remain compliant while delivering exceptional services. The growing emphasis on transparency and accountability can create additional operational burdens, thereby forcing EAMs to fine-tune their business models. Balancing innovative asset management strategies with heightened compliance demands will be crucial for EAMs aiming to secure their position in Singapore’s flourishing wealth management sector.

The Impact of Asian Family Offices on the EAM Sector

Asian family offices are playing a pivotal role in shaping the external asset management (EAM) landscape in Singapore. As wealthy families begin to establish multi-family offices to manage their assets proactively, there is a noticeable shift towards more sophisticated investment strategies, often involving private equity, real estate, and alternative assets. These family offices seek advisors who understand their unique circumstances, thus opening doors for EAMs to form partnerships that leverage their expertise in diverse asset classes.

Moreover, the growing interest of Asian family offices in sustainable investing and ESG (Environmental, Social, Governance) principles is compelling EAMs to re-evaluate their investment philosophies. With the rise of wealth generated from tech startups and successful business ventures, family offices are also looking for innovative ways to diversify their portfolios while aligning with their values. This trend is driving EAMs to expand their offerings, ensuring they meet the expectations of a more socially conscious clientele, ultimately further diversifying the overall scope of wealth management services in Singapore.

Singapore’s Investment Strategies for Wealth Management

Singapore’s investment strategies are increasingly becoming a reference point for EAMs and independent wealth firms looking to navigate the complexities of a dynamic market. The country’s regulatory framework provides an advantageous platform for asset managers to explore various investment avenues, from traditional equities and bonds to innovative opportunities found in the realm of cryptocurrencies and fintech. EAMs that can adeptly harness these opportunities stand to gain a competitive edge, driving innovative solutions for their clients while managing associated risks.

In line with this, there is a growing emphasis on data-driven decision-making within Singapore’s investment landscape. EAMs are increasingly utilizing analytical tools to aggregate and assess market trends, allowing for more informed and adaptable investment decisions. Furthermore, the collaboration between financial institutions and technology providers is paving the way for enhanced investment strategies focused on risk management and long-term asset performance. As this trend continues, investors in Singapore can expect a more responsive and capable wealth management experience.

The Rise of Independent Wealth Firms in Singapore

The rise of independent wealth firms in Singapore marks a significant shift in the wealth management narrative, traditionally dominated by large banks and financial institutions. These firms, often referred to as external asset managers (EAMs), provide tailored financial advice and investment strategies that cater to the distinct needs of affluent individuals and families. As more clients seek independence from traditional banking structures, EAMs are positioning themselves to capture a larger share of the market, offering personalized services that resonate with their clientele’s financial aspirations.

Moreover, the competitive landscape has prompted independent wealth firms to adopt cutting-edge technologies and innovative business models. These firms are not just replicating the traditional wealth management offerings; they are crafting unique value propositions that integrate holistic financial planning, investment advisory, and asset management. As a result, the independent wealth management sector in Singapore is witnessing increased investor confidence, reflected in the substantial growth in assets under management, as they demonstrate the ability to deliver results in a constantly evolving economic environment.

Navigating Compliance Challenges in the EAM Industry

In the realm of external asset management (EAM), regulatory compliance is a necessary yet challenging aspect that firms must navigate. As the regulatory landscape evolves, EAMs are faced with stringent requirements that emphasize anti-money laundering (AML) and know-your-client (KYC) regulations. This growing emphasis on compliance can lead to significant operational challenges, particularly for smaller firms that may lack the resources to effectively manage these complex requirements. The pressure to comply is not only an operational concern but also impacts client relationships, as lengthy compliance processes can delay service delivery.

Furthermore, the emergence of new regulatory frameworks demands that EAMs continuously adapt their strategies to stay compliant while remaining competitive. As regulations tighten, EAMs are investing heavily in compliance technologies and skilled personnel to mitigate risks associated with non-compliance. This necessity to balance operational efficiency with stringent compliance standards requires EAMs to rethink their business models and operational workflows. By embracing robust compliance strategies, Singapore’s EAMs can enhance their credibility and ensure sustainable growth in an increasingly regulated environment.

The Competitive Edge of Singapore’s EAMs

Singapore’s external asset managers (EAMs) have a competitive edge in the wealth management sector due to their ability to provide bespoke, client-centric solutions tailored to the unique demands of HNW and UHNW individuals. The flexibility and independence offered by EAMs allow them to craft personalized investment strategies that resonate with their client’s financial goals, a factor that is increasingly important in an era where generic investment advice no longer suffices. The burgeoning wealth in the region, particularly among Asian families and entrepreneurs, further underscores the demand for such personalized services.

Additionally, the strategic regulatory environment in Singapore acts as a catalyst for EAM growth. The Monetary Authority of Singapore has established a conducive framework that facilitates asset management while ensuring compliance and risk management standards are upheld. This supportive approach has fostered a dynamic ecosystem where independent wealth firms can thrive, attracting not only local but also international clients seeking access to Asia’s rich investment opportunities. As a result, Singapore’s EAMs are well-positioned to influence the global wealth management narrative, maintaining a pivotal role in the ongoing evolution of the industry.

Emerging Technology Trends in Wealth Management

Emerging technologies are revolutionizing wealth management, and EAMs in Singapore are at the forefront of this transformation. From artificial intelligence (AI) and machine learning to blockchain, technological advancements are providing firms with the tools necessary to enhance investment strategies and streamline operations. For instance, AI-driven analytics empower EAMs to analyze vast datasets, predict market trends, and generate insights that inform investment decisions. This not only increases efficiency but also positions EAMs to offer competitive, data-backed investment strategies that appeal to a modern clientele.

Moreover, the rise of digital platforms has transformed client engagement in wealth management. EAMs are now leveraging technology to create user-friendly interfaces that allow clients to monitor their portfolios in real-time, access financial advice on-demand, and engage with their advisors more seamlessly. As clients increasingly expect transparency and involvement in their investment processes, EAMs that successfully integrate technology into their service offerings will likely emerge as industry leaders. This trend signifies a paradigm shift in how wealth is managed, aligning with the growing expectations of a digital-savvy generation of investors.

Frequently Asked Questions

What are the key trends shaping the external asset managers in Singapore sector?

The external asset managers (EAM) sector in Singapore is currently shaped by several key trends, including increasing demand for conflict-free investment advice, the rise of second- and third-generation wealth holders, and the growth of technology-driven solutions. Furthermore, regulatory compliance, including anti-money laundering requirements, is also influencing practices within the EAM sector.

How do Asian family offices impact wealth management in Asia?

Asian family offices significantly influence wealth management in Asia by tailoring investment strategies to meet the unique needs of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs). These family offices often seek independent investment advice and focus on alternative assets, such as private equity, enhancing the diversity and sophistication of wealth management options available in the region.

What investment strategies are popular among Singapore investment strategies?

Popular Singapore investment strategies among external asset managers include a focus on discretionary asset management, alternative investments like private equity and hedge funds, and sustainable investing. EAMs in Singapore are increasingly adopting multi-asset approaches to meet client demands for diversified portfolios that align with their risk tolerance and long-term financial goals.

What challenges do independent wealth firms in Singapore face in today’s market?

Independent wealth firms in Singapore face several challenges, including heightened compliance pressures, the need for innovative technology solutions, and competition from traditional banks entering the EAM landscape. Additionally, slow onboarding processes can frustrate clients, urging firms to streamline their operations and enhance client service.

How has the Variable Capital Company (VCC) impacted the EAM sector in Singapore?

The Variable Capital Company (VCC) framework has positively impacted the EAM sector in Singapore by providing a flexible and efficient structure for fund management. Since its implementation, the number of incorporated VCCs has risen significantly, enhancing the appeal of Singapore as a wealth management hub and offering EAMs innovative ways to manage client assets and create tailored investment vehicles.

What role does the Association of Independent Wealth Managers in Singapore play in the EAM sector?

The Association of Independent Wealth Managers Singapore plays a crucial role in representing and supporting EAMs, family offices, and other stakeholders in the sector. By fostering collaboration, facilitating knowledge exchange, and advocating for industry interests, this organization enhances the EAM sector’s growth and competitiveness in Singapore and the broader Asia region.

Which banks are actively investing in the external asset management sector in Singapore?

Several banks are actively investing in the external asset management sector in Singapore, including UBS, LGT, and the Bank of Singapore. These financial institutions are committing resources and enhancing their EAM service divisions, recognizing the growing significance of EAMs in the wealth management landscape.

What is the market outlook for external asset managers in Singapore?

The market outlook for external asset managers in Singapore remains optimistic, characterized by continued growth in assets under management and increased demand for independent wealth advisory services. As EAMs adapt to regulatory changes and embrace technological advancements, they are expected to capture a larger share of the wealth management pie in Asia.

| Key Points |

|---|

| The Singapore EAM sector is thriving, with significant growth in independent wealth firms driven by high demand for conflict-free advice. |

| Regulatory pressures, particularly around compliance and anti-money laundering, are key challenges for EAMs. |

| The rise of variable capital companies (VCC) since 2020 has enhanced the attractiveness of the sector for family offices. |

| A diverse range of services exists within the EAM sector, with some firms focusing on niche markets like private equity. |

| Technological advancements and digital infrastructures are critical areas of investment for EAMs and supporting banks. |

| The total assets under management in Singapore were S$5.4 trillion in 2023, indicating a substantial market opportunity. |

| Industry associations are forming to provide a unified voice for EAMs, enhancing collaboration and advocacy. |

Summary

The Singapore EAM sector is positioned uniquely within the Asia market, demonstrating resilience and adaptability in the face of global financial challenges. Recent advancements in regulations, the introduction of the VCC, and an increasing demand for personalized wealth management services are shaping its dynamic landscape. As EAMs evolve, their focus on compliance and digital infrastructure will likely define their success moving forward in this competitive environment. The future of the Singapore EAM sector looks promising, poised to capitalize on both regional and international opportunities.