**Singapore CPF Contributions 2025** usher in significant changes that play a pivotal role in shaping the financial landscape for workers across the nation. With updated CPF contribution rates, higher salary ceilings, and an enhanced focus on retirement savings Singapore, these updates aim to support citizens in their long-term financial planning. As individuals navigate the complexities of their take-home pay CPF adjustments, understanding these developments becomes essential. The 2025 changes not only encourage more substantial retirement funds but also affect how employees and employers approach Singapore retirement planning. This guide elaborates on the latest CPF updates 2025 to ensure you are well-informed and prepared.

In 2025, the revision of the Central Provident Fund (CPF) contributions signals a transformative shift in how Singaporeans approach their financial futures. These revised rates and thresholds are designed to bolster retirement savings and offer a clearer path for retirement planning. For individuals concerned about their income and overall saving strategy, understanding the implications of these changes is crucial. This exploration of CPF updates encompasses vital aspects such as the evolving contribution rates and the potential impacts on take-home salaries, thus equipping citizens to make informed decisions. Ultimately, these developments reflect a commitment to enhancing financial security for all Singaporeans.

Overview of Singapore CPF Contributions Updates for 2025

In 2025, Singapore’s Central Provident Fund (CPF) is undergoing significant changes that are set to enhance the retirement savings landscape for its citizens. Key updates include an increased monthly CPF salary ceiling from $6,800 to $7,400, which will further rise to $8,000 in 2026. These adjustments reflect the government’s commitment to improving retirement security, ensuring that contributors can maximize their savings effectively. As such, everyone, from young workers to seniors, will have more incentives to bolster their savings for future financial stability.

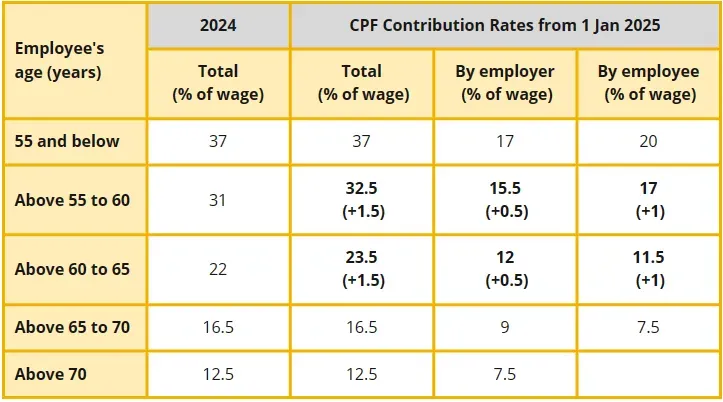

Another critical aspect of the updates includes a 1.5 percentage point increase in CPF contribution rates for senior workers aged 55 to 65. This enhancement aims to strengthen the financial well-being of older employees, providing them with a more substantial safety net as they continue to work in their later years. With these updates, it is crucial for Singaporeans to understand the implications on their take-home pay and long-term retirement planning.

Frequently Asked Questions

What are the new CPF contribution rates for 2025 in Singapore?

In 2025, the CPF contribution rates in Singapore have been adjusted, particularly for senior workers aged above 55 to 65, whose rates increased by 1.5 percentage points. For instance, those aged 56–60 now have a total contribution rate of 32.5% (15.5% employer and 17% employee). This change aims to enhance retirement savings for older workers.

How does the increase in the monthly CPF salary ceiling affect my retirement savings?

With the monthly CPF salary ceiling now raised from $6,800 to $7,400 as of January 1, 2025, a larger portion of your monthly earnings will contribute to your CPF. This means higher retirement savings over time, although it may reduce your immediate take-home pay if you earn above the previous ceiling.

What is the impact of the closure of the Special Account for members aged 55 and above?

Starting in 2025, the Special Account (SA) for members aged 55 and above will be closed, simplifying CPF management. Funds will be transferred to the Retirement Account (RA) up to the Full Retirement Sum for improved monthly payouts under CPF LIFE, ensuring a streamlined approach to retirement savings.

Can I still make voluntary contributions to my CPF after turning 55?

Yes, after turning 55, you can still top up your Retirement Account (RA) up to the new Enhanced Retirement Sum (ERS) of $426,000 in 2025. This allows you to enhance your retirement savings and benefit from higher monthly payouts.

What are the changes to the Matched Retirement Savings Scheme (MRSS) in 2025?

In 2025, the Matched Retirement Savings Scheme (MRSS) remains applicable for Singaporeans aged 55 to 70 with low CPF balances. However, from 2026, this scheme will expand to include individuals with disabilities of all ages, allowing for increased total cash top-ups to retirement accounts.

How will the CPF updates for 2025 affect my overall retirement planning in Singapore?

The CPF updates for 2025, including increased contribution rates, a higher salary ceiling, and the closure of the Special Account for those over 55, significantly enhance the potential for retirement savings. These changes are key considerations for effective retirement planning in Singapore, enabling individuals to better prepare for their financial future.

Is there an increase in the annual CPF salary ceiling for 2025?

No, the annual CPF salary ceiling remains unchanged at $102,000 for 2025. This means that while the monthly salary ceiling has increased, the annual limit stays the same.

How should employees adjust to the changes in CPF contributions for 2025?

Employees are encouraged to budget for the slight decrease in take-home pay if earning above $6,800 per month due to increased CPF contributions. Viewing this as an investment in their long-term retirement savings is crucial.

What resources are available for me to understand more about Singapore’s CPF contributions for 2025?

For comprehensive details regarding changes to CPF contributions in 2025, including rates and policies, the CPF Board’s official website offers resources, guides, and updates tailored to help Singaporeans navigate these changes effectively.

What do I need to know about the Enhanced Retirement Sum (ERS) for 2025?

The Enhanced Retirement Sum (ERS) has increased to $426,000 in 2025, encouraging members to top up their Retirement Account (RA) for higher CPF LIFE monthly payouts. This promotes greater retirement savings for individuals approaching retirement age.

| Feature | Details |

|---|---|

| Monthly CPF Salary Ceiling | Increased from $6,800 to $7,400 (2025); will further increase to $8,000 (2026). |

| Annual CPF Salary Ceiling | Remains at $102,000. |

| Senior Worker Contribution Rates | Raised by 1.5 percentage points for workers aged 55 to 65. |

| Closure of Special Account (SA) | SA for members aged 55 and above will be closed from January 2025; funds move to RA or OA. |

| Enhanced Retirement Sum (ERS) | Raised to $426,000 in 2025. |

| Matched Retirement Savings Scheme (MRSS) | Expanding in 2026 to include Singaporeans with disabilities of all ages. |

Summary

Singapore CPF Contributions 2025 introduce significant changes aimed at enhancing retirement savings and financial security for all Singaporeans. With the increased monthly salary ceiling and improved contribution rates for senior workers, individuals can expect a stronger support system for their retirement and healthcare needs. The closing of the Special Account for members over 55 simplifies fund management while promoting more substantial long-term savings in the Retirement Account. As Singaporeans navigate these updates, it is crucial to adapt financial planning strategies accordingly to ensure adequate retirement preparedness.