Singapore CPF Contribution plays a vital role in the financial landscape of the nation, acting as a cornerstone of Singapore’s social security system. This structured system not only facilitates savings for retirement but also aids in covering essential needs such as housing and healthcare. With the upcoming changes to CPF contribution rates in 2025, both employers and employees are poised to benefit from enhanced savings potential. These adjustments reflect Singapore’s commitment to fostering a financially secure workforce while accommodating the diverse needs of its citizens and permanent residents. Ultimately, the CPF system stands as a testament to Singapore’s proactive approach in ensuring long-term financial stability for its people.

The contributions made to the Central Provident Fund (CPF) in Singapore are essential for maintaining the financial well-being of its citizens. This savings scheme is designed to secure funds for various life stages, ensuring that individuals can effectively manage their retirement, housing, and healthcare needs. As the CPF system evolves, particularly with the new contribution rates set for 2025, the focus remains on encouraging disciplined savings habits among the workforce. By integrating both employer and employee contributions, the CPF not only promotes financial literacy but also enhances the overall economic resilience of Singapore. Understanding the intricacies of CPF contributions is crucial for maximizing benefits and preparing for a stable future.

Overview of the Singapore CPF System

The Central Provident Fund (CPF) system is a cornerstone of Singapore’s social security framework, designed to provide citizens and permanent residents with financial stability throughout their lives. This government-run initiative encourages disciplined savings for critical needs such as retirement, housing, and healthcare. By combining contributions from both employers and employees, the CPF system fosters a culture of saving that is essential for long-term financial well-being. As the CPF system evolves, it continues to adapt to the changing demographics and economic landscape of Singapore, ensuring that it remains relevant to the needs of its citizens.

In 2025, significant updates to the CPF contribution rates are expected to enhance the savings potential for Singaporeans. These adjustments are particularly beneficial for younger employees, as they provide a clear pathway to accumulate wealth over time. This systematic approach not only safeguards individual financial futures but also contributes to the overall economic resilience of Singapore. As the CPF system matures, it encourages a greater emphasis on financial literacy, enabling citizens to make informed decisions regarding their savings and investments.

Frequently Asked Questions

What are the CPF contribution rates for Singaporean citizens in 2025?

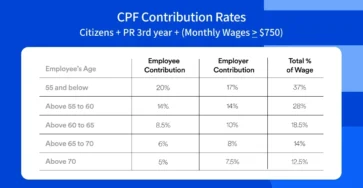

In 2025, the CPF contribution rates for Singaporean citizens vary by age and monthly wages. For employees aged 55 and below with monthly wages over $750, the total contribution rate is 37%, consisting of a 20% employee share and a 17% employer share. For those aged 55 to 60 with wages over $750, the total contribution rate is 32.5%, with a 17% employee share and a 15.5% employer share. Lastly, for employees aged 60 to 65 with wages over $750, the total contribution rate is 23.5%, split between an 11.5% employee share and a 12% employer share.

How does the CPF system contribute to retirement savings in Singapore?

The CPF system is a key component of Singapore’s social security, specifically designed to assist citizens and PRs in building retirement savings. Contributions made to the CPF account help individuals accumulate funds for a stable income during retirement. The savings, which are compulsory for employees, enable disciplined saving practices, ensuring that citizens have the financial security they need post-retirement.

What components are included in the total salary for CPF contributions?

For CPF contributions, the total salary comprises Ordinary Wages (OW) and Additional Wages (AW). Ordinary Wages are capped at $7,400 monthly for contribution purposes, while Additional Wages include bonuses and non-recurring payments, subject to annual income caps. Both components are crucial for calculating the accurate CPF contributions from employees and employers.

What is the significance of the tiered contribution system in the CPF?

The tiered contribution system in the CPF is significant because it adjusts contribution rates based on an employee’s age and income, promoting fairness and sustainability. This approach ensures that older workers receive adequate support while balancing the financial obligations of employers. As a result, the CPF system effectively aids employees in planning for essential needs such as retirement, healthcare, and housing.

How can employees calculate their CPF contributions accurately?

Employees can calculate their CPF contributions by first determining their total wages, which includes both Ordinary and Additional Wages. Next, they should apply the appropriate contribution rate based on their age and income level, rounding the figures as necessary. To find the employer’s share, deduct the employee’s share from the total contribution amount.

What are the benefits of contributing to the CPF for healthcare in Singapore?

Contributing to the CPF allows employees to save for healthcare expenses through the MediSave account. This account helps cover insurance premiums and medical costs, offering financial relief during healthcare emergencies. Thus, CPF contributions play a vital role in ensuring that individuals are prepared for potential medical expenses throughout their lives.

How do CPF contributions support housing needs in Singapore?

CPF contributions support housing needs by allowing individuals to use their savings for purchasing HDB apartments or servicing housing loans. This system encourages homeownership and stability, enabling Singaporeans to secure a place to live while simultaneously building their financial assets through their CPF savings.

| Age Group | Total Contribution Rate | Employee’s Share | Employer’s Share |

|---|---|---|---|

| 55 and Below | 17% (for $50 – $500) / 37% (for > $750) | Nil (for ≤ $50) / 20% (for > $750) | 17% (for $50 – $500) / 17% (for > $750) |

| 55 to 60 | 32.5% (for > $750) | 17% | 15.5% |

| 60 to 65 | 23.5% (for > $750) | 11.5% | 12% |

Summary

Singapore CPF Contribution is a vital part of the nation’s social security system, designed to provide financial stability for its citizens and permanent residents. The tiered contribution rates, set to be effective from January 1, 2025, reflect a commitment to enhancing savings potential while considering affordability. It plays a critical role in supporting long-term financial planning for retirement, housing, and healthcare needs. By encouraging disciplined savings and financial literacy, the CPF system not only strengthens individual financial security but also contributes to the overall economic resilience of Singapore.