Significant changes are coming to Singapore CPF changes 2025, marking a pivotal moment for members aged 55 and above. The CPF Board updates include the notable closure of the Special Account, impacting approximately 1.4 million individuals. This strategic adjustment aims to align CPF interest rates more closely with the intended use of funds, enhancing the overall effectiveness of the retirement savings system. As savings from the Special Account transition to the Retirement Account, members can expect increased monthly payouts during retirement, ensuring greater financial security. With the introduction of the Enhanced Retirement Sum, the CPF Board is setting the stage for a more robust retirement framework, ultimately benefiting Singaporeans in their golden years.

As we approach the new year, the Central Provident Fund 2025 is poised for transformative updates that will significantly affect retirement planning in Singapore. These reforms, particularly relevant for those over 55, include pivotal Retirement Account adjustments and the closure of the Special Account. This strategic move is designed to streamline the allocation of retirement funds, ensuring that higher interest rates are preserved for long-term savings. With an increased focus on maximizing monthly payouts through the Enhanced Retirement Sum, the CPF system is evolving to better support individuals in securing their financial future. These developments underscore the government’s commitment to enhancing the retirement landscape for all Singaporeans.

Understanding the Closure of the Special Account in 2025

In January 2025, a significant transformation will occur within Singapore’s Central Provident Fund (CPF) system, specifically affecting members aged 55 and above. The CPF Board has made the pivotal decision to close the Special Account (SA) for approximately 1.4 million members. This action is designed to better align the interest rates of CPF accounts with their intended purposes, allowing for a more structured approach toward retirement savings. By transitioning SA funds into the Retirement Account (RA), the CPF aims to ensure that members’ savings are preserved for long-term retirement needs rather than short-term withdrawals.

The closure of the Special Account marks a critical shift in how CPF members will manage their savings. Upon the closure of the SA, any funds remaining will be automatically redirected to the RA until the Full Retirement Sum (FRS) is met. This ensures that members benefit from the higher interest rates associated with the RA, which is explicitly designed to enhance retirement payouts. The CPF Board will communicate these changes through various channels, including letters and SMS, ensuring that all affected members are well-informed about the adjustments and the steps they need to take.

Significant CPF Board Updates for Retirement Accounts

Alongside the closure of the Special Account, the CPF Board is implementing several crucial updates to the retirement savings framework. One of the most notable changes is the increase in the Enhanced Retirement Sum (ERS) to $426,000, allowing members to secure larger monthly payouts during retirement. For instance, individuals who reach the ERS can expect to receive approximately $3,300 monthly starting at age 65, a substantial increase from the previous payout limit. This enhancement is part of a broader strategy to encourage Singaporeans to save more effectively for their retirement.

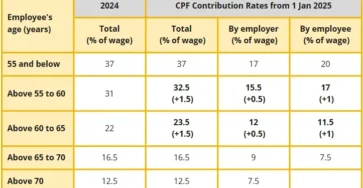

Additionally, the CPF Board will adjust contribution rates for older workers aged 55 to 65, providing a 0.5% increase from employers and an extra 1% from employees. This adjustment promotes greater savings among older workers, acknowledging the need for increased financial support as they approach retirement age. With these updates, the CPF system aims to ensure that individuals not only save adequately but also enjoy higher retirement payouts, thereby reinforcing financial security in their later years.

Maximizing CPF Savings with Enhanced Retirement Options

As Singaporeans navigate the changes in the CPF system, they have several strategies to optimize their retirement savings. One effective approach is transferring Ordinary Account (OA) savings to the Retirement Account (RA), which can significantly boost monthly payouts. Members can top up their RA up to the Enhanced Retirement Sum (ERS), harnessing the advantage of higher interest rates associated with retirement funds. However, it is essential for members to understand that such transfers are irreversible, emphasizing the importance of careful financial planning.

Moreover, CPF members who have already met their Full Retirement Sum (FRS) can support their family by transferring excess savings to relatives, such as parents or spouses. This beneficial transfer not only enhances the retirement savings of loved ones but also ensures that they receive higher monthly payouts during their retirement years. By leveraging these options, CPF members can effectively manage their finances, supporting both their needs and those of their families.

The Importance of Flexibility in CPF Savings Management

In light of the upcoming changes in January 2025, maintaining flexibility in CPF savings management has become increasingly vital. Members who choose to keep their transferred Special Account savings in the Ordinary Account can enjoy an annual interest rate of 2.5%. This option allows for greater liquidity and control over funds, enabling members to withdraw or invest their savings as needed under the CPF Investment Scheme. Such flexibility is particularly appealing for individuals who value immediate access to their funds.

This approach not only caters to the varying financial needs of CPF members but also aligns with the overall goal of helping Singaporeans manage their retirement savings effectively. By considering the balance between liquidity and long-term savings growth, members can make informed decisions that suit their personal circumstances. The CPF Board’s updates underscore the importance of strategic savings management, encouraging individuals to think critically about their retirement planning.

Navigating CPF Contributions and Salary Adjustments in 2025

The adjustments to CPF contribution rates for older workers are another essential aspect of the upcoming changes in 2025. Employers will contribute an additional 0.5%, while employees will see a rise of 1% in their contributions. This increase is designed to bolster retirement savings specifically for those in the 55 to 65 age group, acknowledging the need for enhanced financial support as they approach retirement. Such changes not only foster a stronger retirement savings culture but also aim to ensure that older workers are adequately prepared for their financial future.

Moreover, the increase in the CPF salary ceiling to $7,400 means that individuals earning higher salaries can contribute more to their CPF accounts each month. This adjustment presents an opportunity for higher-income earners to maximize their retirement savings, which is crucial in a time when financial security post-retirement is a growing concern. By understanding these new contribution structures, CPF members can better strategize their savings and ensure a more comfortable retirement.

Preparing for the Upcoming CPF Changes: What You Need to Know

As the January 2025 deadline approaches, it is crucial for CPF members to stay informed about the changes impacting their retirement savings. The closure of the Special Account and the subsequent transfer of funds to the Retirement Account are significant developments that require careful consideration. Members should prepare by reviewing their current CPF balances and assessing their retirement needs to ensure that they can make the most of the new system.

In addition, communication from the CPF Board will be key in helping members navigate these changes. With notifications being sent via letters and SMS, members must pay attention to the information provided to understand how these adjustments affect their accounts. By proactively engaging with the changes and seeking assistance when needed, CPF members can make informed decisions that align with their retirement goals.

Long-Term Financial Security: The CPF’s Role in Retirement Planning

The CPF system plays a pivotal role in ensuring long-term financial security for Singaporeans. With the upcoming changes in 2025, the CPF Board aims to reinforce the importance of strategic retirement planning. By enhancing the Retirement Account and closing the Special Account, the CPF encourages members to allocate their savings more effectively for retirement purposes. This shift not only supports individual financial security but also contributes to the overall stability of the nation’s social welfare framework.

Ultimately, the adjustments to the CPF system reflect a broader commitment to helping Singaporeans achieve financial independence in their golden years. By focusing on higher monthly payouts, increased contribution rates, and enhanced flexibility, the CPF Board is paving the way for a robust retirement savings culture. Members are encouraged to take an active role in their financial planning, leveraging the resources available to them to maximize their CPF benefits for a secure retirement.

The Future of CPF: Ensuring Sustainable Retirement Solutions

As we look towards the future of the Central Provident Fund, it is clear that sustainability and adaptability will be key themes in retirement planning. The changes set to take effect in January 2025 are a reflection of the CPF Board’s commitment to creating a system that not only meets the current needs of Singaporeans but also anticipates future challenges. By closing the Special Account and increasing the Enhanced Retirement Sum, the CPF is positioning itself as a more effective tool for long-term savings.

With an emphasis on higher payouts and improved contribution rates for older workers, the CPF Board is also advocating for a culture of savings that prioritizes retirement preparedness. It is essential for members to engage with these changes actively and utilize the tools available to them to enhance their financial security. The future of CPF is about building a robust safety net that empowers Singaporeans to navigate their retirement with confidence.

Key Takeaways from the CPF Changes in 2025

In summary, the changes to the CPF system in 2025 represent a significant shift towards more effective retirement savings management. The closure of the Special Account, the introduction of the Enhanced Retirement Sum, and the adjustments to contribution rates all aim to strengthen the financial foundation for Singaporeans approaching retirement. Members are encouraged to review their savings strategies and consider how these changes impact their long-term financial goals.

Furthermore, as the CPF Board provides information and support to navigate these changes, members should take advantage of available resources to ensure they are making informed decisions. The CPF system is evolving, and by staying engaged with these developments, Singaporeans can maximize their retirement outcomes and work towards achieving a secure and fulfilling retirement.

Frequently Asked Questions

What are the key Singapore CPF changes in 2025 affecting members aged 55 and above?

In 2025, significant Singapore CPF changes will see the closure of the Special Account (SA) for members aged 55 and above, with funds transferred to the Retirement Account (RA) first. This adjustment aligns interest rates with long-term retirement needs, ensuring higher monthly payouts during retirement.

How will the closure of the Special Account impact my savings under the Singapore CPF changes 2025?

The closure of the Special Account under the Singapore CPF changes in 2025 means your savings will be transferred to the Retirement Account until the Full Retirement Sum (FRS) is met. This ensures your funds are designated for retirement and continue earning higher interest rates.

What options do I have to optimize my CPF savings with the new CPF Board updates in 2025?

With the new CPF Board updates in 2025, you can optimize your savings by transferring Ordinary Account (OA) funds to your Retirement Account (RA) to boost monthly payouts, transferring excess savings to family members, or maintaining flexibility by keeping transferred funds in the OA.

What is the Enhanced Retirement Sum (ERS) under the Central Provident Fund 2025 changes?

The Enhanced Retirement Sum (ERS) under the Central Provident Fund 2025 changes will increase to $426,000, allowing members to enjoy larger monthly payouts during retirement. This adjustment is part of the government’s efforts to enhance retirement savings for Singaporeans.

How will the CPF contribution rates change for older workers in 2025?

Starting in 2025, CPF contribution rates for older workers aged 55 to 65 will increase, with employers contributing an additional 0.5% and employees contributing an extra 1%. This change aims to help older workers save more for their retirement.

What will happen to my CPF contributions if I earn above the new salary ceiling in 2025?

If you earn above the new CPF salary ceiling of $7,400 in 2025, your contributions will still be capped at this amount. This increase allows higher-income individuals to contribute more to their CPF accounts, enhancing their retirement savings.

How will the CPF Board notify me about the changes in the Central Provident Fund in 2025?

The CPF Board will notify affected members about the changes in the Central Provident Fund in 2025 through letters, emails, or SMS starting from January 20, 2025. This communication will detail the next steps regarding the closure of the Special Account.

Can I withdraw my transferred Special Account savings once the closure happens in January 2025?

Once the Special Account is closed in January 2025, the transferred savings will be allocated to your Retirement Account and will not be available for withdrawal until you reach retirement age. This ensures that these funds are reserved for your long-term retirement needs.

| Key Changes | Details |

|---|---|

| Closure of Special Accounts (SA) | SA for members aged 55 and above will be closed in January 2025, transitioning funds to the Retirement Account (RA). |

| Transfer of Savings | Savings will move to the RA until Full Retirement Sum (FRS) is reached, then to the Ordinary Account (OA) for more withdrawal flexibility. |

| Enhanced Retirement Sum (ERS) | ERS will increase to $426,000, allowing for larger monthly payouts (e.g., $3,300 at age 65). |

| Improved Contribution Rates | Contribution rates for members aged 55-65 will rise: employers by 0.5%, employees by 1%. |

| Higher Salary Ceiling | CPF salary ceiling will increase to $7,400, enabling higher contributions for those with higher salaries. |

Summary

The Singapore CPF changes in 2025 are designed to enhance the retirement savings system for citizens, especially those aged 55 and above. These adjustments include the closure of Special Accounts, which will be consolidated into Retirement Accounts to ensure funds are better earmarked for long-term retirement needs. With increased payouts and improved contribution rates, the government aims to provide greater financial security for Singaporeans as they approach retirement.