The Purchasing Managers Index (PMI) is a vital economic indicator that provides insight into the health of the manufacturing and service sectors. Published monthly by the Institute for Supply Management (ISM), the PMI tracks supply and demand trends, allowing businesses to gauge economic conditions effectively. Understanding the PMI definition is essential for corporate decision-makers and investors, as it serves as a reliable tool for predicting future business activity and overall economic performance. With its focus on production, new orders, and employment, the PMI index acts as a compass for various stakeholders trying to navigate market fluctuations. By analyzing manufacturing PMI reports, businesses can make informed decisions that align with anticipated market shifts, ensuring they remain competitive in an ever-evolving economic landscape.

Also known as the Business Activity Index, the Purchasing Managers Index (PMI) is an essential metric used to monitor economic trends in various sectors. It aggregates data gathered from purchasing managers across industries, providing a snapshot of economic conditions and guiding corporate strategies. Often referenced alongside the ISM report, this index helps stakeholders understand demand and supply fluctuations in the economy. By focusing on key data points, such as new orders and inventory levels, the PMI enables analysts and investors to assess growth or contraction within the economy confidently. Recognizing the significance of the PMI is crucial for making informed financial and operational decisions.

Understanding the Purchasing Managers Index (PMI)

The Purchasing Managers Index (PMI) serves as a crucial economic barometer, measuring the pulse of the manufacturing and services sectors. Defined as a monthly index, it reflects the sentiment of purchasing managers regarding supply and demand trends, effectively capturing the economic landscape’s ebb and flow. The Institute for Supply Management (ISM) produces the PMI, offering insights that decision-makers, analysts, and investors rely on to gauge economic growth or contraction. With components that assess new orders, employment, production levels, and inventory, the PMI acts as a comprehensive indicator of business activity.

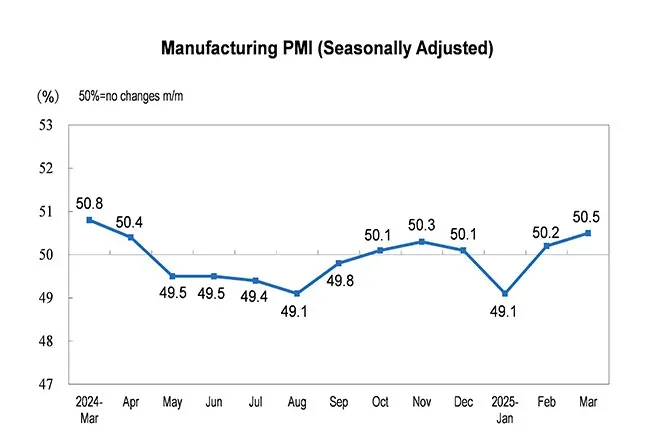

As professionals navigate complex economic conditions, understanding the PMI’s significance is paramount. With its range from 0 to 100, where a figure above 50 indicates expansion and below signals contraction, the PMI encapsulates the market’s prevailing mood. Analysts interpret these figures to forecast potential shifts in GDP and employment rates, making it an invaluable tool for strategic planning and investment decisions. The PMI’s widespread use across various industries illustrates its vital role as an economic indicator, enabling a proactive approach to market changes.

The Impact of PMI on Business Decisions

Corporate managers leverage the Purchasing Managers Index to make informed decisions about their operations and production schedules. By analyzing PMI trends, businesses can anticipate market demands and adjust their strategies accordingly. For example, if the manufacturing PMI is trending upwards, it can signal an increase in consumer demand, prompting manufacturers to ramp up production and procure additional raw materials. This proactive approach ensures that businesses remain competitive and responsive to market dynamics, ultimately safeguarding their profitability.

Furthermore, suppliers also rely heavily on PMI data to forecast their production needs. A supplier monitoring the PMI can make educated decisions about inventory levels and production schedules by understanding the anticipated demand from manufacturers. For instance, if the PMI indicates strong demand, suppliers may choose to expand production capacity to meet the needs of their customers. This alignment between the PMI and business operations exemplifies how integral economic indicators are in shaping both supply and demand in the marketplace.

Decoding PMI Measurements: What They Reveal

The PMI provides a wealth of insights into economic conditions, derived from carefully crafted surveys targeting supply chain managers across various sectors. These surveys delve into crucial business aspects, such as new orders, production levels, employment statistics, and supplier deliveries. The PMI’s calculated figures indicate whether conditions are expanding, stabilizing, or contracting. For businesses, these insights can serve as early warning signs, allowing them to adjust their operations in line with economic trends.

Moreover, the ISM report that accompanies the PMI presents a detailed analysis of the overall economic climate. By studying the underlying factors that influence PMI measurements, such as changes in consumer behavior or external market pressures, stakeholders can make more accurate predictions regarding future economic performance. This predictive capability positions the PMI as a key element in strategic planning, providing managers with a clearer view of potential market shifts.

Using PMI as an Economic Indicator

As a leading economic indicator, the Purchasing Managers Index holds significant weight in financial markets. Investors track PMI data closely to gauge economic momentum and predict trends in industrial production, GDP growth, and employment levels. A consistently high PMI reading can signal a robust economy, attracting more investments, whereas declining PMI figures may prompt caution among investors, leading to strategic portfolio adjustments.

Furthermore, fluctuations in the PMI can influence monetary policy decisions made by central banks. If the PMI indicates economic overheating, there may be a move to raise interest rates to curb inflation. Conversely, a declining PMI could lead to accommodative measures to stimulate growth. Understanding how the PMI functions within this broader economic context can empower stakeholders to make informed decisions that align with anticipated market movements.

The Global PMI: A Broader Perspective

The Global Purchasing Managers Index extends the concept of PMI beyond national borders, offering a comprehensive snapshot of economic health worldwide. Compiled by S&P Global, this index incorporates responses from over 28,000 companies globally, representing a staggering 90% of global GDP. This extensive data collection not only enhances the reliability of the PMI but also provides invaluable insights into how different economies are performing relative to one another.

By analyzing the Global PMI, businesses can identify trends and patterns in international trade and investment opportunities. For instance, if global manufacturing PMI readings are rising, companies may consider exploring markets where demand is surging. This global perspective empowers businesses to capitalize on emerging trends while mitigating risks associated with economic downturns in particular regions.

Interpreting High and Low PMI Readings

Understanding the implications of high and low Purchasing Managers Index readings is vital for businesses and investors alike. A PMI reading above 50 not only indicates economic expansion but also suggests that purchasing managers are optimistic about future market conditions. This optimism can drive increased investment and production efforts, ultimately benefitting the economy as a whole. Higher PMI levels can lead to hiring increases and expansion projects across industries, signaling a healthy and growing economy.

Conversely, a PMI reading below 50 can raise alarms about potential economic contraction. This could suggest that purchasing managers are experiencing decreased demand, potentially leading to cutbacks in production, layoffs, or reduced capital investment. Analyzing these trends is crucial for companies to navigate potential downturns effectively and adjust their strategies to emerge stronger as market conditions improve.

How PMI Influences Pricing Strategies

PMI insights dramatically impact pricing strategies employed by manufacturers and suppliers. When PMI reflects robust demand growth, businesses may respond by increasing prices for their goods and services, anticipating that customers will absorb the higher costs. This pricing power is generally derived from increased orders, where the balance of supply and demand tips favorably for sellers.

On the other hand, a declining PMI could compel businesses to reassess their pricing strategies. When demand begins to wane, manufacturers may lower prices to stimulate sales and retain market share. In such scenarios, they might also negotiate lower prices for components from suppliers, seeking to maintain profitability amid reduced revenue. This interplay between PMI readings and pricing demonstrates the delicate balance businesses must maintain in responding to market signals.

The Role of PMI in Investment Decisions

Investors consider the Purchasing Managers Index as an essential guide for making strategic investment decisions. The PMI’s ability to predict economic cycles provides investors with critical insights into potential market moves and investment opportunities. For instance, a consistent upward trend in PMI readings may signal expanding economic activity, encouraging investors to allocate resources towards growth sectors such as manufacturing or technology.

Moreover, the PMI’s quick release schedule means it can serve as a timely indicator for investors, allowing them to react swiftly to changing economic conditions. By utilizing PMI data alongside other economic indicators, investors can build a robust market strategy that capitalizes on upcoming trends while mitigating potential risks associated with economic downturns.

Connecting PMI Data to Economic Indicators

The Purchasing Managers Index is intricately linked to various economic indicators, reinforcing its value as a tool for understanding market dynamics. For example, readings from the PMI can often precede shifts in consumer confidence, employment statistics, and GDP readings. By analyzing trends in the PMI alongside these other indicators, analysts can develop a more nuanced understanding of the economic landscape, enabling them to provide informed forecasts.

Additionally, correlations between PMI and key economic metrics such as inflation rates and business investment can offer deeper insights into how fluctuations in the PMI impact overall economic stability. This interconnectedness illustrates the PMI’s significant role in comprehending broader economic trends and assisting stakeholders in making data-driven decisions.

Frequently Asked Questions

What is the Purchasing Managers Index (PMI) and why is it important?

The Purchasing Managers Index (PMI) is a vital economic indicator that measures the health of the manufacturing and services sectors. Compiled by the Institute for Supply Management (ISM), the PMI provides insights into supply and demand trends, helping corporate decision-makers, analysts, and investors understand current business conditions and forecast economic activity.

How is the PMI index calculated and what does it signify?

The PMI index is calculated through monthly surveys of purchasing managers, who provide feedback on various factors like new orders and production. A PMI reading above 50 indicates expansion in the economy, whereas a reading below 50 signifies contraction. Each point away from 50 indicates the degree of change.

What is the significance of the ISM report in relation to the PMI?

The ISM report is significant as it releases the Purchasing Managers Index for both manufacturing and services sectors. This report serves as a key economic indicator, summarizing the business outlook based on responses from supply chain managers, which aids investors and analysts in making informed decisions based on current economic trends.

How does the manufacturing PMI differ from the services PMI?

The manufacturing PMI specifically focuses on the manufacturing sector, assessing factors like employment, production, and supplier deliveries. In contrast, the services PMI includes non-manufacturing sectors such as healthcare and education. Both are essential parts of the overall PMI, providing a comprehensive view of economic conditions.

Who are the primary users of the Purchasing Managers Index (PMI)?

Primary users of the Purchasing Managers Index include corporate managers who rely on it for decision-making regarding production and inventory, suppliers who use it to forecast demand, and investors who view the PMI as a leading indicator of economic growth, influencing predictions about GDP and employment.

What impact does a high PMI reading have on economic expectations?

A high PMI reading indicates robust economic expansion and typically leads to positive economic forecasts. Conversely, low PMI readings suggest contraction, which may lead to cautious business sentiment and investment decisions. Thus, the PMI plays a critical role in shaping economic assessments.

How does the PMI influence pricing strategies in businesses?

The Purchasing Managers Index can significantly influence pricing strategies. If the PMI shows increased new orders, manufacturers may raise prices to capitalize on demand. Conversely, a decline in the PMI may lead to reduced prices as businesses adjust to lower demand, prompting negotiations for better procurement costs.

What is the Global PMI and what does it measure?

The Global PMI is an expansive economic indicator that represents global economic health based on responses from over 28,000 companies across various sectors. Compiled by S&P Global, it provides insights into the overall economic activity worldwide, reflecting trends in production and business sentiment.

How frequently is the PMI published and what is its relevance to market analysts?

The PMI is published monthly, providing timely insights into supply and demand conditions in the economy. Its frequent release and reliability make it a crucial tool for market analysts and investors who seek to understand economic trends and inform their financial strategies.

What role does the PMI play in predicting economic trends?

The Purchasing Managers Index plays a pivotal role in predicting economic trends as it reflects changes in business activity. Analysts consider it a leading indicator; for instance, rising PMI values can foreshadow increased economic growth, while falling figures may suggest potential downturns in economic performance.

| Key Point | Details |

|---|---|

| Definition | A monthly index that highlights supply and demand trends in manufacturing and services, based on surveys by ISM. |

| Methodology | PMI is calculated from responses of senior executives, covering new orders, production, employment, supplier deliveries, and inventories. A reading above 50 indicates expansion. |

| Key Users | Corporate managers, suppliers, and investors utilize PMI for decision-making regarding production, pricing, and assessing economic conditions. |

| Global PMI | Compiled by S&P Global, based on responses from over 28,000 global companies, reflecting 90% of global GDP. |

| Impact on Pricing | PMI insights affect supplier prices and manufacturer pricing decisions based on order trends. |

Summary

The Purchasing Managers Index (PMI) is a crucial economic indicator that provides insight into the supply and demand dynamics of various sectors, particularly manufacturing and services. As compiled by the Institute for Supply Management (ISM), the PMI assists corporate managers, suppliers, and investors in making informed decisions based on current economic conditions. By analyzing the PMI readings, stakeholders can gauge market expansion or contraction, facilitating strategic planning and pricing strategies. Thus, understanding the PMI is essential for navigating the complexities of the economic landscape.