In the evolving landscape of investment options, passive funds have emerged as a popular choice among investors, especially amid growing fears of market volatility. These funds, including index funds and exchange-traded funds (ETFs), offer a low-cost approach to investment and aim to replicate market performance instead of trying to outperform it. Over the past two years, the shift towards passive funds has been significant, with their numbers growing in response to increased investor interest. As mutual funds expand their unique investor base, now surpassing 5 crore, passive funds have become pivotal for those seeking stability and steady growth. This momentum highlights the potential these passive investment strategies have in navigating economic fluctuations and fostering long-term investor growth.

As the investment climate shifts, many individuals are turning to more automated and less hands-on approaches to asset management. These alternative funding schemes, often referred to as low-maintenance investment vehicles like index-linked mutual funds or easily tradable ETFs, provide a strategic avenue for capturing market movements. Increasingly, savvy investors are recognizing the advantages of these instruments, particularly in uncertain economic times where market volatility looms large. With a marked growth in the number of investors and total assets under management, these investment options underscore a collective move towards a more passive investment strategy. This transition not only reflects personal investment strategies but also highlights a broader trend of embracing stability through viable financial instruments.

The Rise of Passive Funds Amid Market Volatility

In recent years, passive funds have gained significant traction in the Indian financial market, particularly in response to heightened market volatility. As investors seek stability in their portfolios, these investment vehicles, including index funds and ETFs, emerge as attractive alternatives. With their inherently lower management fees and a strategy that typically involves tracking market indices, passive funds appeal to a growing demographic of risk-averse investors. This trend is reflected in the impressive growth in the assets under management, surpassing Rs 10.30 lakh crore by March 2025, indicating a robust shift toward passive investing strategies.

The global context underscores this trend, as passive funds worldwide have seen similar growth, now constituting 69% of total funds managed. In India, the number of new schemes launched in the passive realm, particularly index funds and ETFs, has skyrocketed, with 144 new launches last fiscal year alone. This expansion signifies increased investor awareness and confidence in passive investing as a viable strategy to navigate turbulent market conditions, thereby enhancing overall investor growth.

Impact of Mutual Funds on Unique Investor Growth

The mutual fund sector has demonstrated remarkable progress in expanding its unique investor base, reaching an impressive count of 5.42 crore by March 2025. This increase is a testament to the growing popularity of passive funds, where the simplicity of investing through index funds and ETFs resonates with a vast array of investors, from novices to seasoned market players. As market volatility spurred cautious investing behavior, individuals have flocked to these funds as a refuge, fostering substantial growth.

Moreover, the mutual fund industry has facilitated educational initiatives to bolster investor confidence and knowledge. By harnessing technology and digital platforms, asset management companies have made the investment process more accessible, demystifying mutual funds and allowing for seamless transactions. As a result, new investor registrations and the total number of folios have doubled, reflecting a thriving ecosystem where passive funds play a pivotal role in supporting investor growth.

Understanding Investor Behavior During Market Uncertainty

Investor behavior tends to shift during periods of market uncertainty, often leaning towards safer investment options that minimize risk. The current landscape reveals that many are opting for passive funds to shield themselves from market volatility, making index funds and ETFs more prevalent. As these instruments typically replicate market indices, they mitigate the risks associated with stock picking while still providing exposure to the equity market.

The movement towards passive investing during turbulent times aligns with broader trends observed both domestically and globally. As investors gain awareness of the long-term performance benefits associated with passive funds—particularly their resilience amidst market fluctuations—they are increasingly reallocating their portfolios to include these investment vehicles. This behavioral shift underscores the growing belief that passive funds are a strategic choice for capitalizing on market potential while managing risk effectively.

The Role of ETF Schemes in Portfolio Diversification

Exchange-Traded Funds (ETFs) have emerged as a cornerstone of modern investment strategies, allowing investors to achieve broad market exposure with enhanced liquidity and lower costs. By holding a basket of securities, ETFs provide an efficient way to diversify across various sectors and asset classes, effectively mitigating individual stock risk. As more investors recognize the importance of diversification in safeguarding their portfolios against market volatility, the demand for ETFs has surged.

The continual rise in funds mobilized through ETFs, which accounted for a substantial 21.1% of the total funds raised by open-ended equity schemes in the latest financial year, illustrates their critical role in enhancing portfolio resilience. By embracing ETF schemes, investors can not only tap into market performance but also efficiently manage risk, making them increasingly popular amid fluctuating market conditions.

Understanding the Benefits of Index Funds

Index funds represent one of the most straightforward forms of passive investing, providing a cost-effective way for individuals to participate in the stock market. The value proposition of index funds lies in their ability to replicate the performance of a specific index while incurring lower fees compared to actively managed funds. This cost advantage, coupled with significant returns over the long term, makes index funds an attractive option for both new and experienced investors alike.

Moreover, with increased focus on transparency and ease of access, index funds are continually appealing to a broader audience. The steady rise in AUM for these funds, which reached Rs 8.67 lakh crore within just one year, showcases the growing confidence investors have in this investment strategy. As markets evolve, index funds are positioned to remain integral in the investment landscape, offering stability and growth potential even during challenging economic periods.

Market Trends Influencing Passive Investment Growth

The evolution of the financial landscape has been significantly influenced by various market trends such as digitalization, regulatory changes, and shifts in investor preferences towards passive investments. Increasingly, individuals are drawn to the idea of investing with minimal intervention and cost, especially as they become more informed about the merits of passive funds like index funds and ETFs. This shift is evident in the surge of unique investors entering the market, particularly during times of economic uncertainty.

In response to this trend, financial institutions have adapted by launching innovative ETFs and index schemes that cater to the needs of diverse investor demographics. As a result, the market has seen a burgeoning array of investment options that not only align with investor preferences but also serve to bolster overall market stability. With passive funds accounting for a significant share of overall AUM, the implications for the future of investing are considerable, as more individuals regard these products as integral components of smart financial planning.

Exploring the Advantages of Passive Investment Strategies

Passive investment strategies, particularly through passive funds, have revolutionized how individuals approach wealth accumulation. This investment philosophy emphasizes long-term growth over short-term speculation, cultivating a disciplined approach to portfolio management. By focusing on maintaining a diversified asset mix, passive funds help investors weather the ups and downs of market fluctuations, ultimately leading to sustainable returns.

The current trend towards passive investments is also fueled by the desire for transparency and simplicity among investors. With lower fees, automatic rebalancing, and straightforward investment strategies, passive funds eliminate much of the complexity associated with active fund management. In doing so, they empower individuals to take control of their financial futures with confidence, all while aligning their investments with broader market performance.

The Future of Mutual Funds in India’s Financial Landscape

As the Indian economy continues to evolve, the role of mutual funds, especially passive funds, will likely grow even more prominent. With a steadily increasing number of investors and expanding assets under management, mutual funds are becoming a vital component of individual wealth creation strategies. The combination of favorable regulatory conditions and rising financial literacy among the population bodes well for the future of mutual funds.

Looking ahead, the introduction of more innovative products and the sustained success of ETFs and index funds will enable mutual funds to capture an even larger share of household savings. As investors seek stability amidst financial upheaval, passive funds are well-positioned to meet this demand, contributing to a more diversified and resilient investment landscape in India.

Navigating Market Changes with Passive Funds

Market changes can often trigger confusion and concern among investors, leading them to reevaluate their investment strategies. In such times, passive funds present a pragmatic solution, allowing investors to navigate market fluctuations without the burden of active management. By adopting a long-term perspective, investors can benefit from the broader market growth that passive funds aim to track.

Furthermore, the inherent features of passive funds enable them to adapt to changing market conditions. As regulatory frameworks continue to tighten and market dynamics shift, these investment vehicles prove resilient, appealing to an increasingly diverse investor segment. This adaptability fosters investor confidence and facilitates sustained growth in the passive investment sector, cementing its role as a strategic choice in uncertain market environments.

Maximizing Returns Through Diversification with ETFs

ETFs not only provide entry points into popular stock market indices but also offer investors the opportunity to diversify their portfolios effectively. By encompassing a broad range of sectors and asset classes, ETFs help mitigate risks associated with individual stocks, hence maximizing potential returns. Their structure allows for a more comprehensive approach to equity investment, making them an attractive option for those aiming to achieve long-term financial goals.

Recent trends reveal that as investors increasingly recognize the benefits of diversification through ETFs, their popularity is expected to rise further. The demand for these funds is anticipated to grow as more individuals strive for balanced portfolios that offer both risk management and access to growth opportunities. In this sense, ETFs have become essential tools for any investor looking to navigate the complexities of today’s financial landscape.

Frequently Asked Questions

What are passive funds and how do they work?

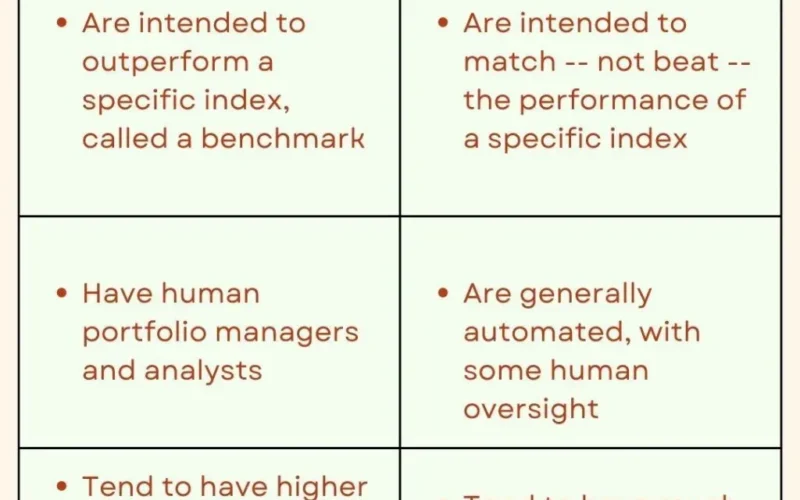

Passive funds are investment vehicles that aim to replicate the performance of a specific index, such as the S&P 500, rather than trying to outperform it. Common types of passive funds include index funds and exchange-traded funds (ETFs). These funds typically have lower management fees and follow a buy-and-hold strategy, making them a popular choice for long-term investors seeking consistent growth without the risks associated with active fund management.

How have index funds impacted investor growth in recent years?

Index funds have significantly contributed to investor growth in recent years, with a notable increase in unique investors reaching 5.42 crore by March 2025. The simplicity and lower costs of index funds attract new investors looking for reliable returns, especially during periods of market volatility, leading to a 22% rise in investor participation over the previous year.

What are ETF schemes and how are they different from mutual funds?

ETF schemes are a type of passive fund that trades on stock exchanges like individual stocks, allowing investors to buy and sell throughout the trading day. Unlike mutual funds, which are priced at the end of the trading day, ETFs provide real-time pricing. Both serve as effective tools for portfolio diversification, but ETFs often have lower expense ratios compared to mutual funds.

Why are more investors turning to passive funds during market volatility?

During times of market volatility, many investors are turning to passive funds as they provide a more stable and predictable investment option. Passive funds, particularly index funds and ETFs, typically incur lower fees, which appeals to cost-conscious investors. The recent trend indicates an increase in the allocation of household savings to passive funds as investors seek to manage risk without sacrificing growth.

What role do passive funds play in diversifying an investment portfolio?

Passive funds, such as index funds and ETFs, play a crucial role in diversifying an investment portfolio. By investing in a broad range of securities that mirror a specific index, these funds help reduce individual stock risk and provide exposure to various market sectors. This diversification is particularly beneficial for investors looking to mitigate risk while aiming for steady long-term growth.

How can investors get started with mutual funds and passive investing?

Investors can start with mutual funds and passive investing by first assessing their financial goals and risk tolerance. They can then research different mutual fund houses and identify suitable index funds or ETFs that align with their strategy. Opening a demat account can facilitate easy investment in ETFs, while mutual funds can be bought directly or through brokers. Regular investments through systematic investment plans (SIPs) can also be an effective way to build wealth using passive funds.

What are the benefits of investing in passive funds over actively managed funds?

Investing in passive funds offers several benefits, including lower expense ratios, simplicity in management, and historically robust returns that often outperform actively managed funds over the long term. As investments in passive funds continue to grow, new investors can capitalize on market trends while avoiding the higher costs typically associated with active fund management.

| Key Point | Details |

|---|---|

| Growth in Unique Investors | The unique investor count in mutual funds increased to 5.42 crore by March 2025, a 22% rise from the previous year. |

| Increase in Passive Funds | The number of index and other ETF schemes grew from 341 in April 2023 to 541 by March 2025. |

| Scheme Launches | 144 new schemes were launched in index and ETF categories during the last financial year. |

| Assets Under Management (AUM) | AUM increased from Rs 6.24 lakh crore in March 2023 to Rs 10.30 lakh crore by March 2025. |

| Index Funds’ Market Share | As of March 2025, passive funds account for 20.8% of total open-ended equity schemes. |

| Inflows into Passive Funds | In FY24-25, index funds and ETFs mobilized Rs 3.51 lakh crore, making up 21.1% of total funds. |

Summary

Passive funds have gained significant traction in India, notably characterized by a growing number of investors and assets under management. As traditional mutual funds adapt to an increasingly volatile market, passive options provide a stable and attractive alternative, reflecting the shift in investor sentiment. With the landscape continuously evolving, passive funds represent a fundamental shift in investment strategy, as they cater to a broader demographic seeking stability amidst market fluctuations.