McDonald’s stock performance has garnered significant attention as investors eagerly await the fast-food giant’s upcoming earnings report on February 10. Analysts predict adjusted earnings per share (EPS) of $2.86, a slight increase from last year’s $2.95, which may not instill much confidence given the recent downturn in comparable-store sales. With a revenue forecast of approximately $6.5 billion, the market is watching closely for any signs of growth or potential recovery in McDonald’s market trends. The stock has faced challenges, losing about 9% of its value since mid-October, raising questions about the impact of international performance on MCD stock analysis. As we delve into McDonald’s fourth-quarter results, both technical and fundamental analyses will provide insights into whether this beloved brand can navigate its current hurdles.

The financial trajectory of the iconic American fast-food chain, often referred to as the “Golden Arches,” is under scrutiny as it prepares to unveil its quarterly performance metrics. With expectations set for earnings per share around $2.86, many analysts are skeptical about the potential for substantial growth given the recent declines in comparable-store sales. Investors are keen to explore the implications of these market dynamics on MCD stock behavior. As McDonald’s faces headwinds from international markets, the upcoming release promises to shed light on the company’s resilience amidst shifting consumer trends. This analysis will encompass both technical patterns and broader market influences that could shape the future of McDonald’s stock.

Understanding McDonald’s Fundamental Analysis

McDonald’s fundamental analysis reveals critical insights into its expected performance in the upcoming fourth-quarter earnings report. Analysts project an adjusted earnings per share (EPS) of $2.86, reflecting a slight increase from last year’s $2.95. However, the revenue forecast of approximately $6.5 billion indicates only marginal growth, raising concerns about the company’s ability to drive significant sales momentum. The downgrades from 17 out of 31 analysts suggest that the market is not anticipating robust earnings growth, particularly given the recent decline in comparable-store sales. This trend highlights the importance of closely monitoring McDonald’s performance metrics, as they can significantly influence investor sentiment and MCD stock analysis moving forward.

Additionally, the recent downturn in comparable-store sales, which saw a 1.5% year-over-year decline in the third quarter, poses a challenge for McDonald’s. This consecutive drop in sales marks a departure from the company’s historically strong performance, particularly in international markets. The struggles outside the United States have contributed to a 9% decline in MCD’s stock price since mid-October, raising questions about the company’s global strategy. As investors prepare for the upcoming earnings report, understanding these fundamental factors will be crucial for assessing McDonald’s potential for recovery and growth.

Analyzing McDonald’s Technical Indicators

Turning to technical analysis, McDonald’s stock chart presents a potentially optimistic outlook ahead of the fourth-quarter results. The presence of a ‘falling wedge’ pattern on the chart indicates a possible bullish reversal, suggesting that MCD could surprise investors with stronger-than-expected earnings. With the stock currently finding support near $280.40, and closing at $294.36, traders are closely watching these critical levels. The interplay between the stock’s 50-day Simple Moving Average (SMA) and its 200-day SMA will play a pivotal role in determining the trajectory of MCD stock in the near term.

Furthermore, the indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) offer additional insights into the momentum behind McDonald’s stock. While the RSI remains neutral, the MACD is yet to show a bullish position. The rising histogram of the 9-day Exponential Moving Average (EMA) signals potential upward pressure, but it is essential to note that both the 12-day and 26-day EMAs must rise above zero for a strong bullish setup. Investors will be keen to see if McDonald’s can break through resistance levels and fill the unfilled gap at $313, which could signify a strong recovery following the earnings report.

Impact of McDonald’s Market Trends

Understanding market trends is crucial for investors tracking McDonald’s (MCD) stock performance. Current market conditions, influenced by economic factors and consumer behavior, play a significant role in shaping the fast-food giant’s earnings potential. Trends such as inflation and changing consumer preferences, particularly post-pandemic, are affecting how fast-food chains position themselves in the market. A decrease in discretionary spending may impact McDonald’s ability to drive sales growth, particularly as consumers look for value in their dining experiences.

Moreover, the competitive landscape for fast food has intensified, with numerous chains vying for market share. McDonald’s must adapt to these trends, focusing on innovation and menu diversification to attract customers. Understanding how these market trends interact with McDonald’s operational strategies is essential for investors seeking to understand the potential implications for MCD stock analysis and future performance. As the company prepares to report its fourth-quarter results, these dynamics will be critical in predicting how McDonald’s will fare in an ever-changing market.

Examining McDonald’s Earnings Report Expectations

As McDonald’s approaches its fourth-quarter earnings report, expectations are tempered among analysts and investors. With projected earnings of $2.86 per share, the anticipation is that McDonald’s may not meet prior growth levels, particularly given the recent downgrades in earnings estimates. Investors will be keen to assess whether McDonald’s can overcome the challenges posed by declining comparable sales, especially in international markets, which have significantly underperformed relative to domestic results.

The earnings report will also provide insights into McDonald’s strategic initiatives to drive growth in the coming quarters. Key metrics to watch include comparable-store sales and any commentary on how global market conditions are affecting business operations. A positive surprise in these areas could bolster MCD stock analysis and potentially reverse the recent downward trend. Conversely, continued struggles could further dampen investor confidence, making it imperative to interpret the results within the broader context of the fast-food industry’s recovery.

McDonald’s Stock Performance Analysis

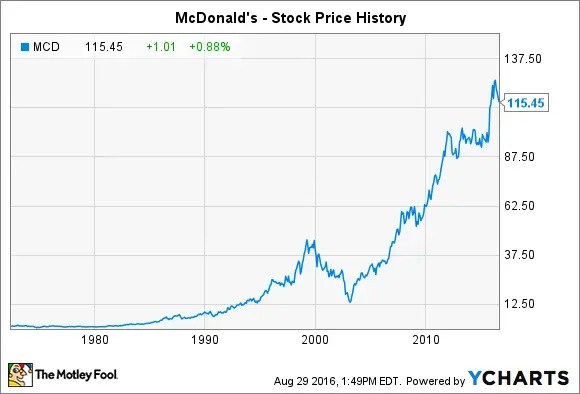

The analysis of McDonald’s stock performance (MCD) provides valuable insights into how the company has navigated recent market challenges. Since mid-October, MCD has experienced a decline of about 9% in its stock price, primarily due to disappointing comparable sales figures and concerns over international market performance. This bearish trend has raised questions among investors regarding the company’s growth prospects and its ability to maintain market leadership in the fast-food sector.

However, technical indicators suggest that McDonald’s stock may be poised for a turnaround. The recent price action has formed a falling wedge pattern, which historically indicates a bullish reversal. If MCD can break through key resistance levels and fill the unfilled gap at $313, it may signal a renewed positive momentum. Understanding these technical signals, alongside fundamental analysis, is essential for investors looking to capitalize on potential recovery opportunities in McDonald’s stock performance.

Future Projections for McDonald’s Earnings

Looking ahead, future projections for McDonald’s earnings will hinge on several key factors, including consumer spending patterns and the company’s ability to innovate its menu offerings. As the fast-food market evolves, McDonald’s must adapt to shifting consumer preferences, particularly among younger demographics that prioritize health and sustainability. This evolution will be crucial for maintaining competitive advantage and driving future earnings growth.

Moreover, analysts will closely monitor how McDonald’s manages its international operations, which have recently struggled. A successful strategy to rejuvenate international sales could significantly bolster the company’s overall performance and improve investor sentiment. As projections for McDonald’s earnings evolve, it will be imperative for stakeholders to stay informed about these trends and their implications for MCD stock moving forward.

The Role of Comparable Sales in McDonald’s Performance

Comparable sales play a crucial role in assessing McDonald’s overall performance and future growth potential. The company’s recent struggles with negative comparable sales growth, particularly in international markets, paint a concerning picture for investors. The decline of 1.5% year-over-year in the third quarter indicates a need for strategic adjustments to regain momentum. Understanding the factors contributing to these declines will be essential for evaluating McDonald’s path forward.

In the upcoming earnings report, investors will be particularly attentive to any changes in comparable-store sales. An unexpected increase could serve as a catalyst for MCD stock, reflecting a successful turnaround strategy. Conversely, continued declines would likely exacerbate concerns and could further impact McDonald’s stock performance. Keeping an eye on these comparable sales figures will be paramount for stakeholders as they navigate the fast-food landscape.

Strategic Initiatives for McDonald’s Growth

In light of recent challenges, McDonald’s is likely to focus on strategic initiatives aimed at driving growth and enhancing customer engagement. Innovations in menu offerings, including healthier choices and local adaptations, may play a significant role in attracting a broader customer base. In addition, leveraging technology for improved customer service and operational efficiency will be key to staying competitive in the fast-food industry.

Moreover, McDonald’s commitment to sustainability and responsible sourcing could resonate well with today’s environmentally conscious consumers. By aligning its business practices with consumer values, McDonald’s can enhance brand loyalty and potentially drive sales growth. As the company navigates its upcoming fourth-quarter results, these strategic initiatives will be vital in determining its future trajectory in the fast-food sector.

Navigating Investor Sentiment Towards McDonald’s

Investor sentiment towards McDonald’s stock is currently mixed, reflecting the uncertainty surrounding its upcoming earnings report. The recent downgrades from analysts have contributed to a cautious outlook, as many investors are weighing the implications of the company’s declining comparable sales. This sentiment is crucial, as it can influence trading behavior and stock performance in the lead-up to significant earnings announcements.

As McDonald’s approaches the release of its fourth-quarter results, investor sentiment may shift dramatically based on the reported figures. A strong earnings report that exceeds expectations could reinvigorate confidence in MCD stock and lead to a rebound in its market price. Conversely, disappointing results could exacerbate negative sentiment, leading to further stock declines. Monitoring investor reactions to the earnings report will be essential for understanding the broader implications for McDonald’s future performance.

Frequently Asked Questions

What can we expect from McDonald’s stock performance following the upcoming earnings report?

McDonald’s stock performance is closely tied to its upcoming earnings report, where analysts forecast adjusted earnings per share (EPS) of $2.86 and revenue of around $6.5 billion. These figures suggest only a 1% increase in sales, indicating that overall market sentiment may be cautious, which could influence MCD stock performance negatively if expectations are not met.

How did McDonald’s fourth-quarter results impact MCD stock analysis?

McDonald’s fourth-quarter results are crucial for MCD stock analysis. If the company reports better-than-expected comparable-store sales growth, it could lead to a positive adjustment in stock forecasts. However, the recent trend of declining comparable sales may dampen investor enthusiasm and negatively affect McDonald’s stock performance.

What are the key factors affecting McDonald’s earnings report predictions?

Key factors impacting McDonald’s earnings report predictions include analysts’ downgrades of earnings estimates, recent negative trends in comparable sales, and performance variations between domestic and international markets. These elements contribute significantly to the overall outlook for McDonald’s stock performance.

What does technical analysis suggest about McDonald’s stock movement?

Technical analysis indicates that McDonald’s stock might be poised for upward movement, particularly if it breaks out of a ‘falling wedge’ pattern. The stock’s current support level around $280.40 and its relationship with moving averages suggest potential bullish signals if positive fourth-quarter results are reported.

How do market trends influence McDonald’s stock performance?

Market trends play a vital role in McDonald’s stock performance, especially as the company navigates recent declines in comparable sales and challenges in international markets. Observing these trends can provide insights into potential stock movements and investor sentiment surrounding MCD.

What should investors focus on in McDonald’s upcoming earnings report?

Investors should focus on McDonald’s comparable-store sales figures and the company’s ability to meet or exceed the forecasted earnings per share. These metrics will be critical in determining the future trajectory of MCD stock performance and overall market confidence.

How have analysts reacted to McDonald’s stock performance ahead of the earnings report?

Ahead of the earnings report, analysts have shown caution, with 17 out of 31 sell-side analysts downgrading their earnings estimates for McDonald’s. This sentiment reflects growing concerns over the company’s recent performance and could influence MCD stock performance post-report.

What are the implications of McDonald’s stock’s technical setup before the earnings report?

The technical setup for McDonald’s stock suggests that it may experience a bullish reversal if it successfully breaks out of the current pattern. This possibility creates a positive scenario for investors, especially if the earnings report includes favorable comparable sales data.

What is the correlation between McDonald’s fourth-quarter results and stockholder expectations?

The correlation between McDonald’s fourth-quarter results and stockholder expectations is significant; positive results could lead to a rebound in stock performance, while disappointing figures may exacerbate current declines, affecting investor sentiment and stockholder confidence in MCD.

Why is McDonald’s comparable-store sales important for understanding stock performance?

Comparable-store sales are crucial for understanding McDonald’s stock performance because they provide insight into the company’s sales growth and operational efficiency. A decline in these figures for two consecutive quarters raises concerns about future profitability, directly impacting MCD stock valuation.

| Key Point | Details |

|---|---|

| Q4 Earnings Report Date | February 10, 2023 |

| Expected Adjusted EPS | $2.86 |

| Expected Revenue | $6.5 billion |

| Comparison to Last Year’s EPS | $2.95 |

| Comparable Sales Growth | -1.5% YoY in Q3, -1% YoY in Q2 |

| Analyst Downgrades | 17 out of 31 analysts downgraded estimates |

| Stock Price Decline | 9% drop since mid-October peak |

| Technical Analysis Setup | Potential bullish reversal from falling wedge |

| Current Stock Price | $294.36 |

| Support Level | $280.40 |

| Resistance Level | $291 (50-day SMA) |

| Unfilled Gap Target | $313 |

Summary

McDonald’s stock performance is under scrutiny as the company prepares to announce its fourth-quarter results. Analysts are projecting a modest earnings report, with adjusted earnings per share expected at $2.86 and revenue around $6.5 billion. This represents only slight growth compared to last year, highlighting concerns regarding comparable sales, which have seen consecutive declines. Additionally, the technical analysis suggests a potential bullish reversal could occur if the stock breaks out from a falling wedge pattern. Investors will be watching closely on February 10 to see if McDonald’s can deliver a positive surprise, which could boost its stock performance.