The Malaysia IPO market trends are poised for significant evolution as we head into 2025, particularly highlighted by the emergence of technology sector IPOs and renewable energy IPOs. With a strong emphasis on innovation, startups leveraging artificial intelligence and fintech are capturing the attention of investors, while companies focused on sustainable energy solutions are gaining momentum. Additionally, consumer goods IPOs are increasingly appealing to investors, reflecting the changing dynamics in lifestyle and wellness trends post-pandemic. Bursa Malaysia is expected to facilitate approximately 50 new listings in 2025, further enriching the investment landscape. As these sectors flourish, retail investors are encouraged to align their portfolios with these promising opportunities to maximize potential returns.

As we explore the landscape of initial public offerings in Malaysia, it’s essential to consider the dynamic shifts occurring within various sectors. The upcoming year is anticipated to bring a wave of new listings, particularly from innovative firms in the technology space and those committed to renewable energy initiatives. The consumer goods sector is also likely to see a surge in interest, following recent lifestyle changes influenced by the global pandemic. With Bursa Malaysia at the forefront of this growth, investors are presented with a unique opportunity to tap into a diverse array of IPOs, which not only promises financial gains but also supports sustainable development efforts. This evolving market landscape is critical for stakeholders looking to navigate the investment opportunities in Malaysia’s IPO scene.

Emerging Trends in Malaysia’s IPO Market for 2025

The IPO market in Malaysia is poised for significant growth in 2025, with emerging trends in technology and renewable energy sectors leading the charge. Companies that leverage cutting-edge innovations such as artificial intelligence and fintech are capturing the attention of investors, indicating a strong preference for tech sector IPOs. This trend is not only reflective of local market dynamics but also aligns with global investment trends, where technology-driven businesses are seen as the future of economic growth. As investors look for opportunities that promise sustainable returns, tech startups are increasingly becoming attractive propositions in the IPO landscape.

Additionally, the renewable energy sector is gaining momentum, particularly firms focusing on solar power and electric vehicle infrastructure. As the world shifts towards sustainable energy sources, Malaysia’s IPO market is likely to see a surge in listings from companies committed to environmental sustainability. Investors are becoming more conscious of corporate social responsibility, and businesses that align with these values are expected to perform better in the market. This presents a unique opportunity for retail investors to diversify their portfolios by investing in companies that are not only financially viable but also contribute to a sustainable future.

The Role of Consumer Goods IPOs in Shaping the Market

The consumer goods sector is another area of interest in Malaysia’s IPO landscape, particularly as companies adapt to post-pandemic lifestyle changes. With growing consumer demand for health and wellness products, IPOs from companies in this sector are set to attract significant investor interest. This trend suggests that consumer goods IPOs will play a crucial role in the broader IPO market, helping to boost investor confidence and stimulate economic growth. Companies that respond effectively to evolving consumer preferences are likely to see favorable listings, as they resonate with the current market sentiment.

Moreover, the growth of the consumer goods market can be partially attributed to the increased disposable income of Malaysians and a shift towards online shopping. As retail dynamics evolve, companies that embrace e-commerce and innovative marketing strategies are well-positioned for success in the IPO market. The expected influx of IPOs from consumer goods companies in 2025 indicates a vibrant and adaptive market, providing investors with numerous opportunities to engage with brands that meet the demands of today’s consumers.

Bursa Malaysia: A Hub for Diverse IPO Listings

Bursa Malaysia is anticipated to be a hub of activity in 2025, with forecasts suggesting around 50 new IPO listings throughout the year. This influx of listings showcases the growing diversity of sectors entering the market, from technology and renewable energy to consumer goods and logistics. The robust economic fundamentals of Malaysia provide a solid backdrop for these IPOs, fostering an environment where companies can thrive and attract both local and international investors. The performance of Bursa Malaysia in recent years has instilled a sense of confidence among investors, encouraging them to explore various sectors for potential investment opportunities.

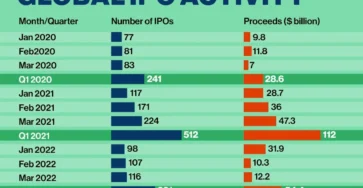

The entry of new companies into Bursa Malaysia not only enhances market liquidity but also promotes healthy competition among sectors. Investors are increasingly looking for diversified portfolios, and the variety of listings expected in 2025 will cater to this demand. Furthermore, the performance of IPOs in Malaysia has been impressive, with the country leading ASEAN in the number of IPOs and funds raised in 2024. This trend is likely to continue as more companies recognize the benefits of going public, contributing to an ever-evolving investment landscape in Malaysia.

Investor Sentiment Towards Renewable Energy IPOs

Investor sentiment in Malaysia is increasingly leaning towards renewable energy IPOs, reflecting a global shift towards sustainability. The interest in solar energy and electric vehicle initiatives positions Malaysia as a key player in the renewable energy sector, making it an attractive destination for investors looking to capitalize on the green transition. Companies entering the IPO market with a focus on these areas are likely to capture significant attention, as investors prioritize environmentally responsible investments that promise long-term growth and stability.

The Malaysian government’s commitment to sustainability and renewable energy further bolsters investor confidence. Policies and incentives aimed at supporting green technologies are encouraging more firms to consider going public. As the demand for clean energy solutions rises, the potential for lucrative returns from renewable energy IPOs becomes evident. Investors are keen on aligning their portfolios with future-focused industries, making renewable energy a pivotal area of interest for the upcoming IPO landscape in 2025.

Impact of Technology Sector IPOs on the Economy

The technology sector’s growth in Malaysia is expected to have a profound impact on the economy, especially with the surge of IPOs anticipated in 2025. Startups that innovate in areas such as artificial intelligence and fintech are not only attracting investor interest but are also contributing to job creation and economic development. As these tech companies go public, they bring fresh capital into the market, which can be reinvested into research and development, fostering further innovation and competitiveness within the sector.

Moreover, successful technology IPOs can stimulate interest in the broader market, encouraging more startups to consider public listings as a viable path for growth. This could lead to a positive feedback loop where increased investor engagement in technology firms results in higher valuations and more robust funding opportunities. The ripple effect of strong technology sector IPOs can significantly enhance Malaysia’s economic landscape, positioning it as a leading hub for technological advancement in the region.

Forecasting IPO Trends in the Consumer Goods Sector

As Malaysia’s economy continues to recover from the pandemic, the consumer goods sector is poised for significant growth, which can lead to a surge in IPOs in 2025. Companies that adapt to changing consumer preferences—especially towards health, wellness, and sustainability—are likely to find favor among investors. The anticipated listings from this sector signal a robust pipeline of opportunities for retail investors eager to capitalize on emerging trends in consumer behavior.

Furthermore, the increasing popularity of online shopping and the growth of the e-commerce market are expected to play a pivotal role in shaping the consumer goods IPO landscape. Firms that effectively leverage digital platforms and innovative marketing strategies will likely see higher valuations and successful public offerings. This trend not only enhances the prospects for individual companies but also contributes to the overall vitality of Malaysia’s IPO market, reinforcing the significance of the consumer goods sector in the upcoming year.

IPO Performance Indicators and Market Outlook

Looking ahead to 2025, various performance indicators suggest a promising outlook for Malaysia’s IPO market. The past success of IPOs, with 55 listings in 2024, sets a high benchmark and provides a solid foundation for future growth. Investor confidence is likely to remain strong, driven by Malaysia’s economic fundamentals and the increasing diversity of sectors entering the market, including technology, renewable energy, and consumer goods. These factors create an optimistic environment for new listings, enabling potential companies to attract substantial investment.

Moreover, the presence of established firms and successful IPOs in recent years serves as a testament to the resilience and attractiveness of the Malaysian IPO landscape. As companies prepare for their public offerings, they will be closely watched by investors looking for the next big opportunities. Therefore, understanding market trends and performance indicators will be crucial for investors aiming to make informed decisions in the vibrant IPO market of Malaysia for 2025.

The Future of IPOs in Malaysia’s Renewable Energy Sector

The renewable energy sector in Malaysia is on the cusp of transformation, with numerous IPOs expected to emerge in 2025. As the world pushes towards sustainability, companies focusing on solar energy, wind power, and electric vehicle infrastructure are becoming increasingly appealing to investors. This trend highlights a significant shift in investor priorities, as they seek to support initiatives that contribute to environmental conservation while also promising financial returns. The potential for IPOs in the renewable energy sector is vast, offering opportunities for investors looking to align their portfolios with sustainable practices.

In addition, the Malaysian government has been proactive in promoting renewable energy initiatives through various policies and incentives, making it easier for firms in this sector to access capital. As more companies recognize the advantages of going public, the renewable energy IPO landscape is likely to flourish. Investors can expect a variety of offerings that not only promise growth but also contribute to the overall sustainability goals of the nation, reinforcing the role of renewable energy in Malaysia’s economic future.

Investor Strategies for Upcoming IPOs in 2025

As Malaysia gears up for an exciting year of IPOs in 2025, investors must develop effective strategies to navigate this dynamic market. Staying informed about upcoming IPOs, understanding sector trends, and aligning investments with long-term growth sectors such as technology and renewable energy will be crucial for maximizing returns. Retail investors should consider leveraging market research and analysis to make informed decisions about which listings to pursue, focusing on companies that demonstrate strong potential for growth and resilience in the evolving economic landscape.

Furthermore, diversifying investment portfolios by including IPOs from various sectors can mitigate risks and enhance overall performance. Investors may also want to explore participation in investment clubs or online forums to share insights and strategies with like-minded individuals. As 2025 approaches, the ability to adapt and respond to changing market conditions will be essential for investors looking to capitalize on the myriad opportunities presented by Malaysia’s vibrant IPO market.

Frequently Asked Questions

What are the key trends in the Malaysia IPO market for 2025?

The Malaysia IPO market in 2025 is expected to be defined by significant trends in the technology and renewable energy sectors. Startups leveraging artificial intelligence and fintech innovations will attract considerable investor interest, while renewable energy firms focusing on solar power and electric vehicle infrastructure will gain traction as sustainability becomes a priority.

How will technology sector IPOs impact Malaysia’s IPO market in 2025?

Technology sector IPOs are anticipated to have a substantial impact on Malaysia’s IPO market in 2025. With a growing focus on AI and fintech, these IPOs are expected to drive investor interest and contribute to a diverse range of opportunities for retail investors, enhancing overall market dynamics.

What role will renewable energy IPOs play in Malaysia’s 2025 IPO landscape?

Renewable energy IPOs are set to play a crucial role in Malaysia’s 2025 IPO landscape. Companies focusing on solar energy and electric vehicle infrastructure align with global sustainability goals, attracting investments and contributing to the country’s economic growth.

What types of consumer goods IPOs are expected in Malaysia in 2025?

In 2025, consumer goods IPOs in Malaysia are expected to cater to post-pandemic lifestyle changes and wellness trends. Companies that adapt to these shifts, particularly in the food and beverage sector, will likely be of great interest to investors, reflecting the evolving consumer preferences.

How many new listings are expected on Bursa Malaysia in 2025?

Bursa Malaysia is expected to welcome approximately 50 new listings in 2025. This optimism is driven by the robust economic fundamentals of Malaysia and the increasing diversity of sectors entering the IPO market, including technology, renewable energy, and consumer goods.

What is the significance of Oriental Kopi’s IPO for the Malaysia IPO market in 2025?

Oriental Kopi’s IPO is significant as it marks the third listing on the ACE Market in 2025 and is generating excitement among retail investors. With plans to raise RM183.96 million to expand its operations, this IPO reflects the growth potential in Malaysia’s food and beverage industry, which is expected to thrive in the coming years.

What is the performance of Malaysia’s IPO market in 2024?

In 2024, Malaysia recorded 55 IPOs, the highest in ASEAN, collectively raising substantial funds. This strong performance has boosted investor confidence and significantly contributed to the overall economy, setting a positive tone for the 2025 IPO market.

What should retail investors consider regarding the upcoming IPOs in Malaysia?

Retail investors should stay informed about upcoming IPOs in Malaysia and consider aligning their investments with long-term growth sectors like technology, renewable energy, and consumer goods. Understanding market trends can help investors capitalize on the diverse opportunities presented by the evolving IPO landscape.

| Key Points | Details |

|---|---|

| Trends in IPO Market | The technology and renewable energy sectors are expected to dominate the IPO market in 2025. |

| Investor Interest | Investors are particularly interested in startups leveraging AI and fintech, as well as renewable energy firms focusing on solar and EV infrastructure. |

| Consumer Goods | Companies responding to post-pandemic lifestyle shifts are also attracting investor attention. |

| 2024 IPO Performance | Malaysia recorded 55 IPOs in 2024, the highest in ASEAN, raising significant funds and boosting investor confidence. |

| Forecast for 2025 | Approximately 50 new listings are expected in 2025, with optimism due to Malaysia’s economic fundamentals. |

| Oriental Kopi Holdings Bhd IPO | Upcoming listing priced at RM0.44 per share, aiming to raise RM183.96 million for expansion. |

| F&B Industry Growth | The domestic F&B sector recorded RM228.66 billion in revenue in 2023, with a forecast growth rate of 7.95% from 2023 to 2027. |

Summary

The Malaysia IPO market trends indicate a promising outlook for 2025, driven by advancements in technology and renewable energy sectors. With a notable increase in investor interest in innovative startups and sustainable initiatives, the landscape is set for diverse investment opportunities. The anticipated influx of new listings, alongside the impressive performance of recent IPOs, positions Malaysia as a key player in the ASEAN region’s capital market. As retail investors align their strategies with these emerging trends, the future of the IPO market in Malaysia looks bright.