Index-tracking funds have gained immense popularity among investors seeking to navigate the complexities of the financial markets. These funds, which include a variety of ETFs and bond index funds, are designed to replicate the performance of specific market indices, offering a streamlined approach to index investing. As economic uncertainties arise, the importance of effective portfolio management becomes paramount, making index-tracking products a vital choice for many. With advantages such as lower costs and market-cap weighting, these funds provide broad exposure to a diverse range of securities. Ultimately, understanding how to effectively leverage index-tracking funds is essential for investors looking to achieve reliable returns in an ever-evolving market landscape.

When discussing low-maintenance investment strategies, one cannot overlook the significance of funds that track market indices. These financial instruments, often referred to as index funds, are specifically engineered to align with the performance of established benchmarks. Investors appreciate the simplicity and transparency that come with these options, as they blend effortlessly into a diversified investment portfolio. By adopting portfolio strategies that incorporate index funds, particularly those based on market-cap distributions, individuals can enjoy a more balanced exposure to market trends. As more investors turn to these straightforward solutions, understanding their implications and benefits becomes increasingly crucial.

Understanding Index-Tracking Funds

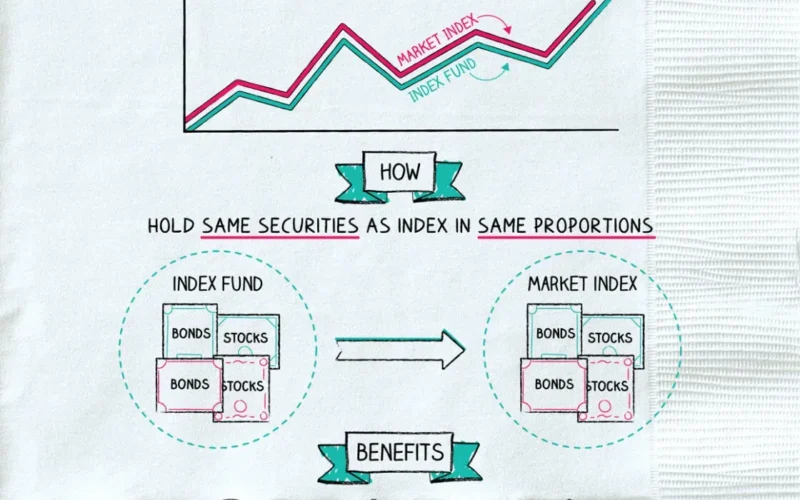

Index-tracking funds, often referred to as index funds, serve as a bridge between traditional active management and passive investing. These funds aim to replicate the performance of a specific index, such as the S&P 500, by holding the same securities in the same proportions. While many investors perceive the management of these funds as straightforward, the underlying mechanics demand a nuanced understanding and sophistication from asset managers. For instance, effective index fund management involves strategic decisions that can significantly impact investor returns, especially during periods of market volatility.

In the realm of ETF investing, the selection of index-tracking funds goes beyond mere cost considerations. Investors must consider factors such as diversification and transparency. While low fees are an attractive feature of index funds, a diverse portfolio that captures broad market movements is essential to managing risk effectively. With a multitude of index products on the market, discerning which funds offer the best mix of cost efficiency and comprehensive market exposure is critical. Thus, understanding the intricacies behind index-tracking funds is paramount for any informed investor.

The Importance of Portfolio Management with ETFs

When investing in ETFs and index-tracking funds, exuding a strong portfolio management strategy is crucial. Investors should recognize that the skill tier of portfolio management teams plays a significant role in maintaining alignment with benchmark indices. Long-term fund performance is typically indicative of how well the asset manager navigates the diverse challenges posed by fluctuating markets and economic cycles. Without proper management, even the most cost-effective index fund can underperform relative to expectations, underscoring the need for investors to consider an asset manager’s capabilities.

Moreover, portfolio management in the context of index funds is not merely about tracking a static benchmark. Competitive portfolios must adapt to market changes while maintaining fidelity to the index they are designed to follow. This highlights the importance of evaluating the long-term performance of index-tracking funds versus their benchmarks. Experienced fund managers use sophisticated techniques to ensure that the funds are adept at capturing market movements, which is integral for those investors seeking steady performance throughout various market conditions.

When evaluating different index-tracking funds, one should consider aspects like securities lending as a part of effective portfolio management. Understanding the costs, risks, and fee-sharing associated with securities lending can significantly impact overall fund performance—being well-informed about these factors can lead to better investment decisions.

Debunking Misconceptions Around Index Investing

One common misconception about index investing is that it resembles a “set-it-and-forget-it” strategy. On the contrary, the management of index funds, especially in the realm of fixed income, necessitates a proactive and skilled approach. Asset managers need to employ advanced strategies to mirror the performance of a benchmark index closely, particularly when they are required to utilize sampling methods due to the impracticality of holding every security in the index. Understanding this complexity helps demystify the index fund management process and highlights why many investors may overlook the need for experienced management.

Furthermore, as market dynamics fluctuate, it’s essential to know that merely investing in an index fund does not absolve an investor from the risks associated with market volatility. For instance, fixed income index funds may confront additional challenges, as evidenced by the sheer volume of securities in indices such as the Bloomberg Global Aggregate Index. An investor’s success in these markets often hinges on the asset manager’s expertise in navigating the multifaceted landscape of fixed income securities—this is vital information for anyone considering index investing.

Securities Lending and Its Impact on Index Funds

Securities lending is a prevalent practice in the asset management industry, helping to generate returns for index-tracking funds through fees collected from lending out securities. However, not all securities lending practices are created equal. Investors should explore the nuances between different types of securities lending—such as value lending versus volume lending—and how these strategies align with the overall goals of the fund. Understanding the different risk profiles involved in securities lending can empower investors to make more informed decisions regarding their index-tracking fund investments.

It’s also vital for investors to comprehend how securities lending revenues are shared within a fund. For example, some firms, like Vanguard, return all net securities lending revenue back to the fund, thereby enhancing investor returns. Such practices illustrate the importance of transparency in fund management and reinforce the idea that investors should prioritize those asset managers who have a vested interest in the success of their investors. This knowledge not only aids in choosing the right index fund but also showcases the added complexities that go beyond simple index tracking.

Market-Cap Weighting vs. Equal-Weighting in Index Funds

Investors face crucial decisions when selecting their index exposure, particularly the choice between market-cap weighting and equal weighting methodologies. Market-cap weighted indices, which assign weight based on the market capitalization of constituent stocks, provide a straightforward and passive method of tracking market movements. This traditional strategy has been effective over the years, particularly for investors seeking broad diversification within their portfolios and minimal tracking error against market benchmarks.

In contrast, an equal-weighted methodology distributes investment evenly across all constituent securities, leading to a markedly different risk profile. This strategy can introduce higher volatility and necessitates more frequent rebalancing, which can incur additional costs. Investors need to understand how switching between these weighting approaches dramatically alters risk exposure and potential returns, making it essential to align the chosen methodology with one’s broader investment goals and risk tolerance.

The Role of Index Funds in Diversified Portfolios

Index funds play a pivotal role in modern portfolio construction strategies, providing investors with cost-effective exposure to diverse asset classes. As markets evolve, investors frequently turn to index funds for their predictable performance and lower volatility relative to actively managed funds. The ability to closely mirror the performance of a benchmark index allows investors to achieve returns that align closely with overall market movements, helping to mitigate risks associated with poorly timed investment decisions.

Additionally, during periods of heightened uncertainty or volatility, the diversification benefits of index funds become increasingly evident. Investors can leverage broad market cap-weighted strategies to capture the overall movement of market segments. This approach simplifies the investment process, focusing on replicating the market performance rather than attempting to outperform it—this aligns well with the objectives of many investors looking for stability in their return profiles.

Cost-Efficiency and Its Importance in ETF Selection

The cost-efficiency of index-tracking funds is undoubtedly one of their greatest attractions, particularly in an investment landscape where fees can significantly erode returns. Lower expense ratios enable investors to retain a more significant portion of generated returns, particularly over the long term. However, when selecting an index fund, it is essential to consider not just the expense ratio but also the associated costs of other factors such as tracking error, turnover, and securities lending.

Investors need to analyze the intricacies of total costs when evaluating index-tracking ETFs. A lower upfront fee does not always translate into better long-term returns. Fund managers fluctuate in their ability to minimize costs associated with trading and rebalancing, and these elements can significantly affect overall performance. Therefore, thorough research into the total cost structure of available funds is vital for achieving optimal investment outcomes.

The Future of Index Investing: Trends and Innovations

As the investment landscape continues to evolve, index investing embraces emerging trends and innovations that can reshape traditional strategies. Investors are increasingly seeking thematic index funds that align with their values or investment philosophies, such as ESG or low-carbon indices. As these trends gain popularity, asset managers are responding by creating more nuanced index offerings, broadening the appeal of index-tracking funds across diverse investor bases.

Moreover, advancements in technology and data analytics are enhancing how index funds are constructed and managed. Techniques that improve transparency, methodology, and efficiency are expected to lead to more tailored investment strategies that can offer better adaptive responses to market movements. As these innovations unfold, investors will likely see new opportunities for diversification and risk management within their portfolios, further solidifying the role of index-focused investing in comprehensive investment strategies.

Frequently Asked Questions

What are index-tracking funds and why are they important for investors?

Index-tracking funds are investment funds designed to replicate the performance of a specific index, such as the S&P 500. They are important for investors as they offer cost-effective access to broad market exposure, facilitate diversification, and typically come with lower fees compared to actively managed funds.

How do index-tracking ETFs differ from traditional index-tracking funds?

Index-tracking ETFs (exchange-traded funds) differ from traditional index-tracking funds primarily in their trading mechanisms. ETFs trade on an exchange like stocks, allowing for real-time pricing, while traditional index funds are bought and sold at the end of the trading day at the net asset value (NAV). This trading flexibility often makes ETFs more appealing for active traders.

What should investors consider about portfolio management when choosing index-tracking funds?

When selecting index-tracking funds, investors should assess the asset manager’s portfolio management capabilities, including their track record over various market cycles, and the expertise involved in managing the fund. A fund’s performance should be viewed over the long term to fully capture how it performs relative to its benchmark during different market conditions.

What are the common misconceptions regarding index investing?

A common misconception about index investing is that it requires minimal management effort, often referred to as a ‘set-it-and-forget-it’ strategy. In reality, while index funds aim to track a benchmark, they necessitate sophisticated management techniques to maintain performance, especially in volatile markets.

How do market-cap weighting and equal-weighting impact index-tracking fund risk?

Market-cap weighting allows larger companies to have a more significant impact on the index’s performance, thus reflecting market conditions accurately, while equal weighting gives all securities an equal stake, increasing exposure to smaller companies. This shift can affect risk profiles, so understanding each approach’s nuances is critical for investors choosing index-tracking funds.

Why are low fees important in selecting index-tracking ETFs?

Low fees in index-tracking ETFs help maximize investors’ returns by reducing drag on performance. Since these funds are designed to match, not exceed, index performance, keeping expense ratios low is vital to ensuring that investors can capture more of the index’s gains.

What role do bond index funds play in a diversified portfolio?

Bond index funds play a crucial role in a diversified portfolio by providing exposure to the fixed income market, which can reduce overall portfolio volatility and risk. They serve as a counterbalance to equities, especially during market downturns, by delivering more stable returns.

How do securities lending practices affect index-tracking funds?

Securities lending allows asset managers of index-tracking funds to earn additional income by lending securities to other investors for a fee. It’s important for investors to understand how these practices are implemented and how any generated revenue is shared, as they can impact the overall returns of the fund.

What are the benefits of investing in index-tracking funds during market volatility?

Investing in index-tracking funds during market volatility can provide a stable and predictable return profile that closely aligns with market performance. They offer broad exposure and instant diversification, which can mitigate risks associated with specific sectors or stocks during turbulent times.

What is the significance of transparent investment strategies in index-tracking funds?

Transparency in investment strategies is vital as it builds trust and understanding between investors and fund managers. Knowing how an index-tracking fund selects its securities and rebalances its portfolios enables investors to make informed decisions based on their risk tolerance and investment goals.

| Key Considerations | Details |

|---|---|

| Incentive Alignment | Understanding the asset manager’s ownership structure and philosophy is crucial, as this affects their ability to prioritize client interests, particularly with firms like Vanguard. |

| Portfolio Management | Long-term evaluation of fund performance across multiple market cycles is essential. It ensures that the skill level of portfolio management translates to consistent tracking of benchmark indices. |

| Securities Lending | Assess the different types of securities lending practices, evaluating costs, risks, and fee sharing. Vanguard returns 100% of net securities lending revenue to the fund. |

| Common Misconceptions | Many assume index funds can be managed without a proactive approach, but expertise is essential, particularly in managing fixed income portfolios. |

| Index Weighting Approaches | Investors should understand the differences between market-cap and equal-weighted indices, including the risks and practicalities of each strategy. |

| Role in Portfolio Construction | Index funds can provide consistent returns with lower costs, making them suitable for replicating market segment performance and achieving diversification. |

Summary

Index-tracking funds play a crucial role in modern investment strategies by offering cost-efficient exposure to broad markets. While often perceived as simple, managing such funds requires intricate expertise, especially in navigating complex market conditions. By considering factors like incentive alignment, long-term portfolio management, and understanding various weighting approaches, investors can make informed decisions that enhance their portfolio’s performance while mitigating risks. As the investment landscape evolves, index-tracking funds remain a vital tool for achieving investment goals with reliability and transparency.