Index funds are an increasingly popular investment vehicle, gaining traction among novice and seasoned investors alike due to their simplicity and effectiveness. By mirroring the performance of major market indexes, investing in index funds allows individuals to hold a diverse range of stocks or bonds with a single purchase, significantly reducing associated risks. One of the key advantages of index funds is their low-cost structure, which typically results in lower expense ratios compared to actively managed funds. As you explore how to choose index funds, it’s essential to consider their performance, stability, and the potential for predictable returns amidst market fluctuations. Whether you are interested in stock index funds or bond index funds, this method of investing can be a strategic move towards long-term financial success.

When discussing passive investing strategies, many turn to the concept of market-tracking funds, commonly known as index funds. These investment options aim to replicate the performance of established financial benchmarks, enabling investors to capture a wide swath of the financial marketplace with minimal effort. The benefits of such funds extend beyond cost savings, including lower volatility and greater market representation, making them a favored choice for many. As you delve into effective strategies for portfolio management, understanding how to select and leverage these diversified holdings is crucial. For those interested in both stocks and bonds, exploring the nuances of bond index funds offers additional avenues for stable returns.

The Fundamentals of Index Funds

Index funds are a type of investment fund that seeks to replicate the performance of a specific benchmark index, such as the S&P 500 or the Nasdaq-100. They accomplish this by holding the same securities in the same proportions as the index they track. This approach allows investors to diversify their portfolios without the need for extensive research or stock picking. Unlike actively managed funds, which rely on fund managers to make buy and sell decisions, index funds are passively managed. This means they typically have lower fees and lower turnover rates, making them a cost-effective investment option.

Investing in index funds can be particularly advantageous for long-term investors. Since these funds aim to mirror market performance, they often deliver competitive returns over time, making them an ideal choice for those looking to maximize wealth accumulation with minimal effort. The ability to invest in a broad range of companies through a single fund provides instant diversification, reducing individual stock risk.

Frequently Asked Questions

What are index funds and how do they work in investing?

Index funds are investment vehicles designed to track the performance of specific market indexes, such as the S&P 500 or the Bloomberg U.S. Aggregate Bond Index. By investing in index funds, you gain exposure to a diverse mix of stocks or bonds, which helps to represent large segments of the market. These funds passively mirror the performance of their indexes, offering a cost-effective investment strategy.

What are the advantages of investing in index funds?

The advantages of investing in index funds include lower fees compared to actively managed funds, diversification across many stocks, market representation, and historical consistency in returns. Index funds benefit investors by providing steady growth over time with reduced management costs, making them an efficient choice for long-term portfolios.

How can I assess index fund performance effectively?

To assess index fund performance, compare its returns to the relevant benchmark index it aims to track. Evaluate the fund’s expense ratio, as lower costs generally lead to better net returns. Historical performance indicators, such as volatility and tracking error, also provide insights into how closely the fund aligns with its benchmark.

What should I consider when choosing index funds?

When choosing index funds, consider factors like the fund’s expense ratio, the index it tracks, the fund’s historical performance, and your investment goals. It’s crucial to select funds with low fees that fit your strategy, whether for diversifying your equity portfolio or for stability through bond index funds.

What are bond index funds and how do they differ from stock index funds?

Bond index funds are designed to track specific bond market indexes, such as the Bloomberg U.S. Aggregate Float Adjusted Index. They typically exhibit slower growth than stock index funds but can offer lower volatility and predictable income streams during market downturns, making them suitable for risk-averse investors.

Can index funds provide diversification benefits in a portfolio?

Yes, index funds can provide significant diversification benefits by allowing investors to hold a broad array of securities in a single fund. This helps mitigate risks associated with individual stock investments and provides exposure to various sectors or asset classes, including both equities and bonds.

Are there any downsides to investing in index funds?

While index funds offer numerous benefits, they also have downsides, such as exposure to market downturns, concentration risk from large-cap stocks dominating indexes, and the lack of active management. Investors may also experience significant losses during bear markets, as demonstrated during the 2008 financial crisis when the S&P 500 dropped by over 36%.

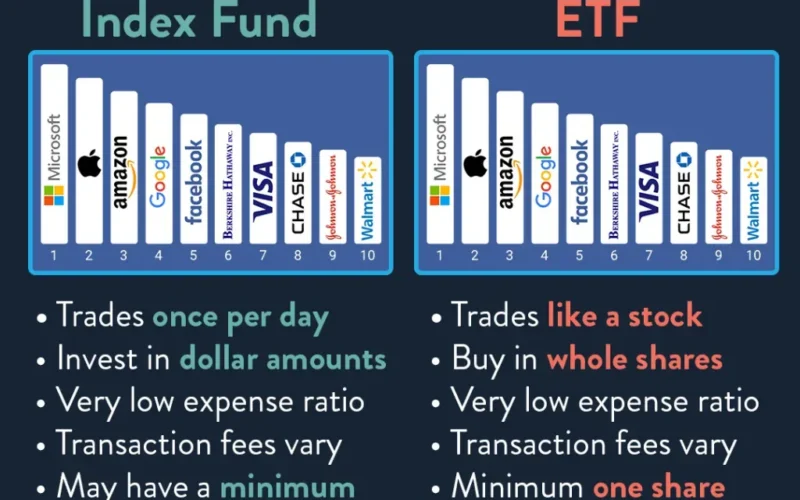

What is the difference between index mutual funds and ETFs?

The primary difference between index mutual funds and ETFs lies in how they are traded. ETFs are traded like stocks on exchanges throughout the day, which may offer liquidity advantages, while index mutual funds are typically bought or sold at the end-of-day net asset value (NAV). ETFs often have lower expense ratios and greater tax efficiency compared to index mutual funds.

How can I start investing in index funds today?

To start investing in index funds, open a brokerage account or a retirement account like a 401(k) or an IRA that offers a selection of index funds. Research and choose funds with low expense ratios that align with your investment goals, and consider diversifying your investments across various index funds to minimize risk.

Why should I consider international index funds?

International index funds can enhance your portfolio by providing exposure to global markets and reducing reliance on domestic market performance. By including international index funds, you can achieve greater diversification, potentially mitigate risks, and capitalize on growth opportunities in different economies.

| Key Points | Details |

|---|---|

| Definition | Index funds mirror major stock and bond indexes, allowing investors to gain exposure with a single purchase. |

| Cost Advantage | Investing in index funds is generally cheaper than actively managed funds, with lower management fees. |

| Market Risks | During market downturns, index funds can suffer significant losses as evidenced by historical data. |

| Benefits | Index funds provide market representation, cost-effectiveness, stability, and low fees. |

| Downsides | Concentration risk, lack of active management, and high prices for index stocks are potential drawbacks. |

| How to Invest | Look for funds with low expense ratios; ETFs offer flexibility for trading, while mutual funds may have different benefits. |

Summary

Index funds are a popular investment vehicle that allows investors to easily track the performance of specific market indices, such as the S&P 500. By mirroring these benchmarks, index funds can provide a cost-effective way to achieve diversified market exposure while minimizing management fees. However, it is important to consider potential downsides, including market risk and concentration risk. Overall, for those looking to grow their portfolios with less effort and lower costs, index funds can be a highly appealing option.