The recent GST hike inflation impact has ignited a heated debate among Singaporeans, particularly spotlighting Prime Minister Lawrence Wong’s assertion that the increase in the Goods and Services Tax hasn’t significantly influenced inflation rates. Many netizens have taken to social media, challenging Wong’s claims that the hike from 7% to 9%—staggered across 2023 and 2024—didn’t escalate the cost of living in Singapore. Instead, they argue that the rise in taxes is directly linked to their daily financial struggles. Wong’s comments, made during the Budget debate, fail to resonate with those experiencing rising costs in their everyday lives, further complicating the Singapore inflation debate. As the community engages in discussions and reactions, understanding the tangible effects of the GST increase is crucial for navigating the complexities of living expenses in this economic climate.

The discussion surrounding the Goods and Services Tax increase and its repercussions on inflation highlights a broader issue of rising living costs in Singapore. Many citizens are feeling the pressure of increasing expenses, which they believe are exacerbated by the recent tax adjustments. Critics, including netizens and members of Parliament such as Pritam Singh, assert that the government’s position on the limited impact of the GST hike overlooks the real experiences of everyday Singaporeans facing these financial burdens. As the dialogue continues, it’s evident that this situation raises essential questions about the government’s role in managing living expense growth and the efficacy of their economic strategies. Delving into this important topic requires an examination of how these tax adjustments are perceived by the populace amidst ongoing fiscal concerns.

The Impact of GST Hike on Inflation in Singapore

Prime Minister Lawrence Wong’s claims regarding the Goods and Services Tax (GST) hike have sparked significant debate among Singaporeans. When Wong asserted that the GST increase did not have a substantial impact on inflation, many netizens quickly refuted this statement, asserting that the tax hike has directly contributed to rising living costs. The discourse around the GST hike’s influence on core inflation has been especially contentious, with netizens highlighting that even a marginal increase in the GST rate can lead to a broader escalation in prices across various sectors.

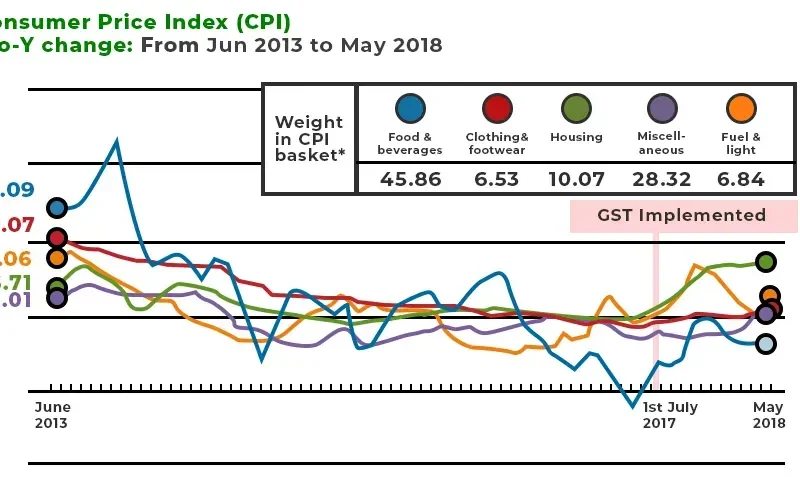

Critics, led by Opposition Leader Pritam Singh, suggest that government data reflects a different reality; they argue that GST hikes can indeed have a lasting impact on inflation rates. Singh’s reference to core inflation observations that include increments directly linked to the GST hike brings urgency to the discussion. As Singapore grapples with external inflation pressures, the public’s focus remains fixed on understanding the tax’s direct correlation to their diminishing purchasing power.

Frequently Asked Questions

What is the impact of the recent GST hike on inflation in Singapore?

The recent GST hike from 7% to 9% has sparked debates regarding its impact on inflation in Singapore. While Prime Minister Lawrence Wong claims that the hike did not significantly fuel inflation, critics argue otherwise. They cite government data that suggests the GST hike contributes to rising living costs, affecting core inflation by nearly one percentage point. This has led to concerns that the GST increase is a driver of the overall rise in prices, despite Wong’s assertion of external factors being predominant.

How do netizens react to Lawrence Wong’s claims about GST and inflation?

Netizens have predominantly disputed Lawrence Wong’s claims regarding the GST hike and inflation impact. Many argue that while the government suggests the GST increase’s effect is minimal, the real-life consequences are felt deeply in rising living costs across Singapore. Frustration over basic necessities becoming more expensive has led to nearly 2,000 comments challenging Wong’s statements on various platforms.

Is the GST hike a permanent issue for rising living costs in Singapore?

Yes, the GST hike is viewed as a permanent issue affecting rising living costs in Singapore. Critics of the government highlight that although there are support measures like the Assurance Package and GST Vouchers, these are temporary solutions. The hike itself, however, remains a lasting increase in costs that consumers will face regularly, contributing to the long-term inflationary pressures and overall cost of living challenges.

What measures are being taken to mitigate the GST hike’s impact on the cost of living?

In response to the concerns surrounding the cost of living and the GST hike’s impact, the Singapore government is implementing various support measures. These include the Assurance Package and GST vouchers aimed at assisting lower-income groups. While these initiatives aim to alleviate some financial pressures, many Singaporeans feel that the ongoing rise in living costs outpaces these temporary supports.

Why do some believe gov’t data contradicts Lawrence Wong’s statements on the GST hike?

Critics, including Opposition Leader Pritam Singh, highlight that government data indicates a measurable impact of the GST hike on inflation. They argue that Wong’s dismissal of this information overlooks its implications for rising living costs. According to estimates, the GST increase may account for a significant portion of the projected core inflation, suggesting a direct connection contrary to Wong’s claims of minimal effect.

What economic factors are contributing to the inflation debate in Singapore?

The inflation debate in Singapore encompasses various economic factors beyond just the GST hike. While Prime Minister Wong emphasizes external elements like global supply chain disruptions and increasing energy prices as major contributors to rising costs, critics point to the GST adjustment as a key factor in accelerating inflation. This discussion reflects widespread concern about the sustainability of livelihoods amidst prevailing economic challenges.

How does the GST hike relate to Singapore’s long-term budget plans?

Lawrence Wong has framed the GST hike as a necessary decision for long-term fiscal stability in Singapore. He suggests that without the increase, Singapore would face budget deficits, impacting funding for essential public services. This justification underscores the government’s reliance on the GST hike to balance financial needs against the backdrop of rising living costs.

What alternative views exist regarding the GST hike’s timing and necessity?

Opponents of the GST hike, including members from the Progress Singapore Party (PSP), argue that price increases began prior to the GST adjustment. They contend that the timing of the GST hike may not align with actual economic conditions, as consumers had already been facing rising prices for certain necessities. This highlights ongoing debates about whether the GST increase was necessary at this juncture, or if it simply exacerbated existing financial pressures.

| Point | Details |

|---|---|

| Lawrence Wong’s Claims | Wong asserts GST hike didn’t fuel inflation; cites global factors. |

| Opposition Perspective | Opposition Leader Pritam Singh argues GST hike contributed to core inflation by nearly one point. |

| Impact on CPI | CPI trends show falling inflation from 6.1% in 2022 to 2.4% in 2024 despite GST. |

| Public Reaction | Netizen dissent challenges the notion that GST hike is not a key inflation driver. |

| Long-term Funding | Wong defends GST hike as essential for funding public services and avoiding deficits. |

| Support Measures | Wong mentions Assurance Packages to help lower-income groups amid rising costs. |

| Ongoing Concerns | Public frustration over rising living costs continues despite government measures. |

Summary

The debate surrounding the GST hike’s inflation impact highlights significant divides in perception. While Lawrence Wong maintains that the GST hike did not contribute substantially to inflation, opposition voices firmly disagree, emphasizing the tangible effects on living costs. This discussion underscores the broader concern of rising costs in Singapore, with citizens increasingly feeling the strain on their finances despite government assurances.