Good corporate governance is essential for ensuring that companies operate transparently and ethically, particularly in the context of Singapore’s vibrant stock market. The recent $5 billion initiative by the Monetary Authority of Singapore (MAS) aims to partner with fund managers, presenting an excellent opportunity for institutional investors to prioritize governance practices in their investment strategies. Strong corporate governance not only enhances the credibility of businesses but also significantly contributes to the long-term financial performance of investments. In light of this, fund managers must recognize the intrinsic value of companies with robust governance frameworks, as research suggests that they typically yield better returns. Embracing good corporate governance can empower fund managers and institutional investors to boost market stability while fostering competitive advantages in the investment landscape.

In the realm of financial investments, effective governance frameworks serve as guiding principles for ethical management and accountability within corporations. Particularly in Singapore, where the stock market thrives, there is a pressing need for fund managers and institutional stakeholders to adopt sound governance practices that uphold the integrity of their portfolios. The MAS’s recent financial injection into the market underscores the importance of moving beyond mere investment in index components, emphasizing the need to evaluate companies based on their governance standards. Recognizing the role of shareholder activism and oversight in corporate performance is paramount, as it directly correlates with enhanced investor confidence and overall market health. By prioritizing these governance standards, fund managers can not only safeguard their investments but also ensure sustainable growth for the companies they support.

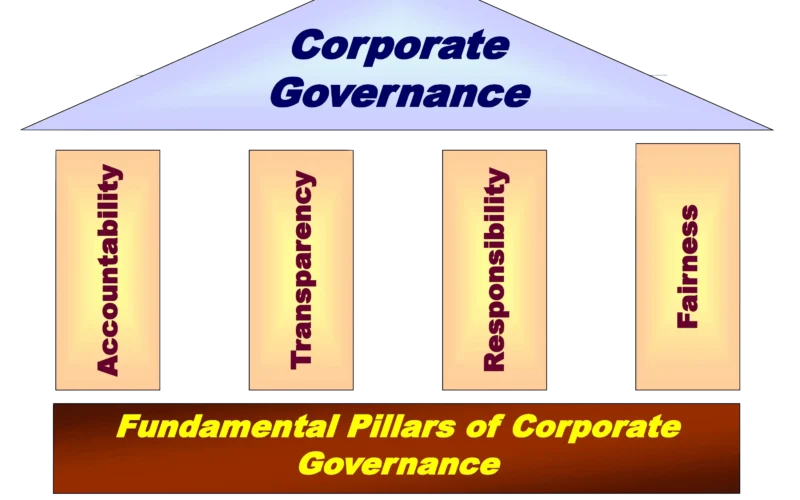

The Importance of Good Corporate Governance for Fund Managers

Good corporate governance serves as a vital component for the sustainability and success of companies in today’s dynamic financial landscape. Fund managers must play an essential role in championing these governance practices, ensuring that their portfolios consist of companies that prioritize ethical behavior, transparency, and accountability. The potential for higher returns from investments in firms with strong governance structures is substantial, as numerous studies have indicated that well-governed companies significantly outperform their counterparts over time.

Incorporating sound governance criteria into investment strategies can not only enhance a fund’s performance but also mitigate risks linked with corporate misconduct. Emphasizing good corporate governance encourages companies to align their interests with those of their shareholders and stakeholders, ultimately contributing to a more stable and robust market environment. As MAS initiates a $5 billion fund aimed at improving our local stock market’s liquidity, fund managers are presented with a unique opportunity to prioritize governance while managing potential investments.

The Role of Institutional Investors in Corporate Governance

Institutional investors play a pivotal role in shaping corporate governance and can significantly influence the quality of management practices at the companies they invest in. Despite this potential, engagement levels among institutional investors in Singapore have historically been relatively passive. Many fund managers appear more focused on short-term returns rather than advocating for good corporate governance practices, which undermines the principles of fiduciary responsibility they are obliged to uphold. Tackling this apathy is crucial in today’s marketplace, particularly as institutional investors stand to benefit materially from the MAS’s $5 billion injection into the market.

Active participation by institutional investors in governance discussions can enhance transparency within the companies they invest in, fostering a culture of accountability. By attending annual general meetings (AGMs) and exercising their voting rights, they can advocate for policies that align with long-term interests, thus improving overall corporate governance standards. As the ACGA highlights, stakeholder pressure and visibility can significantly improve governance practices when institutions take a more engaged stance.

Trends in Fund Manager Behavior and the Need for Change

The trend of passive investing, coupled with short-term management mandates, is one of the leading factors causing fund managers to overlook their governance responsibilities. As they buy and hold index components through ETFs, concerns arise about their level of engagement with the companies behind these stocks. Short-term focus often harms the potential for long-term corporate growth and governance improvements, as decisions may primarily revolve around immediate financial returns instead of fostering responsible corporate behavior.

In light of these trends, there is a pressing need for fund managers to evolve their practices, particularly with a significant liquidity boost from MAS’s funding initiative. Rethinking investment approaches could involve setting clear governance criteria while evaluating potential investments, thereby discouraging passive strategies and encouraging a more proactive investment style focused on sustainability and responsible governance. This embrace of a more engaged investment philosophy will help nurture a well-governed corporate landscape.

Retail vs. Institutional Investors: A Comparison of Engagement

The disparity in engagement levels between retail and institutional investors highlights a concerning gap in accountability within the Singapore market. Retail investors, with their more pronounced participation during AGMs and in voting, have been noted for their positive influence in elevating corporate governance standards. In contrast, institutional investors often remain on the sidelines, which raises questions about their commitment to fulfilling their fiduciary duties. The need for institutions to step up and align their practices with retail counterparts is crucial for fostering a balanced and effective governance environment.

Addressing the engagement gap could involve encouraging institutional investors to adopt practices that promote active participation, such as developing transparent shareholder engagement policies and demonstrating accountability in their investments. By doing so, institutions can enhance their credibility and encourage more synchronized efforts aimed at improving corporate governance, ultimately benefiting all stakeholders involved.

Enhancing Communication and Reporting Standards

Improving communication and reporting standards within companies is vital for promoting good corporate governance practices, especially as fund managers allocate their investments through the MAS fund. Current governance reporting often lacks depth and fails to engage stakeholders effectively. A better approach would entail providing detailed narratives on board discussions, decision-making processes, and performance metrics, alongside standard compliance checklists. Elevating these standards encourages transparency and fosters trust among investors and stakeholders.

Moreover, clear director biographies need to serve a dual purpose—that of providing qualifications while establishing a direct link between those qualifications and the expected contributions to governance. Fund managers should advocate for these standards when engaging with companies, presenting them as prerequisites to securing investments from the MAS fund. An improved engagement on these fronts could stimulate more robust corporate governance, ultimately benefiting the companies and their investors.

The Future of Fund Management and Corporate Governance

As the landscape of fund management evolves, the integration of good corporate governance into investment strategies will be a significant determinant of future success. The MAS’s $5 billion funding initiative presents an opportune moment for fund managers to reassess and enhance their roles in promoting governance among the companies they evaluate for investment. An emphasis on long-term performance rather than short-term gains will enable fund managers to build more sustainable portfolios aligned with governance best practices.

Looking ahead, the expectation for fund managers to engage more actively in their investment choices is set to increase. Institutional investors are encouraged to transition from traditional passive methodologies to more dynamic engagement strategies that prioritize good governance. This shift, if executed correctly, could revitalize both investor confidence and corporate reputation, setting a precedent for how fund management interfaces with corporate governance in the future.

Investing in Governance: A Prerequisite for Accessing Funds

Instituting a requirement for fund managers to invest in companies with established governance ratings as part of MAS’s $5 billion fund could initiate a much-needed transformation in the marketplace. By ensuring that only those with strong governance practices receive investment, it would incentivize companies to implement best practices and prioritize stakeholder interests, resulting in a healthier corporate ecosystem. This approach offers a potent solution to the current governance engagement dilemma faced by many fund managers.

Implementing governance investment criteria may also catalyze a wider industry shift, where all fund managers begin to prioritize governance when evaluating potential investments. With the right frameworks in place, it could redefine how investments are approached, ensuring that good governance is not merely an afterthought but rather a fundamental criterion for all investment decision-making processes.

Lessons from International Markets on Corporate Governance

Studying international markets reveals that strong corporate governance correlates positively with better investment outcomes and reduced risks. Countries that emphasize good corporate governance have witnessed improved investment attractiveness, ultimately leading to enhanced stock performance. By learning from these lessons, Singapore’s fund managers have a unique opportunity to enhance their investment strategies, aligning them with global best practices.

This alignment may involve adopting global standards of transparency, accountability, and shareholder engagement that resonate with the expectations of today’s institutional investors. By continuously improving corporate governance standards, fund managers can not only enhance their own portfolios but also contribute to the overall integrity of the Singapore stock market. Ultimately, such improvements will serve to attract more investment into Singapore, fostering a thriving and resilient financial market.

The Path Forward: Collaborative Efforts for Governance Enhancement

Collaboration among various stakeholders in the fund management and investment community will be essential to promote a culture of good corporate governance moving forward. Fund managers must work closely with regulators, companies, and academia to establish frameworks and guidelines that prioritize governance best practices across the industry. This collaborative approach can help ensure that all parties involved understand their roles and responsibilities in promoting higher standards of governance.

By fostering such partnerships, Singapore can create an environment that emphasizes the significance of corporate governance, encouraging all fund managers to take proactive steps in advocating for their investment portfolios. As the MAS’s funding program rolls out, it will be imperative that stakeholders work together to drive positive change, leading to sustainable investment practices and ultimately bolstering investor confidence in the corporate governance framework.

Frequently Asked Questions

What is the role of fund managers in promoting good corporate governance in the Singapore stock market?

Fund managers play a crucial role in promoting good corporate governance in the Singapore stock market by actively engaging with the companies they invest in. Their responsibilities include voting at shareholder meetings and encouraging transparent governance practices. With the enhancement of corporate governance frameworks, fund managers can advocate for higher standards and ensure that companies adhere to good governance principles, thus fostering market integrity and potentially improving returns for investors.

How does good corporate governance impact the performance of funds managed by institutional investors?

Good corporate governance directly impacts the performance of funds managed by institutional investors. Research shows that portfolios consisting of well-governed companies tend to outperform those with weaker governance. As institutional investors engage more with companies on governance issues, they can enhance their investment outcomes and contribute to long-term value creation in the Singapore stock market.

Why is shareholder engagement important for institutional investors practicing good corporate governance?

Shareholder engagement is essential for institutional investors practicing good corporate governance because it ensures that their investments are aligned with sustainable business practices. By actively participating in shareholder meetings, voting on key issues, and holding companies accountable, institutions can influence corporate behavior and foster better governance. Increased engagement also helps institutional investors fulfill their fiduciary duties and promotes transparency in the companies they invest in.

What are the challenges fund managers face in promoting good corporate governance?

Fund managers face several challenges in promoting good corporate governance, including a tendency towards passive investment strategies, such as those focusing on ETFs that prioritize index components over individual company governance. Additionally, short-term objectives may limit their engagement with governance practices, as they may prioritize immediate returns over long-term value creation. Overcoming these challenges requires a commitment to active participation in governance from fund managers.

What measures can enhance corporate governance practices among fund managers in Singapore?

To enhance corporate governance practices among fund managers in Singapore, several measures can be implemented, such as requiring institutional investors to integrate governance assessments into their investment decision-making processes. Additionally, creating incentives for fund managers to engage with companies on governance issues or linking access to funds, such as the MAS’s $5 billion program, to investments in companies with strong governance records could promote more active involvement.

How can institutional investors benefit from embracing good corporate governance practices?

Institutional investors can significantly benefit from embracing good corporate governance practices by achieving better investment returns and minimizing risks associated with poor governance. By investing in well-governed companies, institutional investors enhance their portfolio performance and protect their beneficiaries’ interests. Furthermore, advocating for good governance can improve market conditions and foster a healthier investment environment in the Singapore stock market.

What is the significance of the MAS’s $5 billion fund initiative for corporate governance in Singapore?

The MAS’s $5 billion fund initiative is significant for corporate governance in Singapore as it provides a substantial capital boost intended for investment in the stock market. This funding presents an opportunity for fund managers to prioritize investments in companies with robust governance structures. By advocating for and investing in well-governed firms, fund managers can influence corporate behavior positively and enhance overall market governance standards.

| Key Point | Description |

|---|---|

| $5 Billion MAS Program | The Monetary Authority of Singapore has initiated a program to invest $5 billion in selected fund managers to boost investment in Singapore stock. |

| Criteria for Investment | Investors prioritize liquidity, fundamentals, and investable theses, but overlook good corporate governance as a critical factor. |

| Institutional Passive Engagement | Fund managers are less active in corporate governance compared to retail investors, who participate more in shareholder meetings and voting. |

| Research on Governance | Studies indicate that companies with strong governance outperform those with weaker governance, yet fund managers often neglect this. |

| Need for Active Role | Fund managers should take a more active role in promoting good corporate governance to achieve better investment outcomes. |

| MAS Fund Prerequisite Proposal | It is suggested that engaging with companies that have good governance ratings should be a condition for accessing MAS’s funds. |

Summary

Good corporate governance is essential for the success of the $5 billion fund announced by the Monetary Authority of Singapore (MAS). As institutional investors prepare to leverage these funds, it is crucial that they actively promote good corporate governance practices. Research indicates that companies with robust governance frameworks tend to yield better investment returns. Therefore, by prioritizing engagement with well-governed firms, fund managers can not only enhance their portfolios but also contribute to healthier market conditions. Ensuring that good corporate governance is a focal point will ultimately align the interests of institutional investors with their fiduciary responsibilities and benefit all stakeholders involved.