Gold Stock ETFs are making headlines as they experience a remarkable surge in value, showcasing a nearly 20% rise in just five days. This spike has caught the attention of investors in the ETF market, especially with its average performance increase of 4.77% among six related ETFs. Notably, the Gold Stock ETF (159321) recorded an impressive gain of 5.83%, furthing affirming its status as a prime investment choice. Supported by strong gold prices and an influx of margin trading, these ETFs have become one of the hottest commodities in today’s financial landscape. With trading data reflecting unprecedented turnover rates, now is an exciting time for both seasoned and new investors to explore the potential of Gold Stock ETFs.

In the world of investment, Exchange Traded Funds (ETFs) focused on gold mining stocks are rapidly gaining traction among traders and investors alike. Often referred to as gold equity ETFs, these funds provide a unique opportunity to gain exposure to the gold market without the need for physical ownership of the precious metal. With the recent uptick in demand and price for gold-related securities, the interest from margin traders signals a significant shift in the market dynamics. Moreover, the robust trading activity and record turnover rates indicate that investors are increasingly turning to these assets for portfolio diversification. As gold equities continue to rise in popularity, understanding the underlying factors driving their performance becomes essential for making informed investment decisions.

The Recent Surge of Gold Stock ETFs

In recent days, gold stock exchange-traded funds (ETFs) have seen a remarkable surge, gaining nearly 20% over a short period of just five days. This explosive growth is primarily attributed to factors such as rising gold prices and renewed interest from margin traders in the ETF market. As of April 14, the Gold Stock ETF (159321) stood out, showing an impressive increase of 5.83%, which eclipses the average gain of other gold-related ETFs. With an overall average increase of 4.77%, these funds are becoming increasingly recognized as a hot investment commodity, particularly in a climate of fluctuating market dynamics and economic uncertainty.

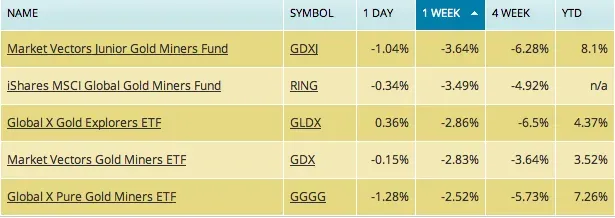

The strong performance of gold stock ETFs reflects a broader trend within the ETF market that emphasizes the appeal of gold investments during volatile economic periods. Investors seeking security often flock to gold, viewing it as a hedge against inflation and economic downturns. Analyzing trading data from the past week reveals that all six major gold-related ETFs witnessed heightened trading volumes and investor activity, underpinned by the significant rise in gold prices. This trend indicates a solid bullish sentiment among investors who are now looking to capitalize on the momentum of gold stock ETFs.

Understanding Margin Trading in Gold ETFs

Margin trading is an essential aspect of the ETF market, and it has played a crucial role in the recent surge of gold stock ETFs. As margin traders gradually returned to this sector, their activities contributed to a significant uptick in the financing balance of these funds. Notably, the Gold Stock ETF (517520) showcased a remarkable increase in its financing balance, which not only illustrates the confidence of margin traders but also indicates a strategic shift among investors focusing on gold assets. When margin traders engage in increasing their positions, it can create a ripple effect, driving up demand and further elevating gold stock prices.

Margin trading essentially allows investors to borrow funds to invest, amplifying both potential gains and risks. In the case of gold stock ETFs, recent data indicates that margin traders have increased their net purchases significantly, with the Gold ETF (518880) leading the charge. As February and January’s high data still loom over the market, these trading strategies could lead to heightened volatility within the ETF market, especially for gold-related products. Investors should remain vigilant, as the interplay between margin trading and gold prices can significantly affect overall investment strategies moving forward.

Impact of Gold Prices on Gold Stock ETFs

Gold prices play a pivotal role in shaping the performance of gold stock ETFs. Recent surges in gold stock ETFs correlate closely with the rising prices of gold, which have sparked investor interest and rejuvenated trading activity. The past five days have seen gold prices reach levels that have made these ETFs particularly attractive to both individual and institutional investors. As the average turnover data indicates, the correlation between rising gold prices and increasing ETF valuations has become more pronounced, affirming the idea that gold stock ETFs often mirror the fundamental price movements of the commodity.

Investors in gold stock ETFs benefit from the inherent value that gold prices provide. As these prices rise, the underlying assets that these ETFs represent appreciate, enhancing return prospects for holders of gold stock ETFs. For investors who leverage trading data and analysis, the performance of gold during uncertain times is crucial for decision-making. The growing consensus among traders is that gold will continue to be a fundamental aspect of diversified portfolios, especially as macroeconomic conditions evolve.

Trading Data Trends in Gold Stock ETFs

Analyzing trading data trends reveals a wealth of information regarding the increase in popularity of gold stock ETFs. The recent five-day rally has captured the attention of traders, with turnover rates for these ETFs hitting record highs across the board. Particularly noteworthy is the spectacular performance of the Gold Stock ETF (159322), which registered a daily turnover rate that far exceeded that of its counterparts, suggesting a major shift in investor sentiment. Such trading data points highlight the dynamics of liquidity and market interest surrounding gold stocks.

Moreover, the overall trading volume of gold stock ETFs during this period underscores their appeal amidst a backdrop of stock market fluctuations. With an average turnover rate nearing 22%, the commitment from both retail and institutional investors cannot be overstated. As investor focus sharpens on these ETFs, the resulting large volumes can lead to greater market depth and potentially lower volatility in trading. For investors and analysts alike, careful scrutiny of trading data trends becomes essential in crafting informed investment strategies.

The Rise of Margin Traders in the ETF Market

The recent influx of margin traders into the ETF market has generated considerable excitement and speculation. Traditionally, margin trading involves borrowing money to increase the size of an investment, and this strategy can significantly amplify gains – or losses. Recently, a sharp increase in net purchases by margin traders has spurred demand for gold stock ETFs and other popular assets, indicating a renewed confidence among investors in the performance of these financial vehicles. This trend highlights not only an aggressive investment approach but also a strategic shift towards assets that are perceived to have a favorable risk-reward ratio, such as gold.

Investor behavior within the ETF market often reflects broader economic sentiment, and the return of margin traders signals an optimistic outlook regarding market prospects, particularly in gold stock ETFs. Not surprisingly, gold ETFs have drawn significant attention due to their historical performance during uncertain market conditions. The fact that over 52% of recent trades by margin traders involved ETFs shows just how pivotal these products have become in the search for growth and stability within investment portfolios.

Analyzing Volume Data of Gold Stock ETFs

Volume data serves as a critical indicator of market health, especially within the realm of gold stock ETFs. Recent statistics show that several gold stock ETFs reached annual highs in their turnover, suggesting a robust level of market enthusiasm. Understanding volume trends is essential for investors seeking to ascertain the strength behind price movements – higher volume often corroborates price increases, legitimizing trends and instilling confidence in potential investors. The substantial turnover for ETFs like the Gold Stock ETF (517520) indicates that not only are individual investors participating, but institutional players are also recognizing the value in these financial products.

Moreover, the dynamic nature of trading volume in the gold ETF sector reflects broader economic dynamics, with gold prices reinforcing investor demand. As recent trends indicate, volumes have surged as traders respond to market shifts, positioning themselves strategically ahead of anticipated movements in gold prices. This increasing interest exemplifies how volume data can be utilized as a predictive tool, enabling investors to make informed decisions when considering gold stock ETFs as part of a diversified investment strategy.

Strategies for Investing in Gold Stock ETFs

Investing in gold stock ETFs requires a thorough understanding of both technical and fundamental analysis. A prudent investment strategy often involves monitoring macroeconomic indicators, including inflation rates and global instability, which impact gold prices. Given the recent performance of gold stock ETFs, investors should consider diversifying their portfolios with these funds to capitalize on the precious metal’s historic tendencies as a safe haven in turbulent times. Assessing factors such as trading data and margin trading activity can also aid in making informed decisions regarding entry and exit points for these investments.

Furthermore, staying up-to-date with the latest trends surrounding gold prices and market demand is essential for maintaining an edge in this sector. Understanding the nuances between different gold stock ETFs, including their respective performance metrics, can also assist investors in selecting the most suitable products for their financial goals. Exploring various strategies such as dollar-cost averaging can help mitigate risks, particularly in a volatile market where gold prices are continuously fluctuating.

Future Outlook for Gold Stock ETFs

The future outlook for gold stock ETFs appears promising, with several factors suggesting continued growth in this investment sector. As economic uncertainties continue to loom, investors are likely to gravitate towards gold as a hedge, thus supporting sustained demand for gold stock ETFs. Market experts predict that as inflation concerns rise, the attractiveness of gold as an asset class will further bolster the performance of gold ETFs. This ongoing trend reflects an increasing recognition of gold’s importance within investor portfolios as a diversification strategy.

The interaction between margin trading and gold prices will also play a significant role in shaping the future of gold stock ETFs. With recent upticks in margin trading activity, investors should remain alert to shifting dynamics that could affect the performance of these ETFs. Future trading data will provide essential insights regarding investor sentiment and market conditions, enabling strategic adjustments. As the financial landscape evolves, gold stock ETFs, supported by strong fundamentals and favorable market conditions, are set to be a prominent choice for both traditional and modern investors.

Key Considerations for Gold ETF Investors

When investing in gold stock ETFs, there are several key considerations that potential investors should weigh carefully. Understanding the intrinsic factors that influence gold prices is crucial, as geopolitical events, economic data releases, and changes in monetary policy can lead to rapid price fluctuations. Additionally, assessing the performance history and expense ratios of various gold stock ETFs is vital in determining which funds align best with individual investment goals. Investors are encouraged to conduct thorough research and stay informed about market trends to navigate the complexities of the gold ETF landscape.

Moreover, the impact of margin trading cannot be overlooked when considering investments in gold stock ETFs. As seen from the recent influx of margin traders, the dynamics within the ETF market can shift quickly, and being aware of the overall market sentiment is essential for making timely investment decisions. Building a diversified portfolio while incorporating gold stock ETFs can be an effective strategy to manage risk and capitalize on potential gains, especially in uncertain economic climates where gold often shines as a valuable asset.

Frequently Asked Questions

What are Gold Stock ETFs and why have they surged recently?

Gold Stock ETFs are exchange-traded funds that primarily invest in stocks of companies involved in the gold industry, including mining and exploration companies. Recently, these ETFs surged nearly 20% over a 5-day period due to rising gold prices and increased interest from margin traders returning to the market.

How do Gold Stock ETFs perform compared to other ETFs in the market?

Gold Stock ETFs have recently outperformed many other ETFs in the market. As of April 14, they recorded an average increase of approximately 18.1% over the previous five days, making them one of the top performers in the ETF market.

What role do trading data indicate in the performance of Gold Stock ETFs?

Recent trading data show that Gold Stock ETFs have experienced significant turnover, with the highest annual turnover recorded for several ETFs during a 5-day rally. This high trading volume reflects investor confidence and active participation in the gold sector.

What impact has margin trading had on Gold Stock ETFs?

Margin trading has positively impacted Gold Stock ETFs, with an influx of margin traders leading to increased financing balances. For instance, the financing balance of Gold Stock ETF (517520) rose nearly 47% recently, showcasing a strong interest from investors leveraging their positions.

Which Gold Stock ETF has the highest volume of trading activity?

As of April 14, the Gold Stock ETF (159322) exhibited the highest trading activity, with a full-day turnover rate of 102.56%. This high volume signifies its popularity among investors and the excitement surrounding gold stock investments.

How do Gold Stock ETFs reflect fluctuations in gold prices?

Gold Stock ETFs are inherently tied to gold prices, as their performance is driven by the profitability of gold-related companies. Consequently, as gold prices rise, the value of these ETFs typically increases, attracting more investors and driving up trading volumes.

Are there risks associated with investing in Gold Stock ETFs?

Yes, investing in Gold Stock ETFs comes with risks, such as market volatility, the dependence on gold prices, and potential changes in the ETF market dynamics. Investors should conduct thorough research and consider their risk tolerance before investing.

What are the benefits of investing in Gold Stock ETFs?

Gold Stock ETFs offer several benefits, including diversification within the gold sector, ease of trade like regular stocks, and lower expense ratios compared to mutual funds. Additionally, they provide exposure to gold prices without needing to invest directly in physical gold.

What was the turnover rate of Gold Stock ETFs in the recent trading period?

During the recent 5-day trading period, the average daily turnover rate of Gold Stock ETFs was approximately 22%, which indicates strong interest and trading activity among investors in these funds.

How do Gold Stock ETFs compare in terms of financing balances?

Gold Stock ETFs have shown significant increases in financing balances recently. For example, Gold Stock ETF (518880) has the highest financing balance in the market, reflecting substantial investor confidence and increased margin trading activity.

| Key Points | Details |

|---|---|

| Gold Stock ETFs Performance | Gold stock ETFs surged nearly 20% in 5 days, with an average increase of 18.1% among 6 ETFs. |

| Daily Turnover | The average daily turnover rate was nearly 22%, with ETF 159322 reaching a turnover of 102.56%. |

| Increase in Margin Trading | Margin traders’ interest has returned, marking a notable increase in financing balance, especially for ETF 517520. |

| Recent Net Purchases | 201 ETFs saw net purchases by margin traders, with Gold ETF (518880) attracting over 100 million yuan. |

| Highest Financing Balances | 23 ETFs reported a financing balance over 1 billion yuan, led by Gold ETF (518880) with 9.256 billion yuan. |

Summary

Gold Stock ETFs have recently become a focal point in the investment landscape, experiencing substantial gains and increased trader interest. This surge indicates a robust market sentiment towards gold as a valuable asset amid fluctuating economic conditions. As investors return to margins and trading volumes soar, these ETFs are solidifying their status as a key investment vehicle.