Cryptocurrency user growth has surged dramatically in recent years, with an astounding increase of nearly 190 percent between 2018 and 2020, and this trend continued into 2022. This remarkable expansion highlights the rising interest in digital assets, as indicated by Bitcoin ownership statistics and various crypto adoption trends across the globe. While some reports note a decline in wallet usage, the overall demand for cryptocurrencies remains robust, especially in regions like Africa and Asia where consumers are eager to explore stablecoins trading Bitcoin. The participation of major companies like Tesla and Mastercard has further fueled this enthusiasm, contributing to a more vibrant cryptocurrency market analysis. As we delve deeper into this topic, it becomes clear that understanding the shift in user demographics and their preferences will be crucial for future investment strategies and market stability.

The explosive rise in the number of individuals engaging with digital currencies marks a significant shift in the financial landscape, often referred to as the cryptocurrency boom. This phenomenon reflects not only the increasing prevalence of Bitcoin and similar assets but also the broader adoption of decentralized finance (DeFi) solutions worldwide. Notably, while there has been some fluctuation in wallet downloads, the overall trend shows a persistent interest among users in crypto trading and investment options. Companies venturing into this space are recognizing the potential of stablecoins as a bridge between traditional finance and innovative digital currencies. As we explore the dynamics of this evolving sector, it is essential to consider how demographic changes and technological advancements influence the future trajectory of cryptocurrency engagement.

Understanding Cryptocurrency User Growth

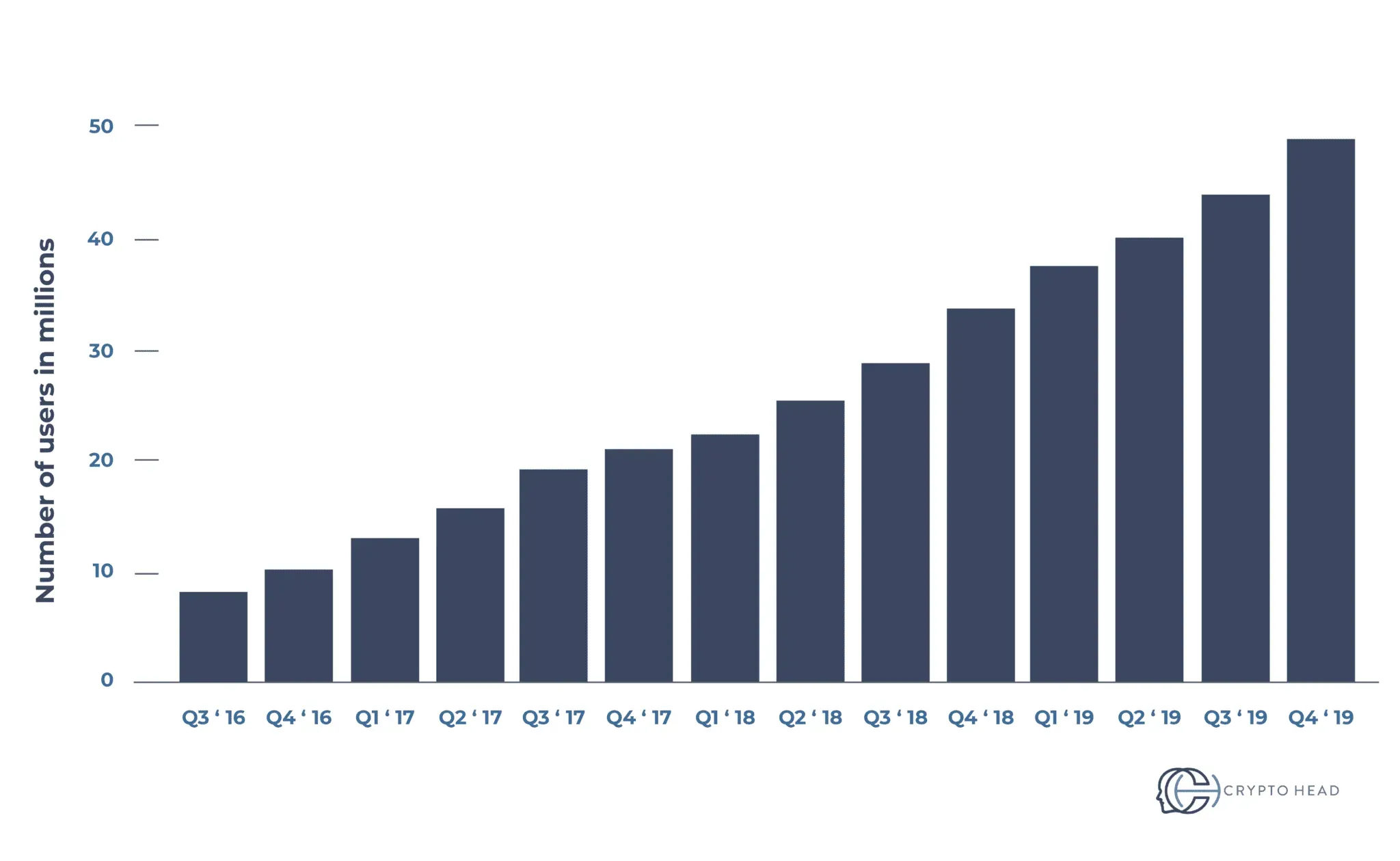

Between 2018 and 2020, the global user base of cryptocurrencies witnessed an astounding growth of nearly 190 percent. This surge was primarily influenced by the influx of new account registrations and significant improvements in identification processes on various trading platforms. As more people became aware of the potential benefits of cryptocurrencies, ranging from investment opportunities to decentralized finance, many sought to enter this emerging market. The acceleration of user growth in 2022 further highlights the increasing interest and acceptance of digital currencies among the global population.

The demographic shift towards cryptocurrency ownership has also been notable, with regions such as Africa, Asia, and South America leading the charge. This trend indicates a growing recognition of cryptocurrencies as viable financial assets, particularly in areas where traditional banking systems are underdeveloped. As companies like Tesla and Mastercard began to embrace cryptocurrencies, user confidence soared, paving the way for broader adoption and integration into everyday transactions.

Frequently Asked Questions

What are the latest cryptocurrency user growth statistics?

The global user base of cryptocurrencies experienced a remarkable growth of nearly 190% between 2018 and 2020, with further acceleration noted in 2022. This growth is attributed to increased account registrations and improved identification processes, alongside major companies like Tesla and Mastercard entering the crypto space.

How does Bitcoin ownership statistics reflect cryptocurrency user growth?

While specific Bitcoin ownership statistics are elusive due to the cryptocurrency’s design for privacy, trading volume against fiat currencies provides some insights. User growth in Bitcoin ownership can be inferred from rising transaction volumes, particularly in regions such as Africa, Asia, and South America.

What are the crypto adoption trends affecting user growth?

Crypto adoption trends have shown significant acceleration, especially in 2022, driven by institutional interest and increased consumer awareness. The involvement of major corporations and the growing acceptance of cryptocurrencies in daily transactions have contributed to this user growth.

Is there a decline in wallet usage impacting cryptocurrency user growth?

Yes, there has been a notable decline in wallet usage, with total cryptocurrency wallet downloads dropping significantly in 2022 compared to the previous year. This decline coincides with a broader market downturn, often referred to as a ‘crypto winter,’ which can affect overall cryptocurrency user growth.

How are stablecoins impacting Bitcoin trading and user growth?

Stablecoins, such as Tether and Binance Coin, play a crucial role in trading Bitcoin, facilitating transactions without the volatility typically associated with cryptocurrencies. Their increased usage can indicate a stable environment that fosters user growth in the cryptocurrency market.

What factors are driving cryptocurrency market analysis in relation to user growth?

Cryptocurrency market analysis focuses on several factors driving user growth, including changes in market sentiment, technological advancements, regulatory developments, and the influence of major players within the industry. Understanding these factors helps predict future trends in cryptocurrency adoption.

What role does the collapse of exchanges play in cryptocurrency user growth?

The collapse of major exchanges, such as FTX, can negatively impact user confidence and lead to declines in user growth. However, successful exchanges like Binance can recover market share and stabilize user growth, highlighting the resilience of the cryptocurrency ecosystem despite setbacks.

| Key Points |

|---|

| Global cryptocurrency user base grew by nearly 190% from 2018 to 2020, with further growth in 2022. |

| The rise in users is linked to increased account registrations and improved identification processes. |

| In 2021, major companies like Tesla and Mastercard showed interest in cryptocurrency, boosting adoption. |

| In 2022, the highest ownership of cryptocurrencies was observed in Africa, Asia, and South America. |

| Specific user statistics for cryptocurrencies like Bitcoin are unclear due to their anonymous nature. |

| The trading volume of Bitcoin against local currencies is the best approximation of user activity. |

| There was a decline in total cryptocurrency wallet downloads in 2022 compared to 2021. |

| Notable wallet downloads, such as Coinbase and MetaMask, decreased during a ‘crypto winter’ in 2022. |

| Negative publicity from the collapse of FTX in November 2022 impacted the market significantly. |

| Binance regained market share lost earlier in 2022, growing by 0.8 percentage points in November. |

Summary

Cryptocurrency user growth has been remarkable in recent years, with a 190% increase observed between 2018 and 2020, and further expansion noted in 2022. This trend indicates a growing acceptance and integration of cryptocurrencies into mainstream finance, driven by factors such as increased corporate interest and improved user accessibility. However, challenges remain, including market volatility and negative perceptions stemming from high-profile failures like FTX. Moving forward, the cryptocurrency landscape continues to evolve, and its user base is likely to adapt to these changes, shaping the future of digital finance.