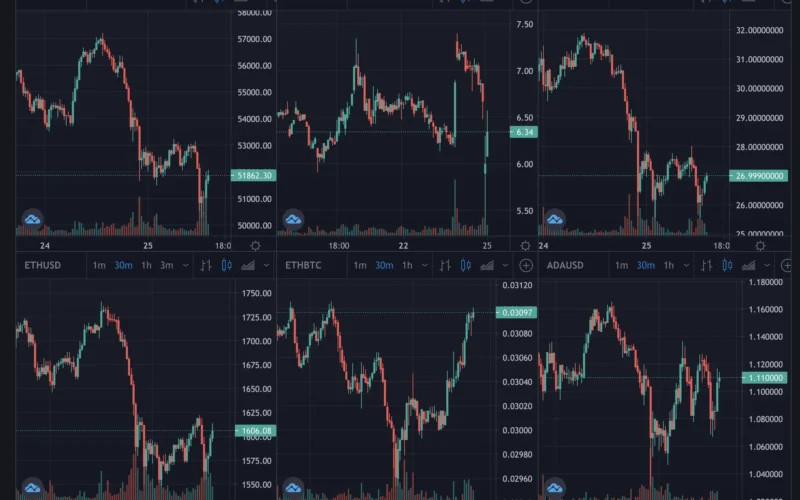

Crypto prices have taken a notable downturn as the SEC’s Crypto Task Force begins its inaugural roundtable, igniting discussions on the security status of various digital assets. This meeting has already caused significant ripples in the cryptocurrency market, impacting leading cryptocurrencies and setting the tone for upcoming regulatory developments. In today’s cryptocurrency market update, analysts are closely monitoring how these discussions may influence the valuation of assets like Bitcoin and Ethereum. Additionally, insights from industry leaders, such as BlackRock’s head of digital assets, highlight that innovations like ether ETFs could reshape investment strategies going forward. This fluctuation in crypto prices coincides with ongoing Ethereum price analysis, revealing potential disconnects between market movements and actual technological advancements on the network.

The landscape of digital currencies is constantly evolving, and recent trends indicate a shift in asset values across the board. As regulatory bodies scrutinize the cryptocurrency arena, investors are keenly observing how these changes impact both market dynamics and asset stability. Notably, the emergence of exchange-traded funds linked to Ethereum represents a potential game changer for traditional investing methods in the blockchain space. Furthermore, discussions surrounding digital assets’ security are gaining momentum, as stakeholders aim to establish clearer guidelines within this innovative sector. Staying updated on these shifts is crucial for anyone involved in trading or investing in cryptocurrencies.

Understanding Crypto Prices Amid Regulatory Changes

Crypto prices have been on a tumultuous ride as regulatory scrutiny increases, reflected in the recent fall observed in major cryptocurrencies. The inaugural roundtable meeting of the SEC’s Crypto Task Force is a critical event, as it sets the stage for establishing a clearer definition regarding the security status of various digital assets. Investors are closely monitoring these developments since clarity from the SEC could significantly influence market sentiment and pricing dynamics.

As the SEC aims to delineate the boundaries of what constitutes a security in the cryptocurrency realm, stakeholders in the crypto market have expressed their mixed sentiments. Some believe that stricter regulations could drive institutional confidence, while others fear it may stifle innovation and growth. Understanding these nuances is vital for anyone looking to navigate the cryptocurrency waters, especially as traders assess the implications for crypto prices in the shorter and longer term.

Frequently Asked Questions

What impact does the SEC Crypto Task Force have on crypto prices?

The SEC’s Crypto Task Force can significantly influence crypto prices due to its focus on defining the security status of digital assets. During its inaugural roundtable, discussions may lead to regulatory changes that affect market sentiment and trading behavior, potentially resulting in price fluctuations for major cryptocurrencies.

How do ether ETFs affect Ethereum price analysis?

Ether ETFs can create additional liquidity and investment opportunities for Ethereum, directly influencing its price dynamics. Analyzing Ethereum prices in the context of ether ETFs helps investors understand potential price movements driven by institutional interest and market demand.

Why are crypto prices falling during the SEC’s Crypto Task Force roundtable?

Crypto prices tend to fall when regulatory scrutiny intensifies, as seen during the SEC’s Crypto Task Force roundtable. Investors may react with caution over potential legislative changes, leading to decreased trading volumes and lower prices across the cryptocurrency market.

What are the factors affecting cryptocurrency market updates?

Cryptocurrency market updates are affected by various factors, including regulatory announcements like those from the SEC Crypto Task Force, market transactions, technological developments, and macroeconomic trends. These elements work together to shape crypto prices regularly.

What is the significance of staking for ether ETFs?

Staking is significant for ether ETFs as it can provide higher yield opportunities, which may attract more investors to Ethereum-based ETFs. This increased interest could positively impact Ethereum prices, as staking mechanisms encourage holding and could lead to reduced circulating supply.

How does digital assets security relate to current crypto prices?

Digital assets security is crucial in maintaining investor confidence, and any threats or incidents can lead to sharp downturns in crypto prices. When discussions, such as those from the SEC’s Crypto Task Force, focus on security regulations, they often influence market perceptions and price stability.

What trends are emerging in Ethereum price analysis post-SEC announcement?

Following SEC announcements, trends in Ethereum price analysis may highlight increased volatility and shifts in investor sentiment. Analysts often observe how regulatory clarity or ambiguity affects Ethereum’s price, providing insights into potential market trajectories.

| Key Point | Details |

|---|---|

| Crypto Prices Trend | Major cryptocurrencies are trading lower as the week ends. |

| SEC’s Crypto Task Force Meeting | The meeting focuses on defining the security status of digital assets. |

| BlackRock Insights | BlackRock’s head of digital assets mentions staking could significantly impact ether ETFs. |

| Ether Price Dynamics | There is a noted disconnect between ether’s price and updates on the Ethereum Network, discussed by EY’s Blockchain Leader. |

Summary

Crypto prices have taken a downturn amid the SEC’s active involvement in regulating the digital asset space. As the SEC’s Crypto Task Force convenes for its inaugural roundtable, it is crucial for investors to stay alert to the implications of regulatory assessments on market movements. Additionally, insights from industry leaders indicate potential game-changers, such as staking for ether ETFs, which could influence future pricing trends. Understanding these developments is essential for those tracking crypto prices.