The Crypto Fear and Greed Index is a vital indicator for gauging the emotional landscape of the crypto market sentiment. It effectively measures whether investors are engulfed in fear or driven by greed, providing insights into potential Bitcoin price movement. With the current index reflecting a fear level of 32, it suggests caution among traders, who may be influenced by Bitcoin volatility as the price approaches yearly lows. Understanding the Fear and Greed Index BTC helps investors anticipate shifts in market trends and potential buy-sell opportunities. As investor behavior in crypto becomes more informed, monitoring this index may provide crucial context for navigating the fluctuations of Bitcoin.

The Cryptocurrency Sentiment Gauge is a crucial tool that evaluates the psychological state of investors within the digital currency space. This index helps track levels of fear versus greed among traders, offering valuable insights into potential market shifts. Currently, a sentiment score indicating fear suggests that many are hesitant, especially with the Bitcoin price trailing near year lows. By analyzing the cryptocurrency sentiment, investors can better comprehend the dynamics that drive Bitcoin price corrections and advancements. Such understanding also highlights significant correlations between market sentiment and investor behavior in crypto trading.

Understanding the Crypto Fear and Greed Index

The Crypto Fear and Greed Index serves as a vital tool for investors and traders in navigating the intricate waters of the cryptocurrency market. By quantifying market sentiment, the index provides insight into whether the current mood is leaning towards fear or greed. Currently, with a reading of 32 reflecting fear, traders need to understand that such metrics are indicative of potential market volatility. Specifically, low levels of greed often signify a time when investors may be pulling back, thus providing strategic opportunities for those looking to enter the market at lower prices.

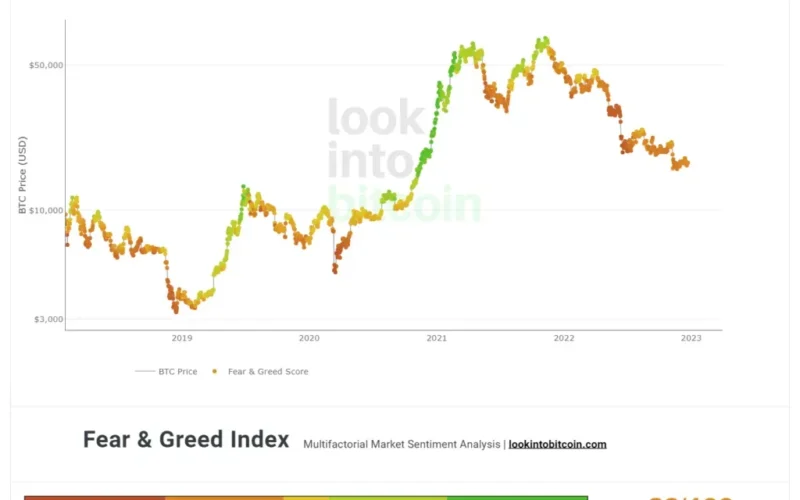

The significance of the Fear and Greed Index becomes even more apparent when one examines its historical correlation with Bitcoin’s price movements. Periods of extreme fear can suggest a market bottom, where savvy investors might find advantageous entry points, while mass greed can signal a market peak. Therefore, understanding the index can help traders appreciate how psychological factors influence investor behavior, ultimately leading to price fluctuations in assets like Bitcoin.

The Impact of Bitcoin Price Correlation

Bitcoin price correlation with the Crypto Fear and Greed Index highlights a fascinating dynamic within the crypto market. Analyzing the historical data shows that values below 30 typically lead to a reversal in prices, making fear an interesting trigger for upward trends in Bitcoin. For instance, during significant dips in price when investor sentiment is primarily fearful, Bitcoin has shown resilience, characteristically bouncing back more robustly than during phases of market euphoria.

Conversely, periods of high greed often predict short-lived price increases followed by abrupt corrections. For example, when the index hit its peak with excessive greed, Bitcoin’s subsequent decline suggests that rushing in during euphoric market conditions can be risky. This correlation emphasizes the need for investors to remain vigilant and attuned to sentiment indicators like the Fear and Greed Index, aligning their trading strategies with observed market behaviors.

Behavior of Investors in Crypto Markets

Investor behavior in crypto markets is profoundly influenced by emotions, as evidenced by readings from the Crypto Fear and Greed Index. During periods of high fear, many investors retreat, potentially leading to increased volatility in Bitcoin prices as panic selling may occur. However, this creates opportunities for others who are willing to buy the dip, thus reversing the price direction in a more bullish trend.

In contrast, during times of greed, many investors become over-optimistic, which can inflate prices beyond sustainable levels. This creates a bubble effect, where once fears of a market correction set in, investor confidence diminishes. Therefore, understanding how investor psychology influences the crypto market, specifically regarding Bitcoin’s volatility, is essential for making informed decisions in a rapidly changing landscape.

Analyzing Bitcoin Volatility Through the Index

Bitcoin volatility is a critical factor driving investor decisions, and the Crypto Fear and Greed Index helps shed light on the reasons behind price fluctuations. High volatility, often associated with fear, indicates uncertain market conditions that can lead to abrupt price movements. When the index signals a state of fear, traders may expect significant reversals, which can offer lucrative short-term trading opportunities in an otherwise tumultuous market.

On the other hand, periods marked by lower volatility and higher greed readings tend to stabilize the market, although they eventually lead to corrective downturns. This dual nature of volatility, paired with investor sentiment as highlighted by the Fear and Greed Index, is vital for understanding Bitcoin’s price trajectories and making strategic investment choices over time.

The Reversal Patterns in Bitcoin Prices

Reversal patterns in Bitcoin prices often coincide with extremes in the Crypto Fear and Greed Index. When the index reflects extreme fear, it typically foreshadows a bullish reversal in the price of Bitcoin as historically observed. In those instances, traders keen on spotting market bottoms tend to capitalize on these low readings, leading to significant rebounds as the sentiment shifts from fear to gradual optimism.

Conversely, when the index flashes readings of excessive greed, reversals become sharper and more unpredictable. While Bitcoin may briefly reach new heights during such periods, the inevitable corrections seem to be more pronounced. Recognizing these patterns not only helps in timing trades but also in understanding the broader market psychology that influences Bitcoin’s price trajectory.

Market Trends and Bitcoin Correlation

Market trends and their correlation with Bitcoin prices are an essential aspect of understanding the cryptocurrency landscape. Trends in the Crypto Fear and Greed Index can provide valuable context about future movements in Bitcoin. For instance, a rising trend in fear often sets the stage for cautious investor behavior, fostering conditions ripe for a potential price bounce.

Conversely, a sustained trend of greed could signal impending market saturation and the possibility of a price correction. It is within these trends that investors should seek to gauge not only the current sentiment but also anticipate shifts in the market landscape. Monitoring these trends can guide investors in making strategic positions concerning Bitcoin and the broader crypto market.

Using the Fear and Greed Index for Trading Strategies

Employing the Fear and Greed Index can significantly enhance trading strategies for Bitcoin investors. Given that certain levels on the index often indicate market reversals, traders might time their entries and exits to maximize gains. For example, when the index displays an extreme fear level below 30, it could signal an optimal buying opportunity, encouraging traders to accumulate positions before a recovery.

Additionally, during periods of greed, investors may opt to take profits or hedge against potential downturns. Understanding how to use the index to inform trading strategies allows proponents of cryptocurrency to leverage psychological market dynamics, balancing risks appropriately in a notoriously volatile environment.

The Importance of Sentiment Analysis in Crypto

Sentiment analysis, particularly through tools like the Crypto Fear and Greed Index, plays a critical role in navigating the unpredictable waters of Bitcoin pricing. By gauging the emotional state of investors, traders can better inform their strategies and expectations about future movements. This analysis not only helps to rationalize price swings but also attempts to predict broader market conditions.

In the crypto realm, where speculation often drives prices, sentiment analysis can provide a useful counterbalance to purely technical analyses. Consequently, keeping a close eye on sentiment indicators allows traders to psychological insights into market behavior, helping them to make more informed decisions when trading Bitcoin and identifying potential opportunities.

Future Outlook on Bitcoin and the Fear and Greed Index

Looking ahead, the interplay between Bitcoin prices and the Crypto Fear and Greed Index will likely continue to shape the market landscape. Speculations surrounding upcoming regulatory changes, technological advancements, and macroeconomic factors will influence investor sentiments, leading to ever-evolving index readings. Investors should remain vigilant in monitoring these developments to anticipate shifts in market dynamics.

Furthermore, as Bitcoin solidifies its position within the global financial ecosystem, the relevance of the Fear and Greed Index as a sentiment gauge will persist. It serves not only as a tool for understanding current market conditions but also as a measure to identify potential investment opportunities for a more stable trajectory amidst Bitcoin’s inherent volatility.

Frequently Asked Questions

What is the Crypto Fear and Greed Index and how does it influence Bitcoin price?

The Crypto Fear and Greed Index measures market sentiment, indicating whether investors are in a state of fear or greed. A score of below 30 indicates fear, which can lead to bullish reversals in Bitcoin price, while scores above 70 suggest greed, often followed by a temporary drop in Bitcoin volatility.

What are the components that make up the Crypto Fear and Greed Index?

The index is constructed from five weighted factors: Volatility (compared to historical averages), Volume (higher trading indicates greed), Social Media engagement (related to Bitcoin), Dominance (higher Bitcoin dominance signals fear), and Trends (Google trends for fear and greed keywords). Together, these factors provide a snapshot of crypto market sentiment.

How does the Bitcoin price react to extreme values in the Crypto Fear and Greed Index?

Historically, extreme values of fear in the Crypto Fear and Greed Index have led to rapid bullish reversals in Bitcoin price, as seen in past market cycles. Conversely, periods of extreme greed usually result in short-lived price increases, often followed by a correction in Bitcoin’s price.

Can the Crypto Fear and Greed Index predict Bitcoin’s price movement?

While the Crypto Fear and Greed Index does not guarantee price movements, it has shown a mixed correlation with Bitcoin’s price. Extreme fear levels tend to predict price bottoms effectively, whereas extreme greed levels may lead to milder corrections in Bitcoin’s value.

How does investor behavior in crypto relate to the Crypto Fear and Greed Index?

Investor behavior in the crypto market is closely tied to the Crypto Fear and Greed Index. When the index indicates fear, investors may look to buy BTC at lower prices, anticipating price rebounds, while during greed phases, investors may be more likely to sell or take profits, leading to increased Bitcoin volatility.

What does a low score on the Crypto Fear and Greed Index signify?

A low score (below 30) on the Crypto Fear and Greed Index signifies that investors are experiencing fear in the crypto market. This can result in favorable buying opportunities as historical data suggests that fear often precedes bullish reversals in Bitcoin’s price movement.

Is the Crypto Fear and Greed Index reliable for predicting Bitcoin volatility?

The Crypto Fear and Greed Index can provide insights into potential Bitcoin volatility. Extreme values in the index have historically correlated with heightened volatility, although it should be used in conjunction with other market analysis tools for more accurate predictions.

How can I use the Crypto Fear and Greed Index to inform my crypto trading strategy?

Investors can use the Crypto Fear and Greed Index to evaluate market sentiment before making trading decisions. When the index indicates a position of fear, it may signal a buying opportunity, while greed signals might suggest profit-taking or caution in entering new positions.

| Key Point | Explanation |

|---|---|

| Current Fear Level | The Crypto Fear & Greed Index shows fear at 32. |

| Bitcoin Price Bounce | Bitcoin (BTC) price has bounced 10% from its lows as of current metrics. |

| Index Creation Factors | The index is created based on five weighted factors: Volatility, Volume, Social Media engagement, Dominance, and Trends. |

| Correlation with Bitcoin | The index shows mixed correlation with Bitcoin, with extreme fear often leading to price rebounds, while extreme greed leads to milder reactions. |

| Historical Behavior | Historical data shows that high fear levels can accurately predict market bottoms, leading to price rallies. |

Summary

The Crypto Fear and Greed Index serves as a significant indicator of market sentiment that can influence Bitcoin’s price movements. By showcasing fear at a level of 32, the index suggests a cautionary approach among investors, often resulting in the opportunity for price recovery, as evidenced by Bitcoin’s recent 10% bounce from its lows. Understanding this relationship can be vital for traders and investors looking to navigate market fluctuations effectively.