In 2025, Singaporeans turning 55 will see significant changes with CPF Monthly Payouts, now projected to range from S$840 to S$900 per month. This is contingent upon setting aside the Basic Retirement Sum (BRS) of S$106,500, a crucial step for effective retirement planning in Singapore. For those looking for enhanced security in their later years, the Enhanced Retirement Sum (ERS) could boost payouts to over S$3,000 monthly, providing retirees with greater financial comfort. Understanding CPF LIFE payouts is vital for anyone nearing retirement, as these updates directly influence their financial future and peace of mind. This guide will help you navigate these changes with advice and insights to maximize your pension benefits for a stable and dignified retirement.

As we look into the future of retirement funding, the discussion around monthly CPF payouts in Singapore, especially for those reaching the age of 55 in 2025, becomes increasingly relevant. The CPF Lifelong Income for the Elderly (LIFE) scheme not only ensures a steady stream of income but also emphasizes the importance of setting aside a substantial amount, specifically the Basic Retirement Sum (BRS). With options to elevate financial security through the Enhanced Retirement Sum (ERS), retirees have a unique opportunity to enhance their monthly incomes significantly. With proper retirement planning, individuals can enjoy a more comfortable lifestyle in their golden years. This overview aims to clarify the mechanics of the CPF system and how the newfound payout framework can be leveraged to ensure a fulfilling retirement.

Understanding the Basics of CPF LIFE in Singapore

CPF LIFE, or Lifelong Income for the Elderly, is a crucial scheme for retirees in Singapore, ensuring they receive a steady monthly income post-retirement. Starting payouts typically at age 65, it is vital for retirement planning in Singapore, particularly for those who want a sustainable income stream during their golden years. The system encourages individuals to save through their Retirement Accounts (RA), specifically targeting amounts like the Basic Retirement Sum (BRS) for those around 55 years old.

The BRS, set at S$106,500 in 2025, lays the foundational financial security for retirees. Understanding how CPF LIFE operates is essential, as it allows one to make informed decisions about potential top-ups or deferments that can significantly augment their monthly income. This ensures retirees can maintain a comfortable lifestyle, aligning with Singapore’s broader goals of fostering a financially secure elderly population.

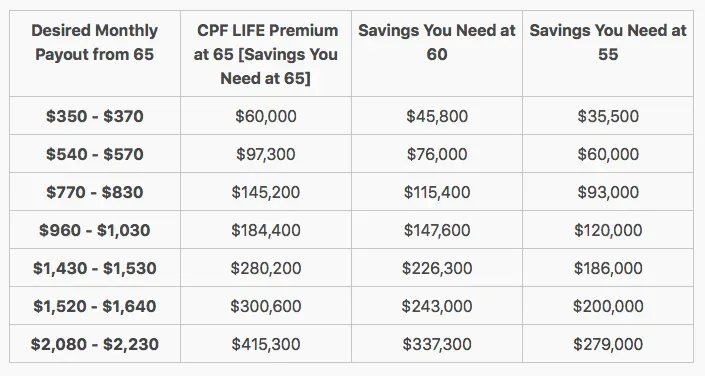

Projected Monthly Payments from CPF LIFE in 2025

Starting in 2025, Singaporeans approaching retirement can expect monthly payouts ranging between S$840 to S$900, provided they meet the Basic Retirement Sum requirements. This payout structure is developed to ensure that retirees can enjoy a basic standard of living without the burden of financial struggle. Moreover, those who can afford to set aside more can consider elevating their savings to the Enhanced Retirement Sum (ERS), allowing for much larger monthly payouts.

With the ERS set at S$426,000—a fourfold increase from the BRS—those who contribute at this level could see monthly payouts ranging from S$3,080 to S$3,310. This dramatic increase not only illustrates the importance of strategic financial planning but also empowers retirees to enjoy higher living standards. As retirement approaches, understanding this scale of payouts becomes crucial for effective retirement income management.

How to Maximize Your CPF LIFE Payouts Through Strategic Planning

To maximize the benefits of CPF LIFE payouts, proactive planning is essential. Retirees can benefit from strategic decisions like delaying the start of their payouts. For every year one postpones their CPF LIFE payments past age 65, there is potential for an increase of up to 7% per annum, making it a savvy choice for those with alternative income sources. This means starting payouts at age 67 can significantly amend future financial outcomes by boosting monthly income for life.

Additionally, engaging with CPF’s Retirement Sum Topping-Up Scheme (RSTU) encourages families to contribute funds directly to their loved ones’ Retirement Accounts, which can bolster overall savings. With the cap on savings in the Special Account (SA) coming soon in 2025, it’s imperative that individuals make informed decisions now to ensure their retirement is as financially secure as possible. Understanding the cumulative effects of these strategies is essential for achieving comfortable and worry-free retirement years.

Key Changes to the CPF Special Account in 2025

In 2025, significant modifications to the CPF Special Account (SA) for members aged 55 and above will take place. This change is part of an effort to simplify CPF management and optimize account functionality. Funds will be moved from the SA into the Retirement Account (RA) to meet the Full Retirement Sum, offering clarity on retirement savings management for seniors.

For those nearing retirement, this shift means they should act swiftly—planning top-ups as necessary and ensuring that they are prepared for these impending changes. Understanding this transition is vital for retirees and contributes to effective retirement planning in Singapore. Being proactive can prevent surprises when accessing retirement savings.

Utilizing CPF to Ensure Financial Stability in Retirement

As Singaporeans approach their retirement, leveraging CPF savings becomes a critical component of ensuring long-term financial stability. CPF LIFE not only provides a consistent monthly payout but also incorporates elements like the deferment bonus, which can help seniors strategize their income. This financial planning aspect allows individuals to tailor their retirement funding according to their lifestyle needs.

Understanding how different retirement sums—such as the Basic Retirement Sum and Enhanced Retirement Sum—work within CPF can greatly affect one’s financial outlook. Those who prioritize this knowledge and act upon it can secure a more comfortable and dignified retirement phase, ensuring they make the most out of CPF payouts.

The Importance of the Basic and Enhanced Retirement Sums

The Basic Retirement Sum (BRS) and Enhanced Retirement Sum (ERS) serve as pivotal financial benchmarks for retirees in Singapore. The BRS sets the minimum needed to receive basic monthly payouts, crucial for providing a safety net during retirement. Understanding these standards is essential in navigating the CPF landscape, especially for those turning 55 in 2025.

The Enhanced Retirement Sum represents a strategic option for those able to contribute more, resulting in significantly higher monthly payouts. This distinction allows individuals to match their retirement income with lifestyle expectations, leading to enhanced security and quality of life in their later years. It highlights the importance of awareness around retirement planning and makes it imperative for working adults to engage with their CPF savings early on.

Step-by-Step Guide to Planning Your CPF LIFE Retirement

When planning for CPF LIFE, a systematic approach is critical for maximizing retirement income. Start by understanding both the Basic Retirement Sum (BRS) and the Full Retirement Sum (FRS) to establish a solid financial foundation. Utilizing CPF’s official calculators can provide tailored estimates depending on individual savings and targeted retirement goals, enabling a clearer vision of prospective payouts.

Next, consider family contributions to the Retirement Account via the Retirement Sum Topping-Up Scheme, enhancing your financial positioning for retirement. By planning the onset age of payouts—delaying if financially feasible—one can significantly improve their monthly retirement income. This multi-faceted approach ensures retirees can effectively plan and enjoy a fruitful retirement years.

Frequently Asked Questions about CPF LIFE Monthly Payouts

Many retirees have questions regarding CPF LIFE and its monthly payouts, particularly concerning withdrawal capabilities after the age of 55. It’s important to note that while individuals must meet the set thresholds for amounts like the BRS, they still retain access to their CPF funds, allowing them flexibility during the transition to retirement.

Additionally, inquiries about foreigners or Permanent Residents seeking to participate in CPF LIFE reveal specifics of eligibility, emphasizing that only Singapore Citizens and PRs with established CPF accounts may benefit from this scheme. Understanding these parameters, along with the systems for obtaining help in financial planning, ensures that all retirees can access the resources they require for a stable and informed retirement.

Frequently Asked Questions

What are the expected CPF Monthly Payouts in 2025 for those turning 55?

In 2025, Singaporeans turning 55 can expect CPF LIFE payouts between S$840 to S$900 per month, provided they set aside the Basic Retirement Sum (BRS) of S$106,500.

How can I increase my CPF LIFE payouts beyond the Basic Retirement Sum (BRS) in 2025?

To increase your CPF LIFE payouts beyond the Basic Retirement Sum (BRS), you can opt for the Enhanced Retirement Sum (ERS), which requires setting aside S$426,000. This can boost your monthly payouts to S$3,080 to S$3,310 starting at age 65.

What is the difference between the Basic Retirement Sum (BRS) and Enhanced Retirement Sum (ERS) for CPF Monthly Payouts in 2025?

The Basic Retirement Sum (BRS) is set at S$106,500, yielding monthly payouts of S$840 to S$900. The Enhanced Retirement Sum (ERS), at S$426,000, provides significantly higher payouts of S$3,080 to S$3,310 per month.

How does the deferment of CPF LIFE payouts impact my retirement income?

Deferring your CPF LIFE payouts beyond age 65 can increase your monthly income by up to 7% for each year deferred, maximally up to age 70. This means waiting to start your payouts can significantly enhance your financial stability during retirement.

What changes are expected for the CPF Special Account for those aged 55 and above starting in 2025?

From early 2025, the CPF Special Account will be closed for members aged 55 and above, and funds will be transferred to the Retirement Account (RA) to simplify the management of CPF savings.

Is it possible to make top-ups to my CPF Retirement Account to increase monthly payouts?

Yes, you can make cash top-ups to your CPF Retirement Account (RA) under the Retirement Sum Topping-Up Scheme (RSTU) to boost your CPF LIFE monthly payouts.

What resources are available for planning retirement using CPF in Singapore?

For effective retirement planning using CPF, you can utilize the CPF LIFE Estimator tool, attend CPF webinars, or seek guidance from CPF service centers and accredited financial advisers.

Are CPF LIFE payouts guaranteed for life?

Yes, CPF LIFE payouts are designed to provide a lifelong monthly income starting from the payout eligibility age (usually 65), ensuring financial support for retirees through their retirement years.

What are the eligibility criteria for CPF LIFE participation?

Only Singapore Citizens and Permanent Residents with a CPF account are eligible to participate in CPF LIFE, which ensures a secure retirement income.

How does CPF ensure the sustainability of monthly payouts for retirees in 2025?

CPF ensures the sustainability of monthly payouts by managing savings in the Retirement Account with attractive interest rates, typically between 4% to 6%, and through well-planned policies that adjust retirement sums over time.

| Monthly CPF LIFE Payouts (BRS) | Basic Retirement Sum (BRS) 2025 | Enhanced Retirement Sum (ERS) | Maximum Monthly CPF LIFE Payouts | Deferment Bonus | CPF Special Account Closure | Official CPF Website |

|---|---|---|---|---|---|---|

| S$840 to S$900 (for those turning 55 in 2025) | S$106,500 | S$426,000 (4x BRS from 2025) | S$3,080 to S$3,310 (ERS level) | Up to 7% increase per year if payouts are deferred (up to age 70) | SA closed for 55+ from early 2025; funds moved to RA or OA | www.cpf.gov.sg |

Summary

CPF Monthly Payouts 2025 will bring significant changes for retirees in Singapore. Starting in 2025, those reaching the age of 55 can expect monthly payouts that range from S$840 to S$900 by meeting the Basic Retirement Sum requirement. This update aims to provide financial security and peace of mind for retirees as they transition into their golden years. Moreover, by achieving the Enhanced Retirement Sum, retirees can increase their monthly payouts to over S$3,000. These changes underline the importance of planning for retirement and offer various strategies, including the option to defer payouts for higher financial gains. It is essential to stay informed about CPF updates to maximize retirement benefits effectively.