CPF members interest rates are set to provide a tremendous boost to retirement savings as they continue to earn extra interest in Q2 2025. This initiative, announced by the CPF Board, highlights the government’s commitment to enhancing the financial security of its citizens. For those under 55, the extra 1 percent interest on the first $60,000 of total balances offers a significant incentive for younger members to contribute more to their accounts. Meanwhile, members aged 55 and above will benefit from an additional 2 percent interest on the first $30,000, conveniently supporting their retirement savings initiatives. With these favorable Singapore CPF rates, members can look forward to a more secure financial future alongside other CPF member benefits.

The interest rates offered to CPF participants are crucial for building robust retirement savings, and recent developments highlight this commitment. In Singapore, the CPF system continues to adapt, ensuring that contributions yield maximum benefits for all ages. Participants can take advantage of extra opportunities to earn on their accounts, thereby growing their financial assets over time. This intentional design not only fosters a sense of financial security but also encourages a culture of saving among CPF account holders. As the landscape of retirement planning evolves, understanding these growth rates and associated advantages will play a key role in future financial strategies.

Extra Interest Rates for CPF Members in 2025

In 2025, CPF members will benefit from extra interest rates designed to enhance their retirement savings. This initiative underscores the government’s commitment to boosting the financial well-being of its citizens through the Central Provident Fund. For members under 55 years of age, an additional interest of 1% will be provided on the first $60,000 of their CPF balances, ensuring they accumulate sufficient funds for their future. This extra interest is crucial as it significantly impacts the overall growth of their retirement savings over time.

For members aged 55 and older, the support becomes even more pronounced, with an additional 2% interest on the first $30,000, and a further 1% on the next $30,000. This structured approach allows seniors to secure more substantial savings, which is especially important as life expectancy rises and the need for a reliable income stream in retirement deepens. Such measures reinforce the CPF member benefits, helping to create a more robust financial foundation for retirement.

Understanding the Impact of CPF Interest Rates on Retirement

The CPF member benefits extend beyond immediate interest rates; they reflect the larger framework of retirement planning in Singapore. The consistently stable minimum interest rates of 4% per annum for Special, MediSave, and Retirement Accounts continue to provide a solid foundation for retirement saving. These accounts are linked to secure government securities, ensuring that members’ funds grow steadily and reliably. As Singaporean citizens navigate through their personal financial landscapes, the significance of these interest rates cannot be understated.

Additionally, with OA interest rates fixed at 2.5%, CPF members can anticipate predictable returns on their savings. This predictability aids long-term financial planning and affirms that members can safely rely on their CPF funds for future needs. As the 2025 CPF interest rates remain competitive in the market, they align with Singapore’s holistic approach to retirement savings, ensuring that both younger and older members are adequately supported.

CPF Life: Ensuring Financial Security for Seniors

CPF Life serves as an essential component of the retirement savings strategy for older Singaporeans, ensuring they receive lifelong monthly payouts starting at age 65. This scheme enhances financial security during retirement, alleviating concerns over outliving savings. The additional interest earned on CPF balances, particularly for those enrolled in CPF Life, strengthens the overall financial reservoir available to them, providing both peace of mind and improved living standards post-retirement.

Moreover, CPF Life’s interconnectedness with the extra interest initiatives signifies a thoughtful approach to retirement income planning. By combining sufficient lifetime payouts with generous interest incentives, the CPF Board effectively addresses the diverse needs of seniors, particularly as they face rising living costs and potential healthcare expenses. This multifaceted strategy solidifies the CPF’s role as a pillar of financial stability for the aging population in Singapore.

Minimum Interest Rates in Special and MediSave Accounts

In the second quarter of 2025, members can rest assured that their funds in Special and MediSave Accounts will continue to earn a minimum interest rate of 4% per annum. This rate has been consistently maintained, providing a reliable yield that is critical for financial planning in retirement. With funds in these accounts typically earmarked for healthcare and future needs, the assurance of a steady interest rate is a vital aspect of managing finances effectively as one ages.

Additionally, the importance of these minimum rates cannot be overstated, especially during times when market conditions fluctuate. Members can feel secure knowing that even if the linked rates from government securities dip, their savings will not suffer. This structure helps safeguard members’ interests while promoting long-term saving habits, thereby enhancing overall retirement preparedness.

The Role of CPF in Enhancing Retirement Savings

The Central Provident Fund serves a critical role in enhancing the retirement savings of Singaporeans. By incentivizing savings through extra interest rates, the government actively promotes a culture of financial independence among its citizens. With an effective framework that caters to various demographics, the CPF initiative is instrumental in shaping robust retirement financial strategies. Members under 55 receiving additional interest exemplify how these policies aim to build a solid foundation for their future.

For retirees, the focus on providing higher interest for older members reiterates the CPF’s commitment to prioritizing above-average returns for individual savings. This ensures that those who have dedicated a lifetime of contributions into the CPF reap significant benefits as they transition into retirement. Such initiatives not only offer financial support but also empower individuals to make informed decisions about their retirement planning.

Understanding Eligibility for Extra CPF Interest Rates

To gain the benefits of additional interest rates, CPF members must understand their eligibility criteria. All members, aged below and above 55, will benefit from the incremental rates specified by the CPF Board. This inclusivity in the program is pivotal for ensuring that everyone in the system can participate in enhancing their retirement savings. Knowing the caps on account balances for which these rates apply helps members strategically manage their funds.

This knowledge about eligibility not only promotes better financial planning but also encourages members to engage more actively with their CPF statements. By taking the time to review their balances and contribution levels, members can make informed decisions about their savings strategies. Overall, understanding eligibility criteria empowers CPF members to maximize the benefits available to them under the enhanced interest structures.

Long-term Strategies for Maximizing CPF Savings

Maximizing CPF savings requires strategic planning and informed decisions throughout the individual’s working life. Members are encouraged to contribute as much as possible to tap into the extra interest rates effectively. This involves being aware of contribution limits and understanding how savings allocated in Ordinary Accounts can be transferred to Special or Retirement Accounts for higher interest yields. Such proactive measures not only enhance the growth of retirement savings but also ensure capital is available for healthcare or other crucial needs.

Moreover, involving oneself in ongoing education on CPF policies and updates can offer additional advantages. By staying informed about changing laws, interest rates, and new initiatives, members can align their financial plans with current opportunities for growth. With careful management and continuous engagement, CPF members can create a strategic pathway to secure their financial future in retirement.

The Link Between CPF Contributions and Interest Rates

There is a direct correlation between CPF contributions and interest rates, which significantly impacts the overall savings potential for members. Higher contributions lead to larger balances, which when combined with enhanced interest rates, yield considerable financial benefits over time. For instance, the additional 1% and 2% interest on various balances has made a substantial difference in the compounded growth of members’ funds, particularly as individuals approach retirement age.

Understanding this link between contributions and interest rates is crucial for CPF members aiming to optimize their retirement savings. By maximizing contributions and making informed decisions about their savings allocations, members can leverage CPF policies effectively. This awareness not only helps in accumulating wealth but also assists members in making strategic choices regarding their financial futures.

Predicting Future CPF Interest Rates Trends

As CPF members look ahead, understanding potential trends in interest rates can be instrumental in financial planning. The CPF Board’s past performance serves as a benchmark for anticipating future interest rates, with current policies indicating stability and steady growth. Members who take advantage of the existing interest schemes while also observing market changes will find themselves better prepared for any upcoming adjustments in the CPF framework.

In light of economic conditions and demographic trends, predictions related to the 2025 CPF interest rates suggest gradual adaptations that prioritize long-term financial security for members. This forward-thinking approach allows members to strategize their contributions and savings plans effectively, ensuring they capitalize on whatever market offers in terms of interest while safeguarding their financial health.

Frequently Asked Questions

What are the current extra interest rates for CPF members in 2025?

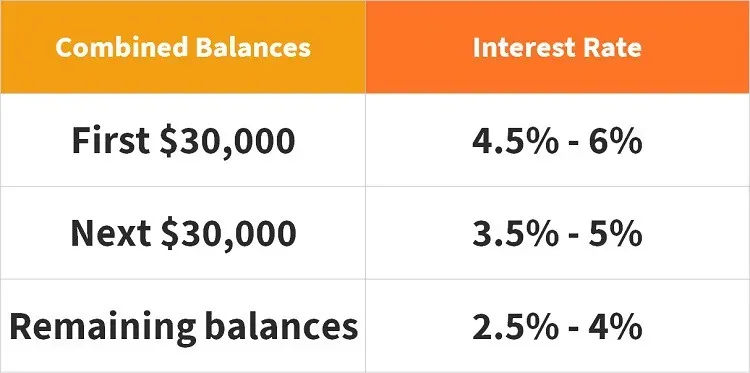

In the second quarter of 2025, CPF members will earn additional interest based on their age. Members under 55 will receive an extra 1% on the first $60,000 of their total CPF balances, capped at $20,000 for their Ordinary Accounts (OA). Those aged 55 and above will get an additional 2% on the first $30,000, and 1% on the next $30,000.

How do the CPF member benefits enhance retirement savings?

The CPF member benefits, including extra interest rates, significantly enhance retirement savings by providing higher returns on contributions. In Q2 2025, the additional interest for members under 55 and those aged 55 and older helps to boost their overall savings, ensuring a better financial foundation for retirement.

What will happen to the interest earned on CPF members’ OA balances?

The extra interest earned on CPF members’ OA balances in Q2 2025 will be transferred into their Special Account or Retirement Account. This transfer contributes to the overall growth of retirement savings for CPF members.

Are there specific CPF rates for retirement accounts in 2025?

Yes, in the second quarter of 2025, savings in Special, MediSave, and Retirement Accounts will continue to earn a minimum interest rate of 4% per annum, while the Ordinary Account will maintain an interest rate of 2.5% per annum.

How does CPF Life affect interest rates for older members?

For CPF members aged 55 and above, those participating in CPF Life will benefit from additional interest rates that apply to their combined CPF balances, ensuring they earn more on their retirement savings, which aids in securing monthly payouts for life starting at age 65.

What is the 2025 CPF interest rate for ordinary accounts?

In the second quarter of 2025, the interest rate for Ordinary Accounts (OA) remains unchanged at a minimum rate of 2.5% per annum, despite the pegged rate being lower.

How do Singapore CPF rates compare for different age groups?

In Singapore, CPF rates differ by age group: members under 55 earn an additional 1% on balances up to $60,000, while those aged 55 and above earn an extra 2% on the first $30,000 and an additional 1% on the next $30,000, promoting better retirement savings across age segments.

| Age Group | Additional Interest Rate | Total Balance Cap | Interest Transfer | Comment |

|---|---|---|---|---|

| Under 55 | 1% | $60,000 | Transferred to Special/Retirement Account | Capped at $20,000 for OA balances |

| 55 and Above | 2% on first $30,000 + 1% on next $30,000 | $60,000 | Transferred to Special/Retirement Account | Capped at $20,000 for OA balances; Includes CPF Life savings |

| All Members | 4% for Special/MediSave/Retirement Accounts | N/A | N/A | Minimum interest with lower peg unless rates improve |

| All Members | 2.5% for OA accounts | N/A | N/A | Unchanged in Q2 2025 due to lower peg |

Summary

CPF members interest rates are set to provide additional earnings throughout Q2 2025, offering significant benefits for retirement savings. The government has confirmed that CPF members, whether under or over the age of 55, will continue to receive extra interest rates on their balances, effectively enhancing their retirement funds. Younger members (under 55) will receive an additional 1% interest on their first $60,000, while older members will benefit from higher rates, ensuring that everyone is encouraged to save for retirement.