The CPF Matched MediSave Scheme is set to revolutionize senior healthcare in Singapore by providing financial support for seniors with limited Central Provident Fund savings. Starting in 2026, this innovative initiative will match voluntary top-ups to MediSave accounts for eligible lower-income Singaporeans aged 55 to 70, with a generous annual grant of up to S$1,000. This scheme complements the existing Matched Retirement Savings Scheme, which aids seniors in enhancing their retirement savings. With an expected 184,000 members qualifying for this support, the initiative aims to bolster retirement savings and improve healthcare access for many families. As Singapore continues to prioritize senior care, this scheme reflects a commitment to ensuring that financial support for seniors is not just a promise, but a reality.

Introducing the CPF Matched MediSave Scheme marks a significant step toward enhancing the financial landscape for elderly citizens in Singapore. This program aims to provide essential assistance by matching contributions to MediSave accounts, helping seniors manage healthcare costs more effectively. In conjunction with other retirement savings schemes and subsidies for long-term care, this initiative underscores the government’s dedication to supporting older adults. By fostering an environment where financial top-ups can significantly ease the burden of medical expenses, the CPF Matched MediSave Scheme is poised to create a more sustainable future for senior healthcare. Such proactive measures highlight Singapore’s commitment to nurturing the well-being of its aging population.

Understanding the CPF Matched MediSave Scheme

The CPF Matched MediSave Scheme is a significant initiative aimed at providing financial support for seniors in Singapore, particularly those with lower Central Provident Fund (CPF) savings. Launching in 2026, this program will match voluntary cash top-ups to the MediSave accounts of eligible seniors, helping them accumulate funds for their healthcare needs. With the government committing to match every dollar contributed, up to S$1,000 annually, this scheme is poised to enhance the financial security of approximately 184,000 lower-income Singaporeans aged 55 to 70.

This scheme complements the existing Matched Retirement Savings Scheme, which was introduced in 2021 to bolster the retirement savings of senior citizens. By facilitating voluntary top-ups, the CPF Matched MediSave Scheme not only encourages savings but also assists in increasing monthly payouts during retirement. This initiative reflects the government’s commitment to ensuring that seniors, especially those who have dedicated their lives to caregiving and homemaking, receive adequate financial support as they age.

Enhanced Long-Term Care Subsidies for Seniors

In addition to the CPF Matched MediSave Scheme, the Singapore government is increasing support for seniors requiring long-term care, particularly those with severe care needs. With the rising cost of healthcare, these enhancements are crucial for ensuring that elderly citizens can access necessary services without facing financial hardship. Starting from July 2026, subsidies for residential care will see an increase of up to 15 percentage points, allowing Singaporeans to receive up to 75% in subsidies for residential care facilities and 80% for non-residential services.

Furthermore, the eligibility criteria for these subsidies will be expanded, raising the maximum qualifying per capita household income from S$3,600 to S$4,800. This adjustment is intended to encompass a broader demographic of seniors, ensuring that those who need assistance can receive it. The government estimates that around 80,000 seniors will benefit from these enhancements, showcasing a strategic effort to address the challenges of aging in Singapore.

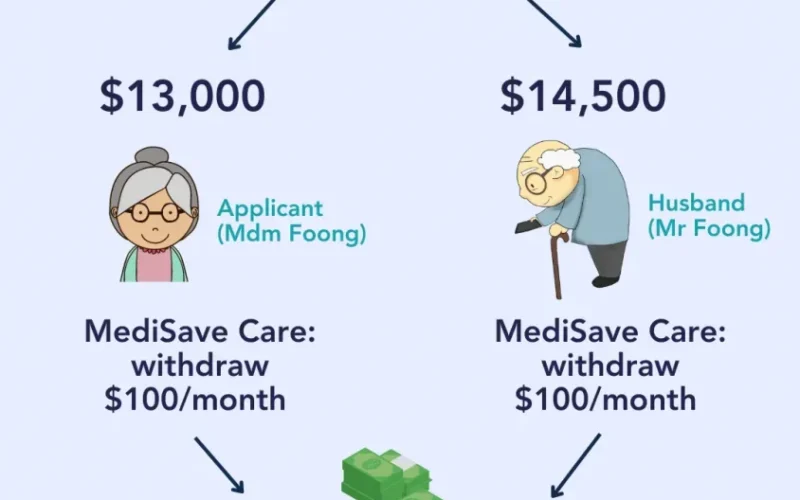

The Importance of MediSave Account Top-Ups

MediSave account top-ups play a pivotal role in the financial landscape for senior healthcare in Singapore. As healthcare costs continue to rise, having a robust MediSave account can significantly ease the burden of medical expenses for seniors. Through voluntary cash top-ups, seniors can enhance their MediSave balances, ensuring they have sufficient funds to cover hospitalization and outpatient services. The CPF Matched MediSave Scheme incentivizes these contributions by providing a dollar-for-dollar match from the government, which can ultimately lead to substantial savings for seniors.

Moreover, these MediSave account top-ups are not just limited to the seniors themselves. Family members and employers can also contribute, fostering a community-centric approach to caregiving and financial support for seniors. This collaborative effort not only strengthens the financial foundation for elderly citizens but also encourages younger generations to take an active role in securing their family’s health and wellbeing.

Retirement Savings Schemes for Singapore’s Seniors

Singapore has been proactive in implementing various retirement savings schemes aimed at supporting seniors in their golden years. The Matched Retirement Savings Scheme, alongside the upcoming CPF Matched MediSave Scheme, represents the government’s commitment to enhancing the financial security of senior citizens. These schemes are designed to help lower-income seniors build their savings, thereby increasing their monthly payouts and ensuring a more stable retirement.

As Singapore’s population continues to age, the importance of effective retirement savings becomes increasingly apparent. By providing financial incentives and matching contributions, the government is not only promoting savings but also encouraging a culture of financial literacy among seniors. This holistic approach to retirement funding is essential for ensuring that all Singaporeans can enjoy a dignified and secure retirement.

Financial Support for Seniors in Singapore

The financial landscape for seniors in Singapore is evolving, with numerous initiatives aimed at providing comprehensive support. Beyond the CPF Matched MediSave Scheme and the Matched Retirement Savings Scheme, the government has introduced various subsidies and grants that address the diverse needs of elderly citizens. These programs are vital for ensuring that seniors can access essential services without facing overwhelming financial strain.

Moreover, the recent enhancements to long-term care subsidies signify a robust response to the challenges posed by an aging population. With increased financial assistance for home and community care, seniors can maintain their independence while receiving the support they need. This multifaceted approach to financial support not only alleviates the burden on seniors but also fosters a more inclusive society where elderly citizens can thrive.

Navigating Long-Term Care Costs in Singapore

As the population ages, navigating long-term care costs becomes increasingly critical for many Singaporean families. The financial implications of caregiving can be daunting, especially for seniors who may require extensive medical support. The government’s initiatives, including enhanced subsidies and grants, are designed to mitigate these costs, ensuring that seniors can access necessary care without financial distress.

Additionally, the expansion of the Seniors’ Mobility and Enabling Fund reflects a heightened awareness of the needs of elderly citizens. By covering the costs of essential healthcare items and providing cash grants to offset daily care expenses, the government is making strides toward a more sustainable and supportive environment for seniors. These efforts are crucial for maintaining the health and wellbeing of elderly Singaporeans, allowing them to live with dignity and independence.

Community Involvement in Senior Care

Community involvement plays a vital role in enhancing the quality of life for seniors in Singapore. Encouraging family members and community members to contribute to MediSave account top-ups not only strengthens financial support but also fosters a sense of belonging among elderly citizens. This communal approach to caregiving promotes the idea that caring for seniors is a collective responsibility, which can significantly improve their overall wellbeing.

Moreover, initiatives such as the Enhancement for Active Seniors (EASE) programme highlight the importance of creating a supportive environment for seniors. By providing senior-friendly fittings and accessible solutions in both public and private housing, the government is ensuring that elderly citizens can navigate their surroundings safely and comfortably. This community-centric approach is essential for fostering an inclusive society where seniors can thrive.

Future of Senior Healthcare in Singapore

The future of senior healthcare in Singapore looks promising, with a strong emphasis on financial support and community care. The government is actively implementing policies that address the evolving needs of an aging population, ensuring that seniors have access to the necessary resources for their health and wellbeing. With initiatives like the CPF Matched MediSave Scheme and the enhanced long-term care subsidies, the financial landscape for seniors is set to improve significantly.

Additionally, as Singapore continues to prioritize the needs of its aging population, there is a growing trend towards integrating technology into senior healthcare. Innovations such as telehealth services and digital health monitoring can provide seniors with easier access to medical advice and support, further enhancing their quality of life. This forward-thinking approach to healthcare demonstrates Singapore’s commitment to ensuring that seniors can lead healthy, fulfilling lives.

Conclusion: A Holistic Approach to Senior Care

In conclusion, Singapore’s initiatives to support its senior population signify a holistic approach to elder care that prioritizes financial security, community involvement, and accessible healthcare. The CPF Matched MediSave Scheme, alongside other retirement savings schemes and long-term care subsidies, illustrates the government’s commitment to ensuring that seniors can navigate the challenges of aging with dignity and support.

As the landscape of senior care continues to evolve, it is essential for all stakeholders—including families, community organizations, and the government—to work collaboratively in supporting elderly citizens. By fostering a culture of care and inclusivity, Singapore can ensure that its seniors not only receive the financial assistance they need but also enjoy a high quality of life well into their golden years.

Frequently Asked Questions

What is the CPF Matched MediSave Scheme in Singapore?

The CPF Matched MediSave Scheme is a new initiative set to launch in 2026 that aims to support lower-income seniors in Singapore. Under this scheme, the government will match voluntary cash top-ups made to eligible seniors’ MediSave accounts, providing up to S$1,000 per year. This initiative is designed to enhance financial support for seniors, complementing other programs that assist with retirement savings and healthcare costs.

Who is eligible for the CPF Matched MediSave Scheme?

To qualify for the CPF Matched MediSave Scheme, individuals must be lower-income Singaporeans aged between 55 and 70. The CPF Board will automatically assess eligibility each year, notifying those who qualify starting from January 2026. Approximately 184,000 CPF members are expected to benefit from this scheme.

How does the CPF Matched MediSave Scheme support senior healthcare in Singapore?

The CPF Matched MediSave Scheme provides crucial financial support for seniors by matching their voluntary MediSave account top-ups. This not only helps seniors manage their healthcare expenses but also encourages families and employers to contribute to their loved ones’ MediSave accounts, enhancing overall senior healthcare support in Singapore.

Can family members contribute to the CPF Matched MediSave Scheme for seniors?

Yes, family members and even employers can make voluntary cash top-ups to the eligible seniors’ MediSave accounts under the CPF Matched MediSave Scheme. This feature allows for greater financial support for seniors, ensuring that they receive the assistance needed for their healthcare costs.

What are the benefits of the CPF Matched MediSave Scheme compared to other senior financial support schemes?

The CPF Matched MediSave Scheme specifically targets healthcare costs by matching top-ups to MediSave accounts, offering up to S$1,000 annually. This is distinct from the Matched Retirement Savings Scheme, which focuses on enhancing retirement savings. Together, these schemes provide comprehensive financial support for seniors in managing both healthcare and retirement needs.

When will the CPF Matched MediSave Scheme be implemented?

The CPF Matched MediSave Scheme is set to be implemented in January 2026. Eligible seniors will receive notifications from the CPF Board regarding their qualification status at the beginning of each year.

What is the impact of the CPF Matched MediSave Scheme on long-term care subsidies for seniors?

While the CPF Matched MediSave Scheme directly addresses MediSave contributions, it complements existing long-term care subsidies in Singapore. The enhanced financial support for seniors, including increased subsidies for residential and community long-term care services, will provide additional assistance to those with more severe care needs, further alleviating healthcare costs.

How does the CPF Matched MediSave Scheme relate to retirement savings in Singapore?

The CPF Matched MediSave Scheme operates alongside the Matched Retirement Savings Scheme, both of which are designed to bolster financial security for seniors. While the former focuses on matching MediSave top-ups for healthcare purposes, the latter aims to enhance retirement savings, ensuring that seniors are supported in both their healthcare and retirement planning.

What additional support is available for seniors under the CPF Matched MediSave Scheme?

In addition to the CPF Matched MediSave Scheme, seniors will benefit from increased long-term care subsidies, enhancements to the Home Caregiving Grant, and the expansion of the Seniors’ Mobility and Enabling Fund. These initiatives collectively aim to provide comprehensive support for Singapore’s aging population.

| Key Points |

|---|

| Introduction of the CPF Matched MediSave Scheme in 2026 to assist seniors with lower CPF savings. |

| Eligible seniors must be between 55 and 70 years old and from lower-income households. |

| The government will match voluntary cash top-ups to MediSave accounts dollar for dollar, up to S$1,000 per year. |

| Approximately 184,000 CPF members are expected to qualify for this scheme. |

| Eligibility will be assessed automatically each year, with notifications starting from January 2026. |

| Additional long-term care support will be provided, including increased subsidies for residential care and home healthcare items. |

| Enhancements to the Home Caregiving Grant, increasing cash payouts from S$400 to S$600 per month, effective April 2026. |

| The scheme aims to support at least 80,000 seniors and will cost an estimated S$300 million in FY2026. |

Summary

The CPF Matched MediSave Scheme is a significant initiative aimed at supporting lower-income seniors in Singapore. Starting in 2026, this scheme will match voluntary top-ups to MediSave accounts, providing crucial financial assistance to eligible individuals aged 55 to 70. This program not only enhances the financial security of seniors but also complements existing support structures aimed at improving their overall well-being. Enhanced long-term care subsidies and grants will further ensure that these seniors receive the care and support they need as they age.