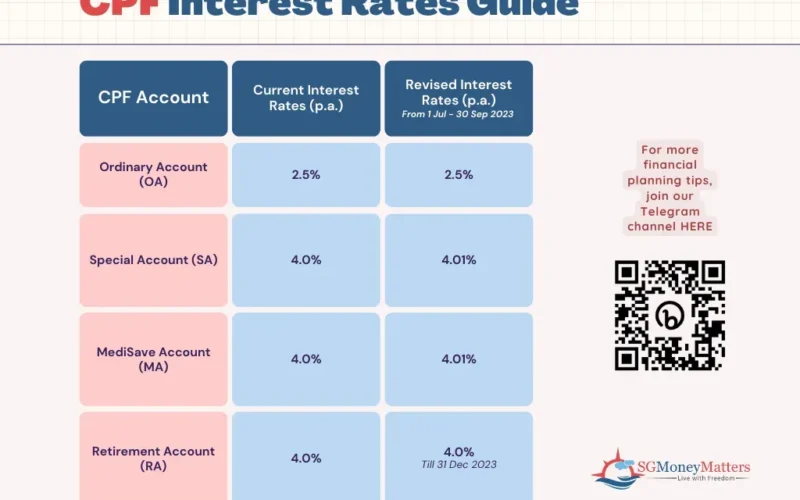

CPF interest rates play a crucial role in shaping the savings landscape for many Singaporeans, especially as they prepare for retirement. From April 1 to June 30, 2025, these rates remain unchanged, ensuring that members can anticipate stable growth of their CPF savings. Specifically, the rates for the CPF Special Account, CPF MediSave Account, and CPF Retirement Account maintain a robust interest of 4% per annum, offering a secure foundation for retirement funds in Singapore. This consistency allows individuals to maximize their savings, while the Ordinary Account interest rate holds steady at 2.5%. By understanding CPF interest rates and the benefits they offer, members can better strategize their financial futures and make informed decisions for enhanced retirement planning.

When it comes to managing retirement savings, the stability of CPF interest rates is vital for account holders in Singapore. The interest levels applicable to the CPF Special Fund, CPF MediSave Fund, and CPF Retirement Fund offer a wealth of opportunity for those planning their golden years. With rates locked in at 4% per annum for these specific accounts, individuals can benefit from predictable growth in their retirement savings. Meanwhile, the Ordinary Account’s lower interest rate of 2.5% ensures a consistent financial backdrop for everyday savings. Understanding these interest dynamics is essential for maximizing one’s CPF investments and effectively preparing for a secure retirement.

Understanding CPF Interest Rates for Savings Accounts

The CPF interest rates for the Special, MediSave, and Retirement accounts (SMRA) play a crucial role in Singapore’s retirement planning landscape. Currently, these accounts yield a stable interest rate of 4% per annum, ensuring that CPF members can grow their savings effectively. The interest rates remain unchanged from April 1 to June 30, 2025, as confirmed by the Central Provident Fund Board. This consistency in rates helps Singaporeans better predict their retirement funds, making it easier to plan financially for the future.

It’s important for CPF members to understand how the interest rates for their accounts affect their overall savings. The Special Account, primarily meant for old-age income, along with the MediSave Account designed for healthcare expenses, collectively complements members’ financial wellbeing. Since the interest rate remains above the general market rates, maintaining this rate is essential for safeguarding retirement savings against inflation and other economic fluctuations.

The Role of Additional Interest in CPF Savings Enhancement

Beyond the base interest rates, the CPF also offers additional interest on savings, further enhancing members’ retirement funds. For younger members, those under 55 years old, a 1% bonus interest is provided on the first S$60,000 of combined CPF balances, including up to S$20,000 in the Ordinary Account (OA). This incentivizes younger Singaporeans to prioritize their savings early and maximize their funds as they approach retirement.

For members aged 55 and above, the additional interest increases to 2% on the first S$30,000 of their combined balances, along with an extra 1% on the next S$30,000. This structured benefit underscores the government’s commitment to supporting its aging population in securing adequate retirement savings. By actively contributing to their MediSave and Retirement accounts, older members can leverage these benefits to enhance their financial stability.

Why CPF Interest Rates Remain Steady

As of the latest announcement, the CPF interest rates for SMRA accounts remain unchanged, primarily due to the current economic conditions. The 12-month average yield of 10-year Singapore Government Securities (10YSGS) falls below the established floor rate of 4%. This ensures that the guaranteed returns on CPF accounts remain attractive compared to other investment options, providing a sense of security and assurance for members planning for their retires.

Additionally, the Ordinary Account’s interest rate stands at a mere 2.5% due to its pegged structure, which is also below the floor rate. This stability is crucial for CPF members as it influences their long-term financial strategy. By keeping these rates constant, the CPF Board provides a reliable framework for Singaporeans to grow their retirement funds steadily, allowing individuals to focus on maximizing their contributions and benefits.

Maximizing CPF Savings Beyond the Base Rates

Maximizing your CPF savings goes beyond simply relying on the base interest rates. CPF members are encouraged to actively manage their accounts to leverage additional interest opportunities available to them. This involves maintaining your savings in the accounts where you can earn the most interest, such as reallocating funds into your Special or MediSave accounts when applicable. These proactive measures support not just saving but also strategic investment of your retirement funds in Singapore.

By understanding and utilizing the available benefits, members can significantly increase their overall CPF balances. The ability to earn additional interest based on age and balance tiers is a unique feature of the CPF system, aimed to encourage long-term saving habits. Taking full advantage of this system can result in larger retirement funds, contributing to financial independence during retirement years.

Key Benefits of CPF for Retirement Planning in Singapore

The CPF scheme is designed to ensure that all citizens have a foundation for retirement planning and financial security in Singapore. With its structured accounts, namely the Ordinary, Special, MediSave, and Retirement accounts, CPF provides a comprehensive approach to managing savings for various needs, such as housing, healthcare, and retirement income. This segmentation allows members to plan their finances more effectively according to their life stages.

Moreover, the CPF system’s focus on providing interest-bearing accounts—especially the Special and Retirement accounts with rates at 4%—shows a commitment to helping members grow their retirement revenues. As members approach retirement, the assurance of earning sustainable interest helps safeguard against economic uncertainties and inflation, ultimately leading to a more secure financial future.

The Importance of the CPF MediSave Account

The CPF MediSave account serves a critical role in managing healthcare costs for Singaporeans. It operates with a mandatory savings requirement that helps individuals accumulate funds specifically for medical expenses. With an interest rate of 4%, the MediSave account not only provides a safety net for healthcare needs but also promotes responsible saving habits among young adults and seniors alike.

In the context of Singapore’s aging population, having a well-funded MediSave account is essential as it coordinates with various health care schemes, reducing out-of-pocket expenses. As members utilize their MediSave accounts wisely, they can ensure better health outcomes in their retirement years while minimizing financial strains.

Investing In CPF Retirement Accounts

Investing in your CPF Retirement accounts is a strategic way to secure financial stability during your retirement years. With interest rates set at 4% per annum, members can experience significant growth over time, making it a viable option compared to traditional savings accounts. These accounts help facilitate the transition to retirement by accumulating funds dedicated solely for post-employment use.

Furthermore, it’s prudent for CPF members to consider additional ways to bolster their savings within these accounts, through regular contributions or by adjusting their investments according to their risk appetite. By making informed decisions regarding how to manage their CPF Retirement accounts, individuals can enhance their future financial accessibility and ensure a comfortable lifestyle during retirement.

Incorporating CPF into Your Overall Financial Strategy

Integrating your CPF savings into a comprehensive financial strategy is vital for long-term stability. CPF accounts, specifically the Special and Retirement accounts, should be central to your retirement planning, given their higher interest rates and the long-term benefits they offer. By understanding your CPF options and aligning them with personal financial goals, you can achieve a more robust savings plan.

Additionally, evaluating how each component of the CPF program fits into your overall investment portfolio can help you make educated choices. Balancing traditional investments with CPF savings can yield optimal returns while maintaining a risk-aware approach to financial planning. This holistic view ensures that CPF members maximize their savings potential and secure their financial futures.

Future Trends and CPF Interest Rates

As Singapore continues to evolve economically, the future trends surrounding CPF interest rates will remain a crucial topic for its citizens. The stability of CPF interest rates, particularly for accounts such as the SMRA, will be influenced by global economic conditions and domestic fiscal policies. Understanding these trends can provide members with insights on when to shift their savings and investment tactics to align with current economic conditions.

Keeping abreast of any announcements regarding changes in CPF interest rates is essential as it directly impacts how members strategize their savings. By following these developments, CPF members can adapt their financial planning to ensure they are maximizing potential benefits and growth from their retirement funds.

Frequently Asked Questions

What are the CPF interest rates for Special, MediSave, and Retirement Accounts from April to June 2025?

From April 1 to June 30, 2025, the CPF interest rates for Special, MediSave, and Retirement Accounts (SMRA) will remain at a steady 4% per annum, according to the latest update from the Central Provident Fund Board in Singapore.

How do CPF interest rates affect my retirement funds in Singapore?

CPF interest rates directly impact your retirement funds in Singapore. With the Special, MediSave, and Retirement Accounts earning 4% per annum, your savings can grow significantly, enhancing your retirement security and providing you with more financial flexibility during retirement.

Are there additional interest rates applicable to CPF savings for members under 55 years old?

Yes, members under 55 years old will enjoy an additional 1% interest on the first S$60,000 of their combined CPF balances, which helps boost their CPF savings and ultimately supports their future retirement funds in Singapore.

What interest rate can I expect on my Ordinary Account (OA) during the same period?

During the period from April 1 to June 30, 2025, the Ordinary Account (OA) will maintain a floor interest rate of 2.5% per annum. This is essential for CPF members who utilize their OA for various savings and retirement planning activities.

What benefits do members aged 55 and above receive regarding CPF interest rates?

Members aged 55 and above benefit from enhanced interest rates on their CPF savings. They earn an extra 2% interest on the first S$30,000 of combined balances (with a cap of S$20,000 for OA) and an additional 1% on the next S$30,000, which significantly boosts their retirement funds in Singapore.

Why haven’t the CPF interest rates changed for Special and MediSave accounts?

The CPF interest rates for Special and MediSave Accounts remain unchanged due to the 12-month average yield of the 10-year Singapore Government Securities (10YSGS) falling below the established floor rate of 4%. This decision helps maintain a stable growth environment for CPF members’ retirement savings.

How can I take advantage of higher CPF interest rates to enhance my savings?

To maximize your CPF interest rates, consider contributing up to the limit to your Special or MediSave accounts, especially if you are eligible for the additional interest that boosts your retirement savings. Utilizing these accounts effectively can significantly improve your overall retirement funds in Singapore.

What is the current floor rate for the HDB concessionary loan regarding CPF interest rates?

The concessionary interest rate for HDB loans remains unchanged at 2.6% per annum during the period from April 1 to June 30, 2025. This rate is pegged at 0.1% above the Ordinary Account interest rate.

| Account Type | Interest Rate (% per annum) | Additional Interest (Under 55) | Additional Interest (55 and above) |

|---|---|---|---|

| Special, Medisave & Retirement Accounts (SMRA) | 4.0 | 1% on first S$60,000 (cap S$20,000 for OA) | 2% on first S$30,000 (cap S$20,000 for OA), 1% on next S$30,000 |

| Ordinary Account (OA) | 2.5 | ||

| HDB Concessionary Rate | 2.6 |

Summary

CPF interest rates have been a crucial topic for members looking to maximize their retirement savings. As of the latest update from April 1 to June 30, 2025, CPF interest rates specifically for Special, Medisave, and Retirement accounts remain steady at 4%, ensuring members benefit from a significant yield. Overall, with additional interest options for younger and older members, CPF continues to support Singaporeans in enhancing their financial well-being for retirement.