In a significant policy shift, Singapore will see an increase in CPF contribution rates for workers aged 55 to 65 by 1.5 percentage points in 2026, as announced by Prime Minister Lawrence Wong on 18 February. This adjustment aims to enhance retirement savings for senior workers, ensuring they can build a more secure financial future while remaining actively engaged in the workforce. The increase in contribution rates reflects the government’s commitment to providing support for older workers, thereby addressing the unique challenges they face in employment. Additionally, the extension of the Senior Employment Credit will offer essential wage support to businesses that hire these experienced individuals. This dual approach not only bolsters the financial security of workers but also reinforces government support for businesses navigating the complexities of the workforce landscape in Singapore.

In a recent announcement, the Singaporean government revealed its plans to raise contributions to the Central Provident Fund (CPF) for senior employees, specifically targeting those aged between 55 and 65. This initiative is part of a broader strategy to bolster retirement savings for older individuals, ensuring they have the financial resources necessary as they transition into retirement. Alongside this, the Senior Employment Credit will continue to provide incentives for organizations hiring older talent, reinforcing the importance of senior employment in the current market. By enhancing support for businesses and simultaneously addressing the needs of older workers, these measures create a robust framework for sustainable employment practices. Overall, this approach signifies a commitment to fostering an inclusive workforce that values the experience and contributions of senior members of the community.

Understanding the Increase in CPF Contribution Rates for Older Workers

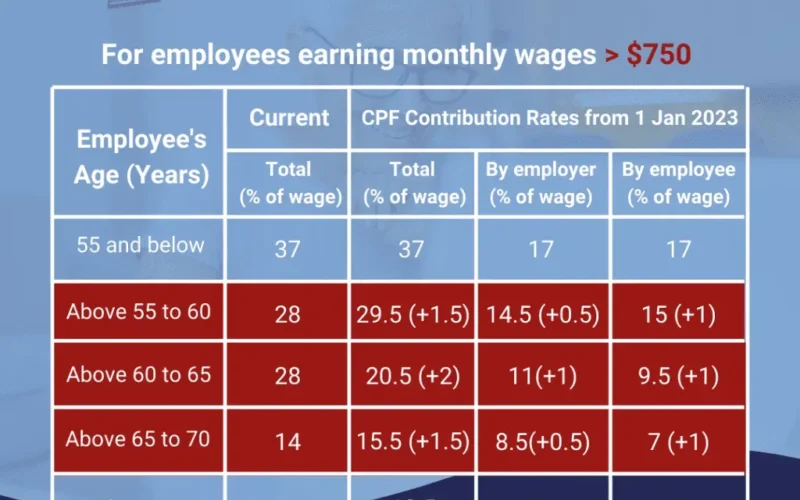

In February 2023, Singapore’s Prime Minister Lawrence Wong announced a pivotal increase in the Central Provident Fund (CPF) contribution rates specifically for workers aged 55 to 65. This increase, set to take effect on January 1, 2026, will raise the contribution rate for those aged 55 to 60 to 34%. This decision is part of a broader strategy to enhance retirement savings for senior workers, allowing them to build a more secure financial future as they continue to engage actively in the workforce. The increase in CPF contribution rates is a critical step towards ensuring that older employees can accumulate sufficient savings to support their retirement.

Moreover, this increase reflects Singapore’s commitment to supporting its aging workforce amidst evolving economic landscapes. With an increasing number of older workers choosing to remain employed, the CPF rate adjustment aims to recognize their contributions while also addressing the financial challenges they may face. The government is keenly aware that enhancing CPF contributions for this demographic not only benefits individual workers but also strengthens the overall economy by fostering a more financially secure older population.

Senior Employment Credit: Continued Support for Employers

In tandem with the increase in CPF contribution rates, the Singapore government has announced the extension of the Senior Employment Credit (SEC) until the end of 2026. This initiative provides essential wage offsets for employers who hire older Singaporean workers aged 60 and above, particularly those earning less than S$4,000 monthly. By extending the SEC, the government aims to incentivize businesses to recruit and retain older workers, thereby enhancing employment opportunities for this demographic. This ongoing support underscores the government’s commitment to fostering a diverse workforce that includes senior employees.

Furthermore, the SEC’s modifications, which will come into effect alongside the CPF contribution increases, signify a proactive approach to accommodating the aging population in the labor market. With enhanced reimbursement rates for employers hiring older workers, the government is not only supporting businesses but also promoting job stability for senior employees. This initiative is crucial for older workers who may face challenges in securing employment, ensuring they have access to suitable job opportunities while contributing meaningfully to the economy.

The Importance of Retirement Savings for Senior Workers

As the population ages, the importance of retirement savings becomes increasingly evident, particularly for senior workers. The increase in CPF contribution rates is designed to bolster the retirement savings of older employees, allowing them to secure a more comfortable financial future. Retirement savings play a vital role in ensuring that individuals can maintain their quality of life once they leave the workforce. By enhancing CPF contributions, the Singapore government is making strides towards alleviating the financial burdens that many older workers face.

Additionally, the increase in retirement savings can lead to a more stable economy. When older workers feel financially secure, they are more likely to spend on goods and services, contributing to economic growth. This strategy not only helps individuals but also benefits businesses by creating a more robust consumer base. Thus, the government’s initiatives to increase CPF contributions and support older workers reflect a comprehensive understanding of the interconnectedness of individual financial health and broader economic stability.

Government Support for Businesses Hiring Older Workers

The Singapore government’s initiatives, including the Senior Employment Credit and upcoming CPF contribution rate increases, are designed to provide substantial support for businesses that hire older workers. By offering wage offsets and automatic adjustments to CPF contributions, the government alleviates some of the financial pressures that employers may face when hiring senior employees. This support is crucial for fostering an inclusive workforce that values the experience and skills older workers bring to the table.

Moreover, this proactive approach demonstrates the government’s recognition of the unique challenges that businesses encounter in the current economic climate. By implementing measures that support both older workers and their employers, Singapore is paving the way for a more resilient economy. Companies can navigate the costs associated with hiring older workers while benefiting from their extensive experience and knowledge, ultimately leading to a more collaborative and productive work environment.

Challenges Faced by Older Workers in the Job Market

Despite the supportive measures introduced by the Singapore government, older workers still face significant challenges in the job market. Age discrimination and misconceptions regarding their adaptability can hinder employment opportunities for senior employees. Many employers may overlook older candidates in favor of younger talent, despite the wealth of experience and skills that older workers possess. Understanding these challenges is essential for creating a more equitable job market.

To address these issues, initiatives such as the establishment of a Tripartite Workgroup on Senior Employment will play a crucial role in identifying and tackling barriers faced by older workers. This workgroup will focus on exploring the current landscape of senior employment and developing strategies to enhance job opportunities for older Singaporeans. By addressing these challenges head-on, the government aims to create a more inclusive labor market where older workers can thrive and contribute to the economy.

Future Policies for Enhancing Employability of Older Workers

The Singapore government is actively exploring future policies aimed at enhancing the employability of older workers. As part of its commitment to creating a supportive environment for senior employees, the Ministry of Manpower (MOM) will establish a Tripartite Workgroup on Senior Employment. This group will focus on evaluating the current employment landscape for older workers and developing actionable strategies to expand their job prospects. By focusing on tailored training programs and skills development, the government is working to ensure that older Singaporeans remain competitive in the workforce.

Additionally, the government’s initiatives will not only benefit older workers but also contribute to the overall economic growth of Singapore. By equipping senior employees with the necessary skills and training, businesses can tap into a valuable resource that brings experience and insight to the workplace. This forward-thinking approach is essential in addressing the needs of an aging population while simultaneously fostering an inclusive economy that values contributions from all age groups.

The Role of Employers in Supporting Older Workers

Employers play a vital role in supporting the integration of older workers into the workforce. By embracing diversity and recognizing the value that senior employees bring, businesses can create a more inclusive work environment. Implementing flexible work arrangements, providing training opportunities, and fostering an age-friendly culture are all pivotal steps that companies can take to support older workers. These strategies not only benefit employees but also enhance overall workplace morale and productivity.

Furthermore, employers who actively engage in supporting older workers can position themselves as leaders in corporate social responsibility. By participating in government initiatives such as the Senior Employment Credit, companies demonstrate their commitment to social equity and community well-being. This not only improves their reputation but can also attract a more diverse talent pool, ultimately leading to a more dynamic and successful organization.

The Impact of CPF Adjustments on Senior Employment

The CPF contribution rate adjustments represent a significant shift in how Singapore supports its senior workers. As the contribution rates increase, older workers can expect to see a more substantial accumulation of retirement savings, which will be critical in providing them with financial security in their later years. This change is anticipated to positively influence the employment landscape by encouraging more seniors to remain in the workforce longer, knowing that their retirement savings will be bolstered.

Moreover, these adjustments are likely to have a ripple effect on businesses as well. With increased CPF contributions, employers may feel more inclined to hire older workers, knowing that the government is facilitating a smoother transition for both parties. This dynamic can lead to a more balanced workforce where experience and youth coexist, ultimately benefiting the economy as a whole.

Navigating the Future of Senior Employment in Singapore

As Singapore continues to evolve, the future of senior employment will depend on the collective efforts of the government, businesses, and the community. The upcoming policies aimed at increasing CPF contribution rates and extending the Senior Employment Credit signify a commitment to creating a supportive environment for older workers. However, the success of these initiatives will largely depend on how well they are implemented and embraced by employers and employees alike.

Looking ahead, it is crucial for all stakeholders to engage in open dialogues about the challenges and opportunities that lie ahead for older workers. By fostering a culture of understanding and inclusivity, Singapore can ensure that older employees are not only valued but also empowered to contribute meaningfully to the workforce. This collaborative approach will create a sustainable model for senior employment that can adapt to the changing dynamics of the economy.

Frequently Asked Questions

What are the new CPF contribution rates for older workers in Singapore?

In 2026, the CPF contribution rates for workers aged 55 to 65 in Singapore will increase by 1.5 percentage points. Specifically, workers aged 55 to 60 will see their contribution rate rise to 34 percent, enhancing their retirement savings.

How does the CPF contribution rates increase benefit senior workers?

The CPF contribution rates increase will benefit senior workers by allowing them to build more substantial retirement savings while remaining active in the workforce. This initiative aims to bolster financial security for older employees in Singapore.

What is the Senior Employment Credit and how does it relate to CPF contribution rates increase?

The Senior Employment Credit (SEC) provides wage offsets to employers who hire older workers, particularly those aged 60 and above. With the increase in CPF contribution rates, the SEC will also be extended until 2026 to support businesses in managing associated costs.

Will employers need to apply for the CPF contribution rates increase for older workers?

No, employers in Singapore will not need to apply for the CPF contribution rates increase. The adjustment will be implemented automatically, ensuring that senior workers benefit from the initiative without bureaucratic delays.

What support can businesses expect from the government regarding the increase in CPF contribution rates?

The Singapore government will continue to provide support to businesses through initiatives like the Senior Employment Credit, which offers wage offsets. This is aimed at alleviating the financial impact of the CPF contribution rates increase on employers hiring older workers.

How does the CPF contribution rates increase fit into the government’s strategy for older workers?

The CPF contribution rates increase is part of the Singapore government’s broader strategy to enhance retirement savings for older workers and improve employability. This includes the establishment of a Tripartite Workgroup on Senior Employment to further refine policies for older workers.

When will the increase in CPF contribution rates for older workers take effect?

The increase in CPF contribution rates for workers aged 55 to 65 will take effect on 1 January 2026, as part of the government’s initiative to support senior employment and enhance retirement savings.

What other measures are being taken to support older workers in Singapore?

In addition to the CPF contribution rates increase, the Singapore government is extending the Senior Employment Credit and assessing policies to further improve employability for older workers, including plans for a Tripartite Workgroup on Senior Employment.

How will the CPF contribution rates increase affect retirement planning for older workers?

The increase in CPF contribution rates will significantly impact retirement planning for older workers by allowing them to accumulate higher savings in their CPF accounts, thus contributing to better financial security during retirement.

What changes are being made to the Senior Employment Credit in light of the CPF contribution rates increase?

The Senior Employment Credit will see modifications to its eligibility criteria, allowing for increased wage reimbursements for employers hiring older workers, thereby providing additional support in conjunction with the CPF contribution rates increase.

| Key Point | Details |

|---|---|

| Increase in CPF Contribution Rates | By 1.5 percentage points for workers aged 55 to 65 effective January 1, 2026. |

| New Contribution Rate | The new CPF contribution rate for those aged 55 to 60 will be 34 percent. |

| Extension of Senior Employment Credit | The SEC will be extended until the end of 2026, providing wage support for employers hiring older workers. |

| Support for Employers | Employers will automatically benefit from the CPF adjustment without needing to apply. |

| Wage Support for Older Workers | From 2026, 7% wage reimbursement for hiring workers aged 69+, 4% for ages 65-68, and 2% for ages 60-64. |

| Tripartite Workgroup on Senior Employment | To be established to enhance employability and job opportunities for older workers. |

Summary

The CPF contribution rates increase is a significant initiative aimed at enhancing the retirement savings of older workers in Singapore. With the planned increase of 1.5 percentage points in 2026, workers aged 55 to 65 will benefit from improved financial security as they continue to contribute to the workforce. This move not only supports senior employees but also aids employers by providing wage offsets through the extended Senior Employment Credit. Overall, these measures reflect a commitment to fostering a sustainable employment environment that values the contributions of older workers.