In 2025, the CPF contribution rates will undergo noteworthy revisions that will impact both employees and employers in Singapore. These changes are designed to bolster retirement savings, particularly for older workers, aligning with Singapore CPF changes aimed at enhancing financial security. As the employee contribution rates adjust, employers will also need to reassess their obligations to meet the new CPF requirements. Additionally, the CPF salary ceiling adjustments will ensure that higher-income earners contribute a larger portion of their wages, further strengthening the retirement framework. Understanding these implications is crucial for effective financial planning, making it essential for all stakeholders to stay informed and prepared.

As we look ahead to 2025, the upcoming revisions to the Central Provident Fund (CPF) contributions present a critical evolution in Singapore’s retirement savings landscape. These modifications, which pertain to both worker contributions and employer responsibilities, are set to influence the financial planning strategies of individuals and businesses alike. With adjustments to the salary ceiling for CPF contributions, particularly affecting higher earners, it’s vital to comprehend how these alterations will shape the retirement security of Singapore’s workforce. Employers must brace for increased labor costs, while employees should take proactive steps to manage their financial health amidst these changes. Ultimately, adapting to these new CPF contribution rates will be essential for fostering a secure retirement future.

Understanding the Importance of CPF Contribution Rates in 2025

The Central Provident Fund (CPF) serves as a vital foundation for Singapore’s social security system, underpinning the financial wellbeing of its citizens in their retirement years. The CPF contribution rates for 2025 will see notable changes, particularly aimed at enhancing the retirement savings of older workers, aged 55 to 70. By increasing the rates for this demographic, the government is addressing the growing need for financial security as the population ages. This proactive approach not only encourages savings but also aligns with Singapore’s vision of creating a sustainable retirement income framework for its citizens.

As Singapore continues to adapt to changing demographics and economic conditions, the adjustments in CPF contribution rates reflect a broader commitment to the welfare of its workforce. Higher contribution rates mean that employees can expect a more robust CPF balance upon retirement, which is crucial for maintaining their quality of life. This shift will be particularly beneficial for older workers who may not have had the opportunity to save adequately in their earlier years, thus reinforcing the importance of CPF contributions in securing a financially stable retirement.

Impacts of CPF Contribution Rate Changes on Employees

The revised CPF contribution rates for 2025 will have a significant impact on employees, particularly those nearing retirement. Increased contributions translate to enhanced retirement savings, allowing employees to build a more substantial nest egg as they approach their golden years. However, it is essential for employees to understand that these adjustments may result in a decrease in their take-home pay, as a larger portion of their salary will be directed towards their CPF accounts. This potential reduction might necessitate a reevaluation of personal budgets and spending habits.

Moreover, the adjustments in contribution rates serve as a reminder for employees to actively engage with their financial planning. With the CPF salary ceiling also being adjusted, higher-income earners will contribute more, reinforcing the need to strategize for long-term financial health. Employees should consider consulting financial advisors to navigate these changes effectively, ensuring that their retirement plans align with the new CPF framework while also accommodating their current lifestyle needs.

Employer Obligations Regarding CPF Contributions in 2025

Employers in Singapore face new obligations with the changes to CPF contribution rates set to take effect in 2025. With rising labor costs, especially for hiring older employees, businesses will need to reassess their financial strategies to manage these increased contributions. This adjustment may prove particularly challenging for small and medium enterprises (SMEs) that operate on tighter budgets. Employers must ensure compliance with the revised CPF regulations to avoid potential penalties, which includes updating payroll systems and HR policies accordingly.

In light of these changes, it is crucial for employers to remain informed about the evolving CPF landscape. Exploring government assistance programs can also provide financial relief and support during this transition. By proactively adapting to the new obligations, employers can mitigate the impact of increased contributions on their operations while ensuring they continue to attract and retain talent within the workforce.

Navigating the Increased CPF Monthly Salary Ceiling

The adjustment of the CPF monthly salary ceiling in 2025 represents a significant shift for high-income earners in Singapore. With an increased ceiling, a larger portion of their monthly salary will now be subject to CPF contributions, thereby enhancing their retirement savings. This change is designed to ensure that all workers, regardless of income level, are adequately prepared for retirement. However, this also means that employees earning above the new ceiling should prepare for higher deductions from their salaries, which may affect their short-term financial planning.

As a result, employees need to reassess their financial strategies in light of these changes. It is essential to account for the increased contributions when budgeting for expenses and savings. Understanding the long-term benefits of enhanced CPF contributions can help employees view this adjustment positively, recognizing the importance of building a secure financial future through effective retirement planning.

Preparing for CPF Rate Adjustments: A Call to Action for Stakeholders

The upcoming CPF contribution rate changes in 2025 require proactive measures from both employees and employers. Employees should take the time to evaluate how the revised rates will impact their net income and adjust their financial plans accordingly. This might include increasing personal savings or reassessing expenditure to accommodate the higher CPF deductions. Being informed and prepared will be key to navigating this transition smoothly.

On the other hand, employers must conduct thorough reviews of their payroll structures and HR policies to ensure compliance with the new CPF requirements. Training for the HR team and updates to payroll systems are critical steps to take in preparation for the changes. By staying ahead of these developments and implementing necessary adjustments, both employees and employers can ensure a smoother transition and better financial outcomes in the long run.

The Long-Term Benefits of CPF Contribution Rate Increases

While the changes to CPF contribution rates in 2025 may pose some immediate financial challenges, the long-term benefits far outweigh these concerns. With increased contributions, employees can look forward to a more secure retirement, which is essential as Singapore’s population ages. The revised rates are designed to bolster retirement savings, particularly for older workers, ensuring they have the financial resources necessary to thrive in their later years.

Additionally, these adjustments represent a significant step towards enhancing the overall sustainability of the CPF system. A robust CPF framework not only benefits individual employees but also contributes to the country’s economic stability by reducing the reliance on state welfare in retirement. As such, while the path may require some short-term sacrifices, the ultimate goal is to create a more secure financial future for all Singaporeans.

Understanding Retirement Savings and CPF Contributions

The relationship between retirement savings and CPF contributions is critical for ensuring financial security in later life. CPF contributions are designed not only to provide for retirement but also to support healthcare and housing needs. By enhancing CPF rates in 2025, the government aims to maximize the retirement savings of its citizens, particularly for those nearing retirement age. This strategy underscores the importance of planning for the future and recognizing CPF as a primary vehicle for financial stability.

Moreover, as employees contribute to their CPF accounts, they are effectively investing in their future well-being. Understanding how CPF contributions work and the benefits they provide is paramount for employees. By engaging with this knowledge, employees can make informed decisions about their financial futures, ensuring they are well-prepared to enjoy their retirement years without financial stress.

The Role of CPF in Singapore’s Social Security Landscape

The Central Provident Fund plays an indispensable role in Singapore’s social security framework, providing citizens with a comprehensive safety net. As a mandatory savings scheme, CPF ensures that workers contribute to their retirement, healthcare, and housing needs throughout their working lives. The adjustments to CPF contribution rates in 2025 are a testament to the government’s commitment to enhancing this system for the benefit of all Singaporeans, particularly older workers who need greater support.

Additionally, the CPF system is a crucial element in fostering a culture of savings among Singaporeans. By mandating contributions and providing incentives for higher savings rates, CPF encourages individuals to take ownership of their financial futures. As the landscape continues to evolve, understanding the CPF’s role in social security will be essential for all stakeholders to navigate these changes effectively.

Future Outlook for CPF Contributions and Retirement Planning in Singapore

Looking ahead, the adjustments to CPF contribution rates will likely influence how Singaporeans approach retirement planning. As contributions increase, individuals may need to adopt a more proactive stance on their financial planning, ensuring that their CPF savings align with their retirement goals. This shift will necessitate greater awareness of the importance of CPF contributions as not just a legal obligation but a crucial aspect of long-term financial health.

Furthermore, as the government continues to modify CPF policies to meet the needs of an aging population, it will be essential for employees and employers alike to stay informed about these changes. By proactively planning and adapting to new CPF frameworks, individuals can ensure they are well-equipped to face the future with confidence, ultimately leading to a more secure retirement experience.

Frequently Asked Questions

What are the CPF contribution rates for 2025 in Singapore?

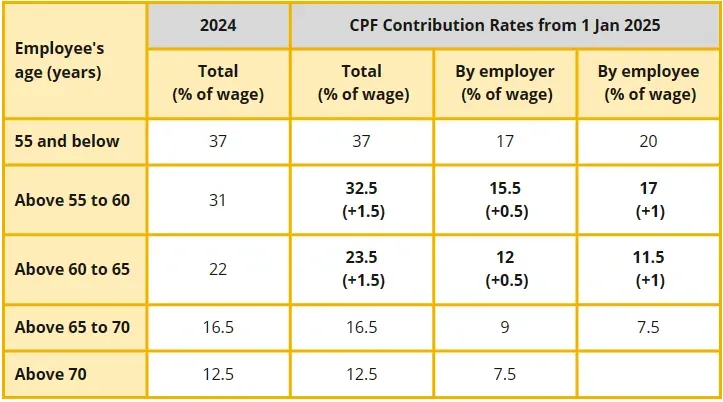

In 2025, the CPF contribution rates in Singapore will see an increase, particularly for employees aged 55 to 70. Employees in this age group will benefit from higher contributions aimed at enhancing their retirement savings. Meanwhile, the contribution rates for employees aged 55 and below will remain unchanged. It’s essential for both employees and employers to familiarize themselves with these new rates to ensure compliance and effective financial planning.

How do the Singapore CPF changes in 2025 affect retirement savings?

The Singapore CPF changes in 2025 are designed to bolster retirement savings, particularly for older workers. With increased contribution rates for employees aged 55 to 70, individuals can anticipate a more substantial CPF balance, providing better financial support during retirement. These changes emphasize the importance of preparing for the future and adjusting financial plans accordingly.

What are the employer obligations regarding CPF contributions in 2025?

In 2025, employers in Singapore will have increased obligations concerning CPF contributions, especially for older employees. As contribution rates rise, businesses must allocate more budget towards these expenses. Employers should also ensure their payroll systems are updated to comply with the new CPF contribution rates and salary ceiling adjustments, thereby avoiding any legal repercussions.

Are there any adjustments to the CPF salary ceiling in 2025?

Yes, the CPF salary ceiling will be adjusted in 2025, which means that higher-income earners will see a larger portion of their salary subject to CPF contributions. This change is intended to enhance retirement savings for employees, but it may lead to higher deductions from their monthly income for those earning above the new ceiling. Understanding this adjustment is crucial for effective personal financial planning.

How can employees prepare for the CPF contribution rate changes in 2025?

Employees can prepare for the CPF contribution rate changes in 2025 by evaluating how the revised rates will affect their net income. It’s advisable to reassess financial plans and consider potential adjustments to spending and savings strategies. Staying informed about the new contribution rates and the implications of the CPF salary ceiling changes will help employees adapt more smoothly.

What financial impacts should employers expect due to CPF contribution rate changes in 2025?

Employers should expect increased labor costs due to CPF contribution rate changes in 2025. Particularly for older employees, businesses may need to adjust budgets to accommodate these higher contributions. It is also important for employers to review HR policies and payroll systems to ensure compliance with the revised CPF laws, as well as to explore any available government relief measures.

What are the long-term benefits of the CPF contribution rate adjustments in 2025?

The long-term benefits of the CPF contribution rate adjustments in 2025 include enhanced retirement security for employees, especially older workers. With increased contributions, individuals can build a more substantial CPF balance, which will provide better financial support during retirement. While there may be short-term financial adjustments needed, the overall goal is to improve long-term financial stability for Singaporeans.

| Key Point | Details |

|---|---|

| CPF Overview | The CPF provides financial support for retirement, healthcare, and housing in Singapore. |

| Contribution Rate Changes | Revisions will take effect in 2025, particularly for employees aged 55-70, to enhance retirement savings. |

| Implications for Employees | Employees will save more for retirement, but may see a reduction in take-home pay. |

| Implications for Employers | Higher labor costs due to increased contributions, especially for older employees. SMEs may need budget adjustments. |

| Monthly Salary Ceiling Adjustment | The salary ceiling will increase, affecting contributions from high-income earners. |

| Preparation for Changes | Both employees and employers need to adjust their financial and payroll plans to align with new CPF rules. |

Summary

The CPF contribution rates 2025 introduce significant changes that aim to enhance retirement savings, especially for older workers. With an increase in contribution rates and adjustments to the salary ceiling, both employees and employers must navigate the implications of these changes carefully. Employees will benefit from increased savings, while employers face higher labor costs, necessitating budget reassessments. Overall, these adjustments represent a crucial step towards ensuring a secure financial future for Singapore’s workforce.