The Central Provident Fund Special Accounts play a crucial role in ensuring that members can secure their financial future, particularly as they approach retirement age. Recently, the CPF has announced the closure of Special Accounts for members aged 55 and above, prompting a transition of savings to their Retirement Accounts. This strategic move is designed to protect retirement savings by consolidating funds into a CPF retirement account where members can enjoy enhanced interest rates. With the current CPF interest rates set at 4% for Retirement Accounts, it’s essential for members to stay informed about their options following account closure. Furthermore, members should remain alert to potential scams, as fraudulent activities surrounding CPF accounts can jeopardize their hard-earned savings.

In the realm of retirement planning, the Central Provident Fund’s specialized accounts are essential for individuals preparing for their golden years. The recent updates regarding the closure of these accounts for older members highlight the importance of transitioning funds into a more beneficial CPF retirement account. This strategic adjustment not only helps in maximizing retirement savings but also aims to provide better interest rates for members’ financial security. As the CPF takes measures to safeguard members from scams and fraudulent schemes related to account management, it is crucial for individuals to stay educated about their rights and options. Understanding the implications of CPF account closure and how to effectively manage retirement savings can lead to a more secure financial future.

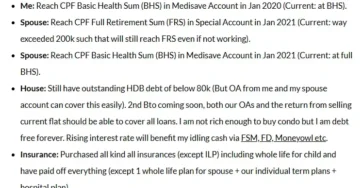

Understanding the Closure of Central Provident Fund Special Accounts

The Central Provident Fund (CPF) has recently implemented a significant change affecting members aged 55 and above: the closure of Special Accounts. This transition is part of a broader initiative to streamline retirement savings management. Upon closure, members’ savings will be transferred to their Retirement Account, ensuring that they can continue to grow their retirement funds effectively. For many, this marks a pivotal moment in their financial planning, making understanding this process crucial.

As the Special Accounts close, members are encouraged to familiarize themselves with the implications of this change. Savings that fall within the cohort’s Full Retirement Sum will be automatically transferred, while any excess will shift to the Ordinary Account. The Ordinary Account typically yields a lower interest rate of 2.5% annually, making it vital for members to consider transferring their remaining funds to the Retirement Account, where they can benefit from a higher interest rate of 4%. This strategic move can significantly enhance their retirement savings.

Maximizing Your CPF Retirement Savings

To maximize retirement savings, it is essential for CPF members to understand the benefits of transferring funds from the Ordinary Account to the Retirement Account. This transfer allows members to take advantage of higher interest rates, ultimately leading to a more substantial retirement fund. With the current interest rates at 4% for the Retirement Account, members can significantly boost their savings, which is crucial as they prepare for retirement.

Moreover, it is important to note that the transfer of funds from the Ordinary Account to the Retirement Account is irreversible. Members must process this transfer before the designated deadline in January to ensure they are optimizing their retirement savings. Planning ahead and making informed decisions can lead to enhanced financial security during retirement.

The Importance of Staying Informed About CPF Account Closure

Members should remain vigilant and informed about the closure of their CPF Special Accounts. Notifications regarding these closures will be sent via physical letters, emails, or SMS. This communication is crucial to ensure that members understand their account status and the subsequent steps they need to take. Staying updated will help members manage their funds effectively and avoid any potential complications.

Additionally, being informed about CPF operations can provide insights into how to safeguard against fraud. With the rise of scams targeting CPF members, understanding the legitimate communication channels and processes can help members distinguish between genuine CPF advisories and fraudulent schemes. This knowledge is critical in protecting personal information and ensuring that retirement savings remain secure.

Recognizing and Avoiding CPF Scam Alerts

With the increasing prevalence of scams, CPF members must be aware of common schemes that target their retirement savings. Scammers may impersonate CPF staff or government officials, providing false advice on CPF-related insurance schemes or investment opportunities. It is vital for members to recognize these tactics and understand that CPF will never ask for sensitive personal information via unsolicited calls or messages.

To help combat these scams, CPF regularly issues alerts and updates to educate members. Staying informed through official CPF channels can empower members to take proactive measures against fraud. By being vigilant and skeptical of unsolicited offers, members can protect their savings and ensure that their retirement plans remain intact.

Evaluating CPF Interest Rates for Better Retirement Planning

Understanding CPF interest rates is crucial for effective retirement planning. The Ordinary Account currently offers an interest rate of 2.5%, while the Retirement Account provides a more favorable rate of 4%. This difference highlights the importance of making strategic transfers to maximize growth potential for retirement savings. Members should regularly review their account statements and consider their options to ensure their savings are working as hard as possible for their future.

Furthermore, it is essential to note that CPF interest rates can fluctuate based on economic conditions. Members should stay updated on any changes to these rates, as they can directly impact overall retirement savings. By keeping an eye on these rates and adjusting their strategies accordingly, members can enhance their financial stability in retirement.

Steps to Take After CPF Special Account Closure

After the closure of the Special Accounts, it is important for members to take proactive steps in managing their retirement savings. First, members should assess their newly allocated funds in the Retirement and Ordinary Accounts. This evaluation will help identify if any action is needed, such as transferring excess funds to benefit from higher interest rates.

Additionally, members should consider reviewing their overall retirement strategy. This may involve consulting with a financial advisor to discuss long-term goals, potential investments, and how to best utilize their CPF savings. Taking these steps can ensure that members are not only compliant with CPF regulations but also maximizing their retirement benefits.

The Role of CPF in Retirement Planning

The Central Provident Fund plays a pivotal role in the retirement planning of Singaporeans. It provides a structured system for individuals to save for their future, ensuring that they have adequate funds upon retirement. The various accounts within CPF, including the Special Account and Retirement Account, cater to different savings needs, allowing members to strategize their funds effectively.

Moreover, CPF also offers various schemes and benefits designed to enhance the retirement experience. From housing grants to healthcare support, CPF members can leverage these resources to secure a comfortable retirement. Understanding these offerings is key to effective retirement planning and can significantly impact members’ financial well-being.

Common Questions About CPF Account Management

Many members have questions regarding the management of their CPF accounts, particularly during the transition period that follows the closure of Special Accounts. Common inquiries include how to transfer funds, the implications of interest rates, and the steps to take if they suspect fraudulent activity. Addressing these questions is vital for members to navigate their CPF experience confidently.

Additionally, CPF provides numerous resources and customer service options to assist members in resolving their concerns. Whether through online portals, helplines, or in-person consultations, members have access to information and support that can facilitate smooth account management. Engaging with these resources can provide clarity and reassurance during this pivotal time.

Future Changes to CPF Policies and Their Impact

As with any financial system, CPF policies are subject to change. Members should remain aware of potential adjustments to account management, interest rates, and eligibility criteria. These changes can significantly impact retirement planning strategies, making it crucial for members to stay informed and adjust their plans accordingly.

Moreover, CPF regularly reviews its policies to ensure they align with the evolving needs of members and the economic landscape. Keeping abreast of these developments allows members to make informed decisions about their retirement savings and take advantage of new opportunities as they arise. By remaining proactive, members can safeguard their financial future.

Frequently Asked Questions

What happens to my Central Provident Fund special account when I turn 55?

When you turn 55, your Central Provident Fund special account will be closed. Your savings will be automatically transferred to your Retirement Account up to your cohort’s Full Retirement Sum, ensuring your retirement savings are secured.

How can I transfer my savings from my CPF special account to my Retirement Account?

You can transfer savings from your CPF special account to your Retirement Account up to the enhanced Retirement Sum for the year. This transfer allows you to earn a higher interest rate of 4% annually on your Retirement Account, compared to the 2.5% interest on your Ordinary Account.

What interest rates apply to my CPF accounts after the closure of the special account?

After the closure of your Central Provident Fund special account, any remaining savings will move to your Ordinary Account, which earns an interest rate of 2.5% annually. If you transfer these savings to your Retirement Account, you can benefit from a higher interest rate of 4% annually.

How will I be notified about the closure of my CPF special account?

You will receive notifications about the closure of your Central Provident Fund special account through physical letters, emails, or SMS starting January 20. It’s important to ensure your contact details are up to date.

What precautions should I take regarding scam alerts related to my CPF accounts?

Be vigilant against scam alerts related to your Central Provident Fund accounts. Scammers may impersonate CPF staff or government officials, requesting personal information or promoting fraudulent investment schemes. Always verify the identity of anyone who contacts you regarding your CPF accounts.

Can I still access the funds in my closed CPF special account?

Once your Central Provident Fund special account is closed, the funds will be transferred to either your Retirement Account or Ordinary Account. You will not have access to the special account itself, but you can manage the funds in your new accounts.

What is the process for transferring my CPF savings to earn higher interest?

To transfer your CPF savings from your Ordinary Account to your Retirement Account, complete the transfer process by January of the current year. This transfer is irreversible, so consider your options carefully to maximize your retirement savings.

| Key Point | Details |

|---|---|

| Closure of Special Accounts | Special Accounts of CPF members aged 55 and above have been closed. |

| Transfer of Savings | Savings up to the Full Retirement Sum will be transferred to the Retirement Account. |

| Remaining Savings Allocation | Any remaining savings in the Special Account will be moved to the Ordinary Account. |

| Interest Rates | The Ordinary Account earns 2.5% interest annually. |

| Transfer Options | Members can transfer savings from the Ordinary to the Retirement Account for a higher interest rate of 4%. |

| Transfer Deadline | The transfer must be processed by January of this year and is irreversible. |

| Notification of Closure | Members will be notified via letters, emails, or SMS starting 20 January. |

| Scam Warnings | Members are advised to be cautious of scammers impersonating CPF staff or officials. |

Summary

Central Provident Fund special accounts have undergone significant changes with the closure of accounts for members aged 55 and above. This transition involves the transfer of savings to the Retirement Account to secure members’ financial future while ensuring a higher interest rate option is available through the Ordinary Account. It is crucial for members to stay informed about these changes and remain vigilant against potential scams during this period of adjustment.