Celsius Holdings stock analysis reveals a dynamic landscape for investors interested in the functional beverage sector. As the company continues to innovate in the energy drink market, understanding Celsius Holdings financials is crucial for evaluating its potential. With a current price of $25.77 and a market capitalization of $6.06 billion, the CELH stock performance has shown resilience despite recent challenges. Analysts are closely watching the Celsius Holdings outlook, especially with upcoming earnings reports that may indicate future growth. Additionally, keeping an eye on energy drink market trends could provide insights into how consumer preferences are shaping the demand for Celsius’s offerings.

An examination of Celsius Holdings stock dynamics highlights the intricacies of investment opportunities within the beverage industry. The company, renowned for its functional drinks and dietary supplements, is at a pivotal moment as it navigates through market fluctuations and legal hurdles. Investors are particularly interested in the performance metrics of CELH, weighed against broader energy drink market trends that could influence its trajectory. With a strong focus on health-conscious products, Celsius Holdings is poised to benefit from evolving consumer behaviors. Understanding these factors will be essential for anyone looking to make informed decisions regarding their investment in this compelling market.

Celsius Holdings Stock Analysis: A Comprehensive Review

Celsius Holdings, Inc. (CELH) has recently been under the spotlight due to fluctuations in its stock performance. As of the latest update, the stock price stands at $25.77, reflecting a commendable increase of 2.92% recently. However, the past three months have seen a significant 21% drop in value, raising concerns among investors. The price-to-earnings ratio of 34.74 suggests that the stock is trading at a premium relative to its earnings, which can be interpreted as a bullish sign by some, while others may view it as overvalued. Investors should consider both the current stock prices and recent performance trends as part of their due diligence before making investment decisions on CELH stock.

In terms of market capitalization, Celsius Holdings is valued at approximately $6.06 billion, indicating strong investor interest and confidence in the company’s business model. Financially, the company reported a net income of $226.80 million, which is significant considering the competitive nature of the energy drink market. The upcoming earnings report on February 26, 2025, is expected to provide insights into the company’s financial health, with analysts estimating an EPS of $0.11. Investors should keep a close watch on these indicators as they can significantly influence CELH stock performance.

Celsius Holdings Financials: Understanding the Numbers

Celsius Holdings continues to demonstrate robust financial performance, with a reported revenue of $1.32 billion. The latest figures for Q3 2023 show revenue hitting $110 million, aligning with expectations, while Q4 projections estimate revenue at $265.75 million. This consistency in revenue generation highlights the company’s effective marketing strategies and the growing consumer demand for health-oriented beverages. As demand for functional drinks rises, Celsius is well-positioned to capitalize on this trend, making its financials a key area of interest for potential investors.

However, the financial landscape for Celsius Holdings is not without its challenges. The company has faced recent scrutiny due to a rating downgrade to ‘hold’ and ongoing legal issues that may affect investor confidence. With net income for Q4 projected to be lower than Q3, it’s crucial for stakeholders to evaluate how these factors might impact future earnings and market positioning. Understanding these financial nuances will be essential for making informed decisions about Celsius Holdings’ stock.

Celsius Holdings Outlook: What Lies Ahead?

The outlook for Celsius Holdings remains a topic of discussion among analysts and investors alike. Despite the recent challenges, including a drop in stock price and legal complications, many industry experts maintain an optimistic view of the company’s growth potential in the energy drink market. The increasing consumer shift towards healthier beverage options suggests that Celsius’s functional energy drinks and dietary supplements could see continued demand. This trend reinforces the notion that the company is strategically aligned with market preferences, potentially leading to long-term growth.

Looking ahead, it’s essential for investors to monitor how Celsius Holdings adapts to market changes and consumer behavior. The company’s commitment to innovation in functional beverages positions it favorably within a rapidly evolving industry. Additionally, upcoming earnings reports will provide critical insights into how well Celsius navigates these challenges and capitalizes on growth opportunities. Staying informed about market dynamics will be crucial for understanding the future trajectory of Celsius Holdings.

Energy Drink Market Trends Impacting Celsius Holdings

The energy drink market has seen significant growth in recent years, driven by a rising consumer focus on health and wellness. As consumers increasingly seek functional beverages that offer both energy and nutritional benefits, Celsius Holdings is uniquely positioned to leverage this trend. The company’s portfolio, which includes post-workout functional energy drinks, resonates well with health-conscious consumers, making it a compelling player in this dynamic market. Understanding these market trends is vital for investors looking to gauge Celsius’s potential for sustained growth.

Furthermore, as the energy drink sector continues to expand, competition is also intensifying. New entrants and established brands are continually innovating to capture market share. Celsius Holdings must remain agile and responsive to these market changes to maintain its competitive edge. By focusing on product quality and consumer preferences, the company can continue to thrive amidst the evolving landscape of the energy drink market.

Technical Analysis of CELH: Charting the Future

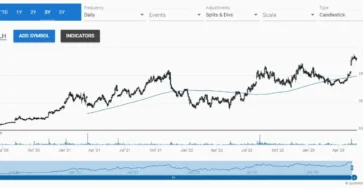

Technical analysis of CELH reveals a bullish trend, as the stock is currently trading within a clearly defined upward channel. This trend indicates a potential for further price appreciation, particularly as it consolidates around key resistance levels between $29.40 and $29.67. Investors often look to such patterns as indicators for future price movements, and the current upward momentum suggests that CELH could be poised for a breakout, provided market conditions remain favorable.

Moreover, the volatility indicated by a beta of 2.12 highlights the stock’s sensitivity to market movements, which could present both opportunities and risks for investors. Those looking to enter the market should consider the implications of this volatility, alongside the technical indicators that suggest potential upward movement. A careful analysis of these technical aspects, in conjunction with fundamental performance metrics, will be essential for making informed investment decisions regarding CELH.

Celsius Holdings: Navigating Legal Challenges

Recently, Celsius Holdings has been navigating a complex landscape of legal challenges that could impact its stock performance and market reputation. Multiple lawsuits concerning allegations of stock inflation have raised concerns among investors, prompting a careful reassessment of the company’s legal standing and potential financial implications. Legal issues can divert management’s focus and resources, potentially impacting operational efficiency and overall growth strategies.

Despite these challenges, it’s important to note that the company has shown resilience in its operations. While legal matters are concerning, they are not uncommon in the corporate world, especially within high-growth sectors. Investors should closely monitor how Celsius Holdings addresses these issues and the potential outcomes, as effective management of these legal challenges could contribute positively to the company’s recovery and long-term outlook.

Investing in Celsius Holdings: Key Considerations

When considering an investment in Celsius Holdings, it is important to weigh various factors that could influence stock performance. The company’s strong fundamentals, including impressive revenue growth and a solid market presence in the functional beverage sector, present a compelling case for potential investors. However, the recent challenges, including a decline in stock price and legal issues, must also be factored into the investment decision. Investors should conduct thorough research and consider the broader market context before making commitments.

Additionally, understanding the energy drink market trends is crucial for investors looking at Celsius Holdings. As the demand for health-oriented products continues to rise, the company is well-positioned to attract health-conscious consumers. Nonetheless, investors should remain vigilant about potential risks, including competitive pressures and regulatory scrutiny. Balancing the potential for growth with the inherent risks will be key to making an informed investment decision regarding Celsius Holdings.

Celsius Holdings and Consumer Health Trends

Celsius Holdings is strategically aligned with the growing consumer health trends that emphasize the importance of nutrition and wellness. The rise in demand for functional beverages is indicative of a broader societal shift towards healthier lifestyle choices. By offering energy drinks that are not only refreshing but also nutritionally beneficial, Celsius is tapping into a lucrative market that is expected to expand further in the coming years. This trend bodes well for the company as it continues to innovate and cater to the evolving preferences of health-conscious consumers.

Furthermore, the emphasis on dietary supplements within Celsius’s product range aligns with increasing awareness about personal health and fitness. As more consumers become aware of the benefits of maintaining a healthy lifestyle, the demand for products that support physical activity, such as post-workout drinks and protein bars, is likely to grow. Hence, Celsius Holdings stands to benefit significantly from these consumer health trends, which should be closely monitored by investors considering the company’s long-term potential.

Conclusion: The Future of Celsius Holdings

Celsius Holdings, Inc. has established itself as a formidable player in the functional beverage market, but it faces several challenges that could impact its future trajectory. Legal issues and stock performance fluctuations present risks that investors must consider. However, the company’s strong financials and alignment with health trends offer a foundation for potential growth. As the energy drink market continues to evolve, Celsius’s ability to adapt and innovate will be critical to its success.

Investors should remain vigilant and informed about both the opportunities and risks associated with Celsius Holdings. Monitoring upcoming earnings reports, market sentiment, and legal developments will be essential for anyone looking to invest in CELH. As consumer preferences shift towards health-oriented products, Celsius is well-positioned to capitalize on these trends, making it a company worth watching in the energy drink sector.

Frequently Asked Questions

What are the current financials for Celsius Holdings (CELH) stock analysis?

Celsius Holdings, Inc. (CELH) currently has a stock price of $25.77 USD, with a market capitalization of $6.06 billion. The Price to Earnings (P/E) ratio stands at 34.74, and the company reported a net income of $226.80 million with total revenue of $1.32 billion.

How has CELH stock performed recently in the energy drink market?

Recently, CELH stock has demonstrated a 2.92% increase, reflecting a positive shift in its performance despite a recent 21% drop in stock price over the last three months. Analysts suggest the stock is trading within an upward channel, indicating potential for future growth in the energy drink market.

What is the outlook for Celsius Holdings stock based on recent news?

The outlook for Celsius Holdings (CELH) stock is mixed. Despite growth concerns and a downgrade to ‘hold’ due to legal challenges, analysts remain optimistic about the company’s position in the energy drink market, especially as health-conscious consumer trends continue to rise.

What are the key trends affecting Celsius Holdings financials in the energy drink sector?

Key trends affecting Celsius Holdings financials include a growing consumer preference for functional beverages and health-focused products. As the energy drink market expands, Celsius is well-positioned to capitalize on these trends, although it faces challenges from legal issues and market volatility.

When will Celsius Holdings report its next earnings, and what are the expectations?

Celsius Holdings is scheduled to report its next earnings on February 26, 2025, for the Q4 2024 period. Analysts estimate an EPS of $0.11 USD and revenue of approximately $331.75 million, which will be crucial for assessing the company’s ongoing growth in the energy drink market.

What are the implications of Celsius Holdings’ recent stock performance for investors?

The recent stock performance of Celsius Holdings (CELH) suggests cautious optimism for investors. While there are concerns due to legal issues and a recent stock price drop, the company’s strong market presence and potential for growth in the energy drink sector make it a stock to watch closely.

How does the beta value of CELH influence its stock analysis?

Celsius Holdings has a beta value of 2.12, indicating that its stock is more volatile than the overall market. This high beta suggests that CELH stock may experience larger price swings, which is an important factor for investors considering the risk associated with their investment in the energy drink market.

| Category | Details |

|---|---|

| Company Overview | Celsius Holdings, Inc. (CELH), established in April 2004, is based in Boca Raton, FL, and specializes in functional beverages and liquid dietary supplements. |

| Current Stock Price | $25.77 USD (+2.92%) |

| Market Capitalization | $6.06B |

| Price to Earnings Ratio (TTM) | 34.74 |

| EPS (TTM) | $0.73 USD |

| Net Income | $226.80M |

| Revenue | $1.32B |

| Shares Float | 167.46M |

| Beta (1Y) | 2.12 |

| Employees | 765 |

| Next Earnings Report | February 26, 2025 (Q4 2024) |

| Q3 ’23 Revenue | $110.00M (Est.: $110.00M) |

| Q4 ’23 Revenue Est. | $266.71M |

| Recent News | Growth concerns lead to rating downgrade; facing lawsuits over stock inflation; recent 21% drop in stock price acknowledged by analysts. |

| Technical Analysis | Currently in a bullish trend with trading prices consolidating around $29.40 – $29.67. |

Summary

Celsius Holdings stock analysis reveals a company with a solid position in the functional beverage market, yet facing challenges from legal disputes and market fluctuations. Despite these issues, analysts remain optimistic about its growth potential, particularly in the energy drink segment. Investors should keep a close eye on upcoming earnings reports and market trends as they assess the future performance of CELH.