In a significant leadership transition, Carrier Strike Group 3 witnessed a change of command as Rear Adm.Todd Whalen took over from Rear Adm.

Read more

Tech Insights

In a significant leadership transition, Carrier Strike Group 3 witnessed a change of command as Rear Adm.Todd Whalen took over from Rear Adm.

Read more

Invest in stocks and unlock the potential for wealth growth in today’s dynamic financial landscape.Stock investing often seems daunting for beginners, but understanding the basics can transform your approach to building financial security.

Read more

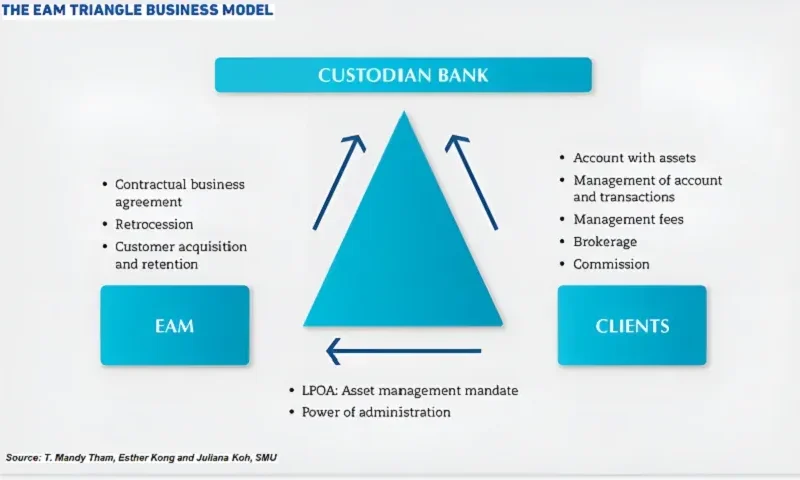

The Singapore EAM sector is rapidly emerging as a pivotal player in the realm of wealth management in Asia, attracting significant attention from external asset managers and family offices alike.With its robust regulatory framework and strategic geographical positioning, Singapore serves as a lucrative hub for independent wealth firms, which are rethinking Singapore investment strategies to cater to the evolving demands of high-net-worth clients.

Read more

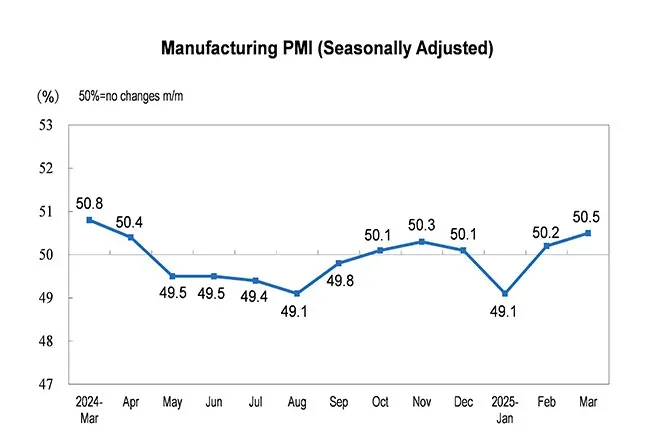

The Purchasing Managers Index (PMI) is a vital economic indicator that provides insight into the health of the manufacturing and service sectors.Published monthly by the Institute for Supply Management (ISM), the PMI tracks supply and demand trends, allowing businesses to gauge economic conditions effectively.

Read more

Singapore’s gig economy has rapidly established itself as a key sector within the nation’s workforce, significantly impacting its overall economic landscape.As platform workers—ranging from ride-hailing drivers to freelance professionals—take on pivotal roles, they often encounter challenges such as inconsistent income and lack of job security.

Read more

When it comes to investing, many individuals are increasingly turning to low-cost index funds as a smart choice for portfolio diversification.The Best Index Funds available today include selections from both index mutual funds and top index ETFs, offering varied exposure to the market while keeping fees in check.

Read more

The Semiconductor Index rebound is on the horizon, hinting at a potentially lucrative turnaround for investors amid recent market challenges.While bearish sentiment has cast a shadow over stock performance, the index has shown promising signs of an upward reversal, mainly through Elliott Wave analysis.

Read more

The Singapore CPF Retirement Sum Changes 2025 will significantly impact how individuals plan for their financial futures.As the Central Provident Fund (CPF) adapts to evolving economic needs, essential updates will include increased Retirement Sum amounts, a gradual rise in the retirement age, and revised CPF LIFE payouts.

Read more

Singapore’s foreign talent policy has become a focal point of discussion among political parties, with consensus on the necessity of attracting international professionals.The need for skilled foreign workers in Singapore is underscored by recent debates surrounding the Ministry of Manpower’s budget, where figures revealed that about 60% of high-paying jobs are filled by foreign talent.

Read moreThe Singapore Workfare Income Supplement (WIS) is an essential initiative designed to support lower-income workers by providing financial assistance and enhancing their CPF savings.Set to offer significant changes in 2025, the WIS scheme Singapore aims to provide eligible individuals with up to $3,267, boosting their income and ensuring better financial stability.

Read more