Bitcoin price volatility continues to be a defining characteristic of the cryptocurrency landscape, creating a whirlwind of opportunities and challenges for investors. With the current Bitcoin trading outlook reflecting a market gripped by fear, the Crypto Fear and Greed Index has plummeted to 31, mirroring the trepidation among traders. As BTC hovers around $85,539.92, analysts are closely observing significant liquidation levels that could propel BTC’s price towards $89,500 in the short term. This unpredictable nature is compounded by external factors, such as the instability in the bond and stock markets that often influences the Bitcoin market analysis. For those hoping to decipher the future movements, the Bitcoin Rainbow Chart suggests potential value to be unlocked, albeit within a backdrop of caution given the prevailing market sentiment.

The erratic movement observed in Bitcoin prices has become a focal point in discussions about cryptocurrency trading strategies. Many market participants are currently evaluating the implications of Bitcoin’s price fluctuations, considering terms like ‘price instability’ or ‘market unpredictability’ as they navigate these turbulent conditions. Amid this backdrop, the prevailing sense of caution among investors has elevated the importance of tools such as the Crypto Fear and Greed Index and the Bitcoin Rainbow Chart. With key indicators revealing a predilection for skittishness, many traders are on the lookout for actionable insights to steer their investments in an ever-changing digital currency environment. As analysts project various BTC price predictions, the need for informed decision-making has never been more crucial in the realm of cryptocurrency.

Understanding Bitcoin Price Volatility

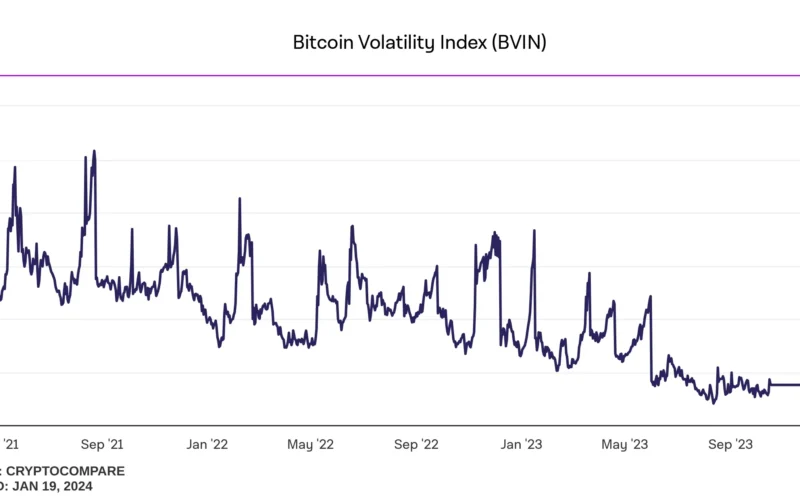

Bitcoin price volatility has become a hallmark of the cryptocurrency market, setting it apart from traditional assets. The unpredictable nature of BTC prices can be attributed to several factors, including market sentiment, macroeconomic influences, and trading volumes. For instance, fluctuations in the global economy, such as changes in the bond market, can directly impact Bitcoin’s trading outlook. This interconnectedness often leads to a correlated movement between bitcoin and stock prices, underscoring the importance of market analysis and investor behavior in predicting potential price movements.

Moreover, tools like the Crypto Fear and Greed Index provide insights into investor sentiment, currently reflecting a state of fear at a reading of 31. This kind of anxiety can lead to rapid sell-offs, exacerbating price volatility. With many traders adopting a cautious approach amid fears of further downturns, understanding market psychology is crucial for navigating these turbulent waters. By analyzing these indicators, traders can better position themselves to anticipate significant shifts in Bitcoin prices within short time frames.

The Role of the Bitcoin Fear and Greed Index

The Bitcoin Fear and Greed Index serves as a pivotal tool for gauging market sentiment in the cryptocurrency space. As of now, this index stands at 31, categorizing the market in a state of fear, which can impact trading behaviors significantly. This fear often leads to hesitance among investors, discouraging them from making large transactions and resulting in increased price volatility. Understanding the components of this index—like trading volume, social media discussions, and price momentum—can provide traders with valuable insights about market trends and potential opportunities.

When in a fearful market, the likelihood of erratic price movements increases as traders react emotionally rather than logically. However, for experienced investors, periods of fear might present buying opportunities. By observing the historical performance patterns and employing tools such as the Bitcoin Rainbow Chart, savvy traders can better navigate these challenges. This index not only reflects current sentiment but can also indicate future market directions based on historical correlations.

The Bitcoin Trading Outlook: A Cautious Perspective

As traders assess the current market, the overall Bitcoin trading outlook appears cautious but not devoid of opportunity. With BTC trading at approximately $85,539.92, the proximity to critical support levels creates a sense of uncertainty about imminent price movements. The market is particularly sensitive to global economic fluctuations, emphasizing a prudent approach to trading. Short-term traders might capitalize on impending price shifts, but the persistent fears surrounding the crypto space demand a well-thought-out strategy.

Investors need to stay informed of any changes in market sentiment, particularly with the ongoing influence of the bond market and economic indicators. Despite the present volatility, as noted with clustered liquidation levels around $89,500, the potential for price spikes exists if trading volumes respond positively. Thus, keeping an eye on technical analysis and market trends can empower investors to make more informed decisions amid the complexity of Bitcoin’s trading landscape.

Bitcoin Rainbow Chart: Analyzing Long-Term Trends

The Bitcoin Rainbow Chart is an invaluable resource for investors looking to understand Bitcoin’s long-term price trajectory. The chart employs a visual representation of price movements over extended periods, allowing traders to identify potential buying and selling zones. Currently, the chart suggests that Bitcoin may be undervalued, presenting a noteworthy opportunity for long-term investors. Historical patterns indicate that similar price levels, classified as ‘Buy’ zones, could lead to substantial gains if BTC follows past trends.

However, users of the Rainbow Chart should exercise caution and not solely rely on its projections. The dynamic nature of the cryptocurrency market means that unforeseen external factors can dramatically alter price paths. Investors must blend analyses from this chart with broader market analysis—like the Bitcoin Fear and Greed Index and BTC price predictions—to formulate effective strategies, particularly as the market heads toward potential peaks or corrections.

Short-Term Strategies Amidst Bitcoin’s Volatility

Navigating the unpredictable landscape of Bitcoin often requires traders to adopt short-term strategies that account for rapid price swings. Given the current volatility and the overall bearish sentiment among traders, aligning one’s trading approach with immediate market conditions is crucial. Methods such as setting tight stop-loss orders and employing day trading techniques can help manage risk while taking advantage of short-lived market opportunities.

Additionally, utilizing market analysis tools like technical indicators can provide further insight into when to enter or exit trades. By studying price patterns and behavioral trends influenced by investor sentiment, traders can refine their strategies for better outcomes. In this environment of fear and uncertainty, adopting a disciplined attitude alongside precise analytical techniques can greatly enhance the chances of success.

Coping with Investor Anxiety in the Crypto Market

Investor anxiety remains a significant factor in the cryptocurrency market, impacting trading decisions and price fluctuations. As indicated by the Crypto Fear and Greed Index, the current sentiment reflects a notable level of fear, prompting many traders to exercise caution. This pervasive anxiety can lead to collective hesitance, resulting in decreased trading activity and an overall chill on the market. For traders, understanding this anxiety becomes essential in navigating their next steps.

To cope with this investor anxiety, it is vital for traders to remain educated on market dynamics and establish clear strategies that mitigate emotional decision-making. Incorporating research and technical analysis into their trading plans can help in maintaining focus and confidence, even amidst market turmoil. Moreover, engaging in supportive communities or forums may provide insights and collective knowledge that can bolster confidence and reduce feelings of isolation in these uncertain times.

Market Influences: The Interplay Between Crypto and Traditional Markets

The Bitcoin market does not operate in isolation; it is significantly influenced by the performance of traditional financial markets. Recent fluctuations in the bond market have had a ripple effect on cryptocurrencies, including BTC. Investors often react to economic news, leading to sell-offs or buying frenzies that impact Bitcoin prices directly. This correlation highlights the importance of analyzing traditional market trends when making predictions about Bitcoin’s future performance.

Understanding the interplay between these markets can better inform traders about potential risk factors and opportunities. For example, a downturn in stock prices might signal an impending bearish trend in cryptocurrency, including Bitcoin. Therefore, keeping an eye on global market conditions could prove beneficial for BTC traders, ensuring that they remain one step ahead in terms of strategy and execution.

Looking Ahead: Bitcoin Price Predictions for 2025

As investors look ahead, Bitcoin price predictions for the coming years remain a topic of significant interest. Analysts often reference historical trends, innovative market tools, and the implications of current investor sentiment to generate these forecasts. The Bitcoin Rainbow Chart, for example, suggests potential peaks around late 2025, with projections placing BTC prices at staggering levels such as $250,000 under favorable conditions.

However, while optimistic predictions can drive enthusiasm, it’s crucial for traders to approach these forecasts with a balanced perspective. Economic variables can shift dramatically, impacting both market sentiment and price directions. Staying informed on market developments and employing a diversified investment approach can help mitigate risks while maximizing potential in a fundamentally sound and potentially profitable asset class like Bitcoin.

Frequently Asked Questions

What are the factors contributing to Bitcoin price volatility?

Bitcoin price volatility is influenced by various factors, including market sentiment, trading volume, and economic indicators. The current market is experiencing heightened volatility due to investor fear, as indicated by the Crypto Fear and Greed Index at 31. Additionally, fluctuations in the stock and bond markets impact Bitcoin’s price, creating uncertainty in the Bitcoin trading outlook.

How does the Crypto Fear and Greed Index affect Bitcoin price volatility?

The Crypto Fear and Greed Index serves as a barometer of market sentiment that directly correlates with Bitcoin price volatility. A low index value, such as the current 31, suggests market fear which often leads to increased sell-offs and unpredictable price swings for BTC. This psychological factor plays a significant role in market dynamics, affecting traders’ decisions.

What does the Bitcoin Rainbow Chart indicate about future price movements?

The Bitcoin Rainbow Chart is a long-term investment tool that visualizes Bitcoin price trends, helping investors gauge potential future movements. Currently, it suggests that Bitcoin may be undervalued, making it an opportune time for long-term investors. It’s important to note that historical patterns suggest price peaks in the ‘Sell’ zone, meaning that while BTC might aim for a target of $250,000 by late 2025, caution is advisable.

What should traders expect in terms of Bitcoin’s price volatility over the coming days?

Traders should brace for potential Bitcoin price volatility in the upcoming days due to clustered liquidation levels around the $89,500 zone. As the market sentiment remains cautious and fear prevails, along with significant support levels intact, BTC’s price could fluctuate considerably, potentially reaching the $89,500 target if trading activity increases.

How do liquidation levels impact Bitcoin price predictions?

Liquidation levels can significantly impact Bitcoin price predictions, especially during times of heightened volatility. When liquidation volumes cluster at certain price points, such as the $89,500 range, they create potential targets for price movements. If market activity spikes, BTC could surge, demonstrating how these levels play a crucial role in shaping short-term BTC price forecasts.

Why is Bitcoin’s price still below critical support levels despite market opportunities?

Bitcoin’s price currently holds above critical support levels like $82,500, yet market opportunities are overshadowed by prevailing investor fear. The Crypto Fear and Greed Index indicates persistent anxiety, leading to caution among traders despite the underlying bullish indicators suggested by tools like the Bitcoin Rainbow Chart. This dichotomy reveals the challenges in predicting BTC’s direction accurately.

| Key Point | Details |

|---|---|

| Bitcoin’s Current Price | Bitcoin is currently trading at $85,539.92. |

| Fear and Greed Index | The index is at 31, indicating a high level of fear among investors. |

| Market Volatility | Bitcoin remains volatile, influenced by market trends in bonds and stocks. |

| Short-Term Price Increase | Potential short-term price spike to $89,500 due to clustered liquidation levels. |

| Long-Term Trends | The Rainbow Chart suggests that BTC is undervalued and may reach $250,000 by late 2025. |

Summary

Bitcoin price volatility remains a significant concern for traders and investors alike. The fear in the market, as indicated by the Fear and Greed Index reading of 31, showcases the cautious sentiment that prevails despite Bitcoin’s efforts to hold above critical support levels. Current market conditions suggest that significant fluctuations are expected in the near term, particularly as Bitcoin eyes the potential target of $89,500 amid clustered liquidation pressures. Therefore, as the landscape continues to shift, stakeholders need to stay alert and make informed decisions.