The recent Bitcoin price drop has reignited concerns among investors as it currently hovers around $84,612, marking a decline of approximately 0.9% within the last 24 hours. This decrease, coinciding with Easter celebrations, has led to reduced trading volume and heightened market sensitivity. Multiple factors are at play, notably geopolitical tensions and economic uncertainties that are causing a shift in investor behavior. As detailed in the latest cryptocurrency market news, market participants seem to be favoring safer assets, evidenced by a surge in gold prices. Additionally, Bitcoin trading analysis reveals that technical indicators such as the Crypto Fear & Greed Index signal significant fear among traders, further exacerbating the decline in Bitcoin futures.

In the world of digital currencies, the recent downturn in Bitcoin’s valuation raises critical questions for stakeholders and analysts alike. The turmoil can be attributed to a complex interplay of economic factors and market sentiment, which has shifted dramatically in response to global events. With overarching uncertainties resulting from geopolitical conflicts and a cautious approach among investors, the cryptocurrency sector feels the strain. Observations from trading platforms suggest that pressure from profit-taking and adjustments in trading strategies following recent changes in Bitcoin’s block rewards are influencing market dynamics. Consequently, the downward trajectory in Bitcoin’s price may serve as a reflective moment for those navigating this volatile industry.

Understanding the Recent Bitcoin Price Drop

As of April 20, 2025, Bitcoin is experiencing a notable price drop, currently trading at approximately $84,612. This represents a decrease of about 0.9% over the past 24 hours, indicating a broader trend of decline in the cryptocurrency market. Analysts suggest that today’s performance can be partly attributed to the Easter holiday, which traditionally sees lower trading volumes. The confluence of market inactivity due to holiday celebrations and heightened geopolitical tensions is creating a perfect storm for downward price pressure.

In the context of current global events, investors are increasingly cautious, leading to a risk-off sentiment that impacts Bitcoin significantly. As more traders and investors retreat from the cryptocurrency space amidst concerns over economic stability, the likelihood of further price drops increases. Thus, understanding the offshoots of geopolitical tensions and their impact on the Bitcoin price is crucial for traders looking to navigate these tumultuous conditions.

Geopolitical Tensions and Their Impact on Bitcoin

The recent escalation of geopolitical tensions, particularly those involving major economies like the United States and China, has had a profound impact on the cryptocurrency market. Investors tend to gravitate towards safe-haven assets such as gold during times of uncertainty, leading to reduced demand for more volatile assets like Bitcoin. The correlation becomes especially pronounced as we witness a surge in gold prices, reinforcing the notion that geopolitical instability drives investors away from risk-laden investments.

As these international conflicts unfold, market participants are advised to closely monitor how these tensions continue to influence Bitcoin trading dynamics. The current environment of economic uncertainty not only influences immediate trading strategies but also sets the stage for future trends in Bitcoin price, making a comprehensive understanding of these geopolitical factors essential for cryptocurrency investors.

Market Sentiment Shifts: Bitcoin Trading Analysis

As the cryptocurrency market responds to external pressures, market sentiment has taken a harsh dive, with the Crypto Fear & Greed Index recently falling to a score of 25. This level indicates extreme fear and suggests that many investors are unwilling to buy into Bitcoin amid rising tensions and market instability. The bearish sentiment reflects a widespread belief that further declines in Bitcoin prices are likely, creating a self-fulfilling prophecy as traders pull back.

Technical analysis suggests that Bitcoin is currently in oversold territory, indicated by a Relative Strength Index (RSI) of 30. These signals, combined with the recent bearish crossover on the Moving Average Convergence Divergence (MACD), provide even more reason for cautious trading. Therefore, it becomes critical for Bitcoin traders to adapt quickly to these shifting sentiments and develop strategies that can capitalize on the potential for recovery or hedge against further declines.

Bitcoin Futures Decline and Its Consequences

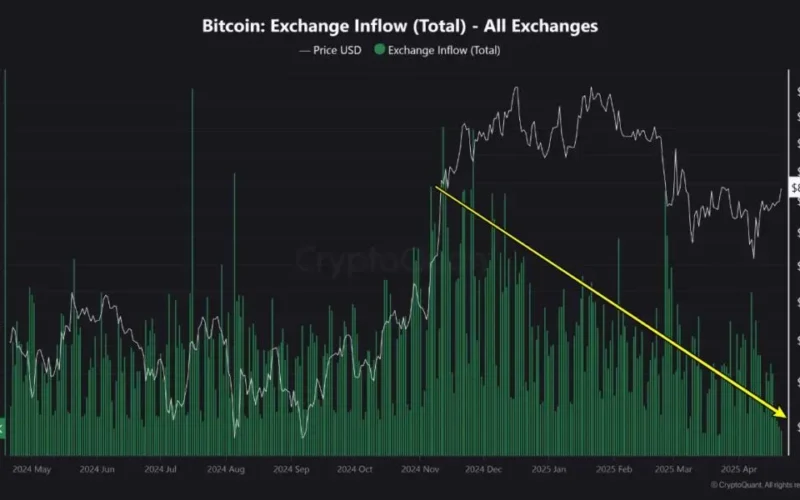

The futures market is a crucial aspect of cryptocurrency trading that reflects trader sentiment and can lead to substantial price changes. Currently, the Bitcoin futures market is witnessing a decline in open interest, suggesting that many traders are closing their positions. This reduction points to a lack of confidence within the market, making it difficult for Bitcoin to maintain its price amid current economic conditions.

This decreased speculative activity raises concerns over liquidity, as low open interest can lead to increased price volatility. If traders continue to retreat and further liquidate their positions, Bitcoin could face increased risk of significant price drops, compounding the challenges posed by the external market and geopolitical factors. Understanding these dynamics is vital for anyone involved in Bitcoin trading, whether for short-term gains or long-term investment.

Post-Halving Behavior Impacting Bitcoin Pricing

Bitcoin’s price movements are often influenced by halving events, which significantly alter the reward miners receive for processing transactions. The most recent halving has led to a period characterized by heightened levels of volatility, as miners and investors recalibrate their strategies to adjust to the new economic reality of reduced block rewards. This transitional phase often brings uncertainty, which can contribute to price declines, as observed in the current market.

Investors should watch for post-halving behavior patterns to better navigate potential market corrections. History suggests that these adjustment periods can lead to erratic price fluctuations as market participants come to terms with new supply dynamics. By understanding the implications of Bitcoin’s halving, traders can develop more informed strategies to manage their investments and potentially capitalize on future price recoveries.

The Role of Profit-Taking in Bitcoin’s Current Decline

After witnessing an impressive rally earlier this year that pushed Bitcoin’s value to an all-time high of over $100,000, profit-taking has become an expected trend among investors. As prices reached their peak, many decided to lock in gains, which directly contributes to the price decline now observed in the market. This selling pressure is not inherently negative; it often signifies a natural correction following substantial price appreciation.

Investors should remain alert to these trends, as profit-taking activities can create both risks and opportunities. Understanding when and how to take profits, especially after significant gains, is crucial for developing a sound investment strategy. Furthermore, recognizing that corrections following major price increases are typically expected will help investors better manage their expectations and avoid panic during downturns.

Adapting to Market Changes: Strategies for Bitcoin Investors

In the ever-evolving landscape of cryptocurrency, adaptability is key for investors looking to mitigate risks associated with market downturns. As Bitcoin’s price fluctuates due to a plethora of factors, including geopolitical tensions and changing investor sentiment, it is crucial to develop versatile trading strategies that allow for flexibility. Keeping abreast of cryptocurrency market news will enable investors to make informed decisions and ideally position themselves for recovery during market rebounds.

Additionally, employing risk management techniques, such as diversifying investments and setting stop-loss orders, can help cushion the blow when prices dip. Understanding the interconnectedness of global economic events and their repercussions on Bitcoin can also foster a more proactive investment approach. By engaging with various analytical frameworks and staying informed, investors can better navigate the complexities of the cryptocurrency market.

Analyzing Bitcoin’s Long-Term Forecast amid Current Events

While short-term movements often dominate headlines, it is equally important for Bitcoin investors to focus on long-term forecasts, especially in the face of current market uncertainties. Analysts predict that despite today’s Bitcoin price drop, the overarching trend may still favor recovery as market conditions stabilize. Key indicators and historical data can aid in identifying patterns that suggest potential upward movements when fear subsides.

The interplay between regulatory developments, technological advancements, and macroeconomic factors will continue to shape Bitcoin’s journey. By maintaining a long-term perspective, investors can weather short-term volatility and capitalize on the overarching bullish sentiment that often follows periods of adjustment. This long view can empower traders to capitalize on future price surges amidst the evolving landscape of cryptocurrency.

Future Implications for Bitcoin Amid Global Market Conditions

In light of the fluctuating global market dynamics, Bitcoin remains an intriguing asset with the potential for significant shifts in price driven by external conditions. Factors such as geopolitical tensions and the performance of traditional financial markets are critical in shaping the future trajectory of Bitcoin. As investor sentiment shifts in response to these factors, the possible implications for the cryptocurrency’s long-term viability remain a central discussion point amongst analysts.

As we anticipate future developments in both the geopolitical landscape and cryptocurrency regulation, Bitcoin followers should remain vigilant. These factors not only affect price fluctuations but also underpin the complex relationship between Bitcoin and the broader financial ecosystem. Engaging with emerging trends and market insights can empower investors to position themselves advantageously for whatever comes next in the ever-dynamic world of cryptocurrency.

Frequently Asked Questions

What caused the Bitcoin price drop on April 20, 2025?

The Bitcoin price drop on April 20, 2025, can be attributed to several factors, including heightened geopolitical tensions that are increasing market volatility, a bearish sentiment in the cryptocurrency market, technical indicators that suggest further declines, and a general tendency for profit-taking after Bitcoin’s significant rally earlier this year.

How do geopolitical tensions affect the Bitcoin price drop?

Geopolitical tensions contribute to the Bitcoin price drop by creating economic uncertainty, prompting investors to move away from volatile assets like cryptocurrencies. As risk aversion grows, more investors gravitate towards traditional safe havens such as gold, impacting Bitcoin and other cryptocurrencies negatively.

What is the impact of market sentiment on Bitcoin price drops?

Market sentiment plays a crucial role in Bitcoin price drops. For example, the Crypto Fear & Greed Index has shown extreme fear among investors, which can lead to decreased buying pressure and increased selling activity. Such sentiments can propel further declines in the Bitcoin price.

How do technical indicators influence Bitcoin price drops?

Technical indicators, like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), provide insight into Bitcoin’s market momentum. A declining RSI indicates Bitcoin may be oversold, but if the MACD is in a bearish phase, it points to potential continued price drops, affecting investor behavior.

What role do Bitcoin futures play in the current price drop?

The decline in Bitcoin futures trading activity reflects a decrease in open interest, indicating that traders are closing positions. This reduction suggests less speculative activity, leading to decreased liquidity in the market and contributing to increased volatility, thus impacting the Bitcoin price drop.

Why is profit-taking a factor in the Bitcoin price drop?

Profit-taking occurs when investors sell off a portion of their holdings following significant price rallies, like the one Bitcoin experienced this year. This selling pressure can exacerbate the current Bitcoin price drop as traders seek to realize their gains, resulting in market corrections.

What is the relationship between Bitcoin price and post-halving market behavior?

Post-halving market behavior often leads to increased volatility as miners and investors adjust their strategies due to changes in block reward structures. This uncertainty can create fluctuations in the Bitcoin price, sometimes contributing to price drops as the market recalibrates.

Is it expected that the Bitcoin price will recover from this drop?

While current indicators show a Bitcoin price drop largely driven by market sentiment and geopolitical factors, history suggests that such corrections can lead to future recoveries. However, it will depend on shifts in investor confidence and broader market conditions.

What are the latest cryptocurrency market news impacting Bitcoin’s price?

Recent cryptocurrency market news highlights include the influence of geopolitical tensions, fluctuations in trading volume due to reduced investor appetite, and the impact of profit-taking after gains earlier in the year. These factors collectively contribute to the recent Bitcoin price drop.

What is the current Bitcoin price as of April 20, 2025?

As of April 20, 2025, Bitcoin (BTC) is trading at approximately $84,612, reflecting a decline of about 0.9% over the past 24 hours, influenced by various market dynamics.

| Key Points | Details |

|---|---|

| Bitcoin Price Status | Trading at approximately $84,612 with a decline of 0.9% over the past 24 hours. |

| Geopolitical Tensions | Increased tensions between the U.S. and China leading to market volatility and a shift towards safe-haven assets like gold. |

| Market Sentiment | Crypto Fear & Greed Index at 25 indicating extreme fear; RSI at 30 suggesting oversold conditions. |

| Futures Market Dynamics | Decreasing open interest as traders close positions, leading to reduced liquidity. |

| Post-Halving Corrections | Market adjusting after Bitcoin’s latest halving event, typically seen with increased volatility. |

| Profit-Taking | Investors selling off after recent highs near $100,000 contributing to the decline. |

Summary

The recent Bitcoin price drop on April 20, 2025, can be attributed to various factors including heightened geopolitical tensions, negative market sentiment, and profit-taking activities. Today’s developments reflect a complex interplay of these issues affecting investor confidence and liquidity in the market.