Bitcoin price change has been at the forefront of discussions in the cryptocurrency community, especially after a recent stunning decline of 9%. Following the initial optimism sparked by President Donald Trump’s announcement regarding a U.S. strategic crypto reserve, traders were left disappointed as prices reversed, pushing Bitcoin down to approximately $86,000. This significant drop emphasizes the volatile nature of cryptocurrency markets, where sentiment can shift rapidly according to political and economic factors. Alongside Bitcoin tumbles, altcoins like Ether also saw substantial losses, reflecting widespread uncertainty in the crypto market. As the landscape continues to evolve with news about tariffs and financial regulations, market analysts are keenly observing Bitcoin trading news to gauge future trends.

The fluctuations in Bitcoin value reflect a tumultuous yet fascinating segment of the broader digital currency ecosystem. Many enthusiasts are closely monitoring the impacts of Donald Trump’s strategic cryptocurrency reserve announcement on market dynamics. The interplay of political decisions and economic forecasts is critical, as they can sway market sentiment and influence investor behavior significantly. As we examine cryptocurrency market shifts, it’s clear that external factors such as proposed tariffs and regulatory changes can trigger rapid price changes. This degree of volatility makes crypto market analysis essential for investors who wish to navigate this challenging terrain.

Bitcoin Price Change: Understanding the Recent Decline

Recent trading activity has shown a significant decline in Bitcoin’s price, highlighting the volatility of the cryptocurrency market. Following President Trump’s announcement about a U.S. strategic crypto reserve, Bitcoin experienced a brief surge, reaching a high of $95,000. However, this optimism rapidly diminished as traders reacted to looming economic concerns, particularly the impending tariffs. Bitcoin’s price fell nearly 8% to approximately $86,000, indicating how sensitive the market is to macroeconomic developments and news. Such fluctuations underscore the challenges investors face in a rapidly changing crypto landscape.

The aftermath of Trump’s announcement demonstrates the complexities of Bitcoin price dynamics. While some investors initially reacted positively, hoping the strategic reserve would bolster confidence in digital currencies, the fears surrounding potential tariffs swiftly overshadowed these sentiments. Analysts like Yuya Hasegawa have pointed out that the market’s reaction may signal that the initial excitement around the crypto reserve has already peaked. As cryptocurrencies continue to navigate through various macroeconomic pressures, ongoing assessment of Bitcoin’s price trends will be essential for traders and investors.

Impacts of Trump’s Crypto Reserve: What Investors Should Know

President Trump’s declaration of a strategic crypto reserve initially sparked enthusiasm within the cryptocurrency sector, suggesting a more sanctioned approach to digital currency management. This reserve plan, which includes not just Bitcoin but also other significant cryptocurrencies like Ether and Solana, represents a potential shift in how government entities interact with the crypto market. Investors welcomed the notion of a U.S. strategic asset class for cryptocurrencies, which could enhance legitimacy and attract institutional involvement. However, as seen with the recent downturn, such announcements need to be underscored by actionable plans and real developments to maintain market momentum.

Despite the initial hype surrounding Trump’s crypto reserve, caution remains paramount among seasoned investors and market analysts. Many are wary that such initiatives may take time to materialize, leading to skepticism about whether they can generate sustainable growth in the cryptocurrency market. The anticipation surrounding subsequent developments, particularly the upcoming White House Crypto Summit, could set the tone for future price movements and investor sentiment—especially as the crypto market remains susceptible to broader economic factors, such as tariff discussions and regulatory changes.

Crypto Market Analysis: Trends and Forecasts

The cryptocurrency market has shown remarkable resilience yet inherent vulnerability to external economic news. The recent fluctuations in Bitcoin’s price, along with declines in stocks of cryptocurrency-related companies like Coinbase and Robinhood, suggest a correlation between Bitcoin’s performance and investor sentiment regarding the overall market stability. While some analysts predict potential recovery around key resistance levels, they are also cautioning investors to pay attention to macro trends, as they are likely to exert pressure on crypto valuations in the near term.

As experts analyze the market, many focus on indicators of future movements. The undercurrents of the recent price drop and the broader cryptocurrency market dynamics could provide insight into upcoming trends. With Bitcoin’s price recently plummeting below $90,000 and the specter of a further drop to around $70,000 looming, investors are advised to remain vigilant. A narrative of uncertainty may linger until significant developments emerge, prompting traders to adapt strategies in response to shifting sentiment and potential market catalysts.

Navigating the Cryptocurrency Landscape: Strategic Insights

With the continuing evolution of the cryptocurrency landscape, investors are finding it crucial to navigate with a strategic mindset. The juxtaposition of Bitcoin’s potential and the inherent risks incumbent upon market volatility necessitate an informed approach to trading. As Bitcoin tumbles and then rallies, investors should heed the broader implications of news such as Trump’s strategic reserve announcement, which, while optimistic, also reflects the volatility embedded within digital currencies. It’s vital for traders to dynamically assess market signals and adjust their strategies accordingly.

Furthermore, understanding the multitude of factors influencing Bitcoin’s price can offer investors greater clarity. Market analysts emphasize that while Bitcoin may experience fleeting periods of growth, the external variables, including political decisions and macroeconomic trends, must be factored into investment timing and decision-making. Being adaptable in such a fast-paced environment is key for anyone looking to make informed choices in the ever-changing cryptocurrency market.

Investor Sentiment: How It Affects Bitcoin Price Trends

Investor sentiment plays a crucial role in the fluctuations seen in Bitcoin’s price, particularly in response to news events. The initial excitement that surged following Trump’s announcement illustrates how quickly sentiments can shift within the cryptocurrency community. When confidence rises, as it did when the crypto reserve was first mentioned, Bitcoin’s price tends to rise; conversely, any hint of economic instability can precipitate a rapid selloff, as seen recently. Understanding these sentiment trends can provide invaluable insight for investors looking to forecast Bitcoin’s future movements.

Market analysts often watch social media and trading volume as indicators of investor sentiment. A surge in discussions about Bitcoin and high trading volumes typically coincide with price increases. However, when worries about external factors, like tariffs or economic forecasts, dominate discourse, it can lead to sharp declines. As traders move in reaction to these shifts, it becomes increasingly important for market participants to stay informed not just of prices, but of the sentiments driving these changes. Ultimately, monitoring market psychology could be as important as analyzing financial indicators.

Crypto Trading News: Staying Ahead of Market Movements

For those involved in cryptocurrency trading, staying informed with the latest news is paramount for seizing opportunities as they arise. Updates from major figures like President Trump can impact values across the sector, whether it’s a bullish announcement about a strategic reserve or insight into broader regulatory issues. Recent trading news underscores the need for traders to stay alert and adaptable, as rapid changes can lead to both significant gains and unexpected losses. Ultimately, timely information can serve as a competitive advantage in the turbulent environment of crypto trading.

Tracking developments within the industry—from trading platform performance to government regulations—is essential for anyone engaged in cryptocurrency markets. With Bitcoin’s recent price reversals and the performance of altcoins like Ethereum and Solana, investors should be proactive in seeking out analysis and reports that can guide their decisions. Moreover, understanding these market shifts empowers traders to foster a more robust trading strategy that can withstand the volatility characterized by cryptocurrencies.

Understanding the Dynamics of Bitcoin Market Reversals

The recent 9% drop in Bitcoin’s price serves as a cautionary reminder of how swiftly market dynamics can change. Market reversals, particularly after significant rallies, are not uncommon in the cryptocurrency domain. Trends indicate that as quickly as Bitcoin can surge, it can also tumble, especially in the face of macroeconomic concerns like tariff implementations and overall market sentiment. The fluctuations observed underline the importance of being prepared for rapid changes, as the crypto market is notoriously unpredictable.

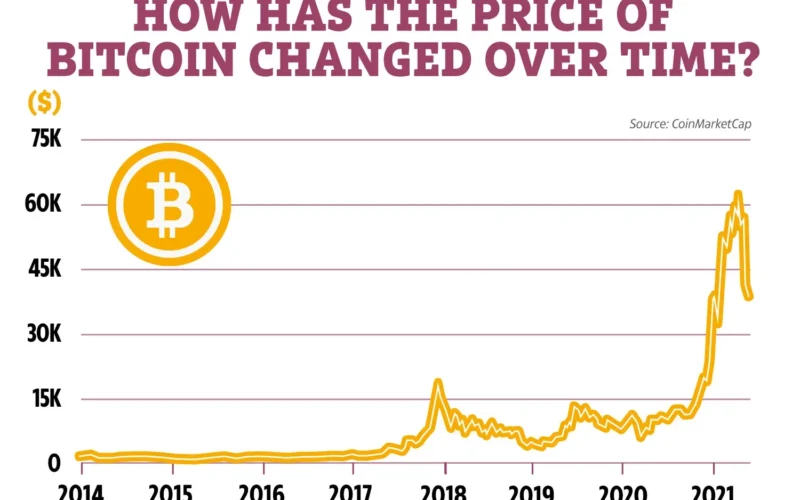

Investors should be particularly attuned to charts and analytics that highlight patterns of reversals in Bitcoin’s value. Understanding past price movements can uncover potential patterns and help traders develop forecasts about future behaviors. Even amidst volatility, there exist opportunities for strategic trading—if one can anticipate shifts in the market tide. As the industry matures, aware investors will increasingly leverage data-driven insights to navigate potential downturns and capitalize on upward trends.

The Future of Bitcoin: Predictions and Market Outlook

Looking forward, the future of Bitcoin remains a focal point of debate within cryptocurrency circles. Analysts suggest that understanding the implications of regulatory measures and economic policies will be instrumental in shaping Bitcoin’s trajectory. The announcement of a strategic crypto reserve marks a pivotal moment, signaling potential shifts in how cryptocurrencies could be treated by the government and financial institutions. This has implications not only for Bitcoin but also for the broader cryptocurrency ecosystem as investors weigh the prospects of a stabilized market.

As investors remain cautious after the recent selloff, many are actively analyzing signals that may indicate a potential recovery. With forecasts suggesting that Bitcoin may test previous lows or find new support levels, traders should remain vigilant about market trends. As developments unfold—from government policies to institutional investments—those engaged in cryptocurrency must be prepared to adjust their approaches. Ultimately, the outlook on Bitcoin must remain flexible, founded in both analysis and the capability to adapt to evolving market conditions.

Frequently Asked Questions

What caused the recent Bitcoin price change following Trump’s crypto reserve announcement?

The recent Bitcoin price change, where it tumbled 9%, was primarily influenced by traders reacting to proposed tariffs that overshadowed the excitement surrounding President Trump’s announcement of a U.S. strategic crypto reserve. Concerns about the economic impact of these tariffs led to a swift reversal of Bitcoin’s earlier gains following Trump’s announcement.

How did Trump’s crypto reserve announcement initially impact Bitcoin price before the drop?

Initially, Trump’s crypto reserve announcement caused Bitcoin to surge to $95,000, reflecting a positive sentiment in the market. However, this rally did not sustain due to emerging macroeconomic concerns, resulting in a significant Bitcoin price change as it ultimately fell back down to around $86,000.

Is the recent Bitcoin price tumble related to broader cryptocurrency market trends?

Yes, the recent Bitcoin price tumble is indicative of broader cryptocurrency market trends. As Bitcoin experienced significant losses, other cryptocurrencies like Ether also saw a drop, signaling that the crypto market is reacting collectively to economic news and investor sentiment.

What should investors watch for in the cryptocurrency market following the Bitcoin crash?

Following the Bitcoin crash, investors should keep an eye on developments related to Trump’s crypto reserve and the upcoming White House Crypto Summit. Any new information or strategic decisions could significantly influence Bitcoin price change and the overall sentiment in the cryptocurrency market.

Can the establishment of a crypto reserve influence future Bitcoin price changes?

The establishment of a crypto reserve could potentially influence future Bitcoin price changes. If further details emerge regarding the reserve’s strategic direction or implementation, it may act as a catalyst for new interest and investment in Bitcoin and other cryptocurrencies, affecting their prices.

What impact did macroeconomic factors have on Bitcoin’s latest price change?

Macroeconomic factors played a significant role in Bitcoin’s latest price change. The announcement of proposed tariffs raised concerns among traders about economic stability, which overshadowed the earlier bullish sentiment from Trump’s crypto reserve announcement, leading to a sharp decline in Bitcoin’s price.

How does investor sentiment affect Bitcoin price changes?

Investor sentiment is crucial for Bitcoin price changes, as it directly influences buying and selling decisions. During positive news cycles, such as Trump’s crypto reserve announcement, sentiment can drive prices up; conversely, negative macro developments can lead to panic selling, resulting in price tumbles.

Why did analysts suggest Bitcoin might return to lower price levels post-rally?

Analysts have suggested that Bitcoin might return to lower price levels post-rally due to its recent inability to break out of a consolidation phase and the lack of strong crypto-specific catalysts to sustain upward momentum. Concerns about macroeconomic factors further add to the apprehension among investors.

| Key Point | Details |

|---|---|

| Bitcoin Price Drop | Bitcoin fell 9% to around $86,000, reversing gains from President Trump’s crypto reserve announcement. |

| Market Reactions | Other cryptocurrencies, like Ether and related stocks (Coinbase and Robinhood), also experienced declines. |

| Trump’s Crypto Reserve Announcement | The announcement included a plan for a strategic crypto reserve, which initially boosted Bitcoin’s price. |

| Investors’ Sentiment | Despite the potential of the crypto reserve, analysts believe there is no immediate catalyst to sustain the rally. |

| Future Prospects | Investors will be watching for developments regarding the reserve as economic concerns persist. |

Summary

The Bitcoin price change has highlighted significant volatility in the market, with a recent tumble of 9% from an initial rally following President Trump’s announcement of a strategic crypto reserve. While the initial news brought excitement, concerns over proposed tariffs and broader economic impacts led to a reversal of gains. As investors digested the implications of the announcement, analysts caution that the lack of new catalysts may keep Bitcoin’s price under pressure. This week will be pivotal, as further developments regarding the crypto reserve are expected, which could influence future Bitcoin price change.