Bitcoin market dynamics have never been more fascinating as they reveal a stark divide between retail traders and whale investors. With growing optimism surrounding Bitcoin price predictions, retail investors are ramping up their long positions in hopes of a price recovery. However, in a contrasting move, whales, who control significant portions of Bitcoin, are pulling back and reducing their exposure, raising concerns about potential market overleveraging risks. This divergence highlights the intricate balance of crypto market sentiment, where retail enthusiasm might clash with the caution exercised by larger players. As Bitcoin’s investment strategies evolve, the interactions between these groups could set the stage for significant price movements.

The evolving landscape of Bitcoin trading showcases the intricate relationships within its market consisting of individual traders and institutional giants. As we witness retail investors doubling down on their positions, there is a noticeable shift in behavior compared to the traditional whales who opt for a more conservative approach in managing their investments. This tension is particularly evident in the context of fluctuating Bitcoin valuations and varying investment strategies that reflect both segments’ perspectives. The sentiment surrounding the cryptocurrency also fluctuates, leading traders to speculate whether these contrasting strategies will result in a bullish breakout or a challenging market correction. Understanding these market forces is essential for anyone looking to navigate the complexities of the Bitcoin ecosystem.

Bitcoin Market Dynamics: Retail vs Whale Sentiment

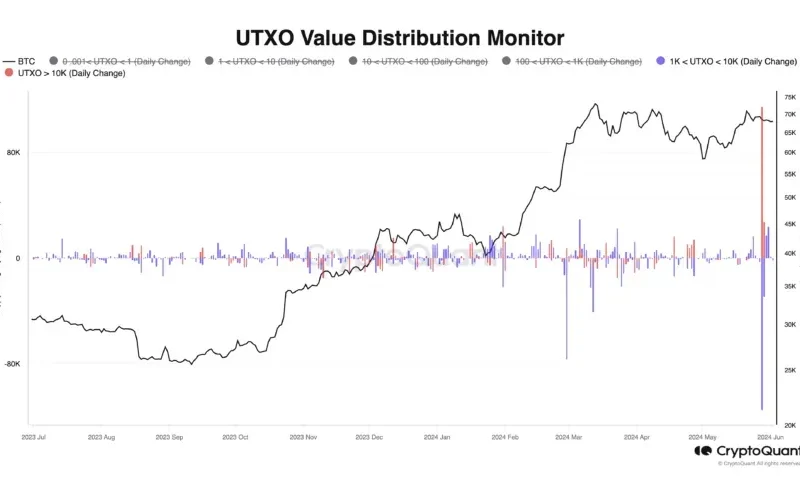

The dynamics of the Bitcoin market currently present a fascinating study in contrasts, particularly between retail traders and whales. Retail investors have been increasingly optimistic, ramping up their long positions in the hopes of capitalizing on a potential price rebound. This surge in participation among smaller investors has shifted market sentiment towards bullishness, with many analysts predicting that sustained retail momentum could drive Bitcoin’s price to new heights. However, the situation is complicated by the behavior of whales—individuals or entities holding substantial Bitcoin reserves—who are showing signs of caution as they strategically reduce their long exposure or even initiate short positions. This divergence raises important questions about the sustainability of Bitcoin’s current price trajectory and indicates a potential power struggle within the market.

The current landscape highlights the significance of understanding market dynamics influenced by both retail traders and whale activity. Retail sentiment has escalated as more individuals recognize the potential for profit, further exacerbating the bullish narrative surrounding Bitcoin. Conversely, whale behavior often reflects a more measured approach to trading, driven by a comprehensive analysis of market trends and underlying economic factors. Historically, significant shifts in market direction have followed patterns where retail euphoria coincides with whale withdrawal. This intricate interplay necessitates that traders remain vigilant and analytical, as the contrasting strategies may signal evolving market sentiments and future price movements.

The Surge in Retail Trading Activity

In recent weeks, the surge in retail trading activities has reached unprecedented levels, with many investors entering the Bitcoin market as prices lingered under pressure. This uptick in long positions taken by retail traders is a testament to their growing confidence and willingness to engage in the crypto market, even amid signs of volatility. Numerous reports indicate that more first-time investors are attracted to Bitcoin due to its perceived recovery potential, further contributing to a bullish market environment. Despite these positive indicators, market analysts caution that the influx of retail investments could lead to overconfidence and increase the risk of a market correction.

The enthusiasm among retail traders signifies a critical shift in the Bitcoin landscape, where smaller investors are beginning to exert a more substantial influence on price movements. Many retail participants are now utilizing advanced trading strategies and leveraging tools to maximize their potential gains, demonstrating an evolving understanding of the crypto markets. Nevertheless, this growing participation also poses risks, especially when the enthusiasm of retail traders is not accompanied by robust backing from whales. Without the stability that whale investments typically provide, the reliance on retail momentum could create a precarious situation where any negative news or market shifts lead to a swift reversal.

Whale Behavior: Caution Amid Retail Optimism

As the retail trading landscape flourishes, whales have adopted a cautious approach, decreasing their long positions or opting for short strategies in response to the shifting market dynamics. This cautious stance from whales serves as a warning signal, as historically, when large holders retreat, it often leads to market corrections. The contrasting actions of whales, who traditionally act as stabilizing forces in the market, highlight a potential disconnect with the optimism pervading retail sentiment. While retail traders race to accumulate positions, their reliance on burgeoning bullish sentiment may soon meet resistance from whale-generated caution, leaving small investors vulnerable to sudden market corrections.

The observational data suggests that the activities of whales are essential for understanding Bitcoin’s price movements. Whale trading behavior often reflects deeper market sentiments and economic indicators that influence Bitcoin’s long-term stability. As they pull back, the lack of institutional reinforcement can result in increased volatility, particularly during rapid price changes. Market observers argue that this dynamic creates a precarious environment for retail traders, who may be ill-prepared for a downturn unaccompanied by whale support. It is imperative for these traders to recognize the implications of whale actions and adjust their strategies accordingly, understanding that the presence of whale caution signals potential risks ahead.

Understanding Bitcoin Overleveraging Risks

Overleveraging among retail traders has emerged as a crucial factor accentuating current market dynamics. As traders increasingly borrow capital to amplify their investment positions, the potential for significant gains accompanies substantial risks—should the market price shift unfavorably. This scenario creates a volatile situation where a rapid drop in Bitcoin’s value could trigger widespread liquidations of overleveraged positions, substantially impacting market stability. This risk underscores the importance of responsible investing, especially as enthusiasm among retail traders mounts.

The history of Bitcoin trading has shown that aggressive investment strategies involving leverage can amplify both profits and losses. During periods of peak optimism, many retail traders find themselves trapped when market corrections occur, especially if they lack the foundational backing from whales. This cyclical pattern of retail exuberance followed by sharp sell-offs has often resulted in liquidations that exacerbate price declines. Therefore, understanding these overleveraging risks is critical for traders aiming to navigate Bitcoin’s unpredictable market landscape effectively.

Historical Patterns: The Danger of Peak Optimism

Throughout Bitcoin’s history, patterns of retail trading peak optimism followed by whale intervention have played a defining role in establishing market trends. During moments of rampant enthusiasm, smaller investors frequently accumulate long positions, betting on continued price increases, while whales strategically capitalize on these moments by offloading their holdings. This cycle has led to significant price corrections in the past, presenting a cautionary tale for the current retail-driven market. As eager investors fill their portfolios with Bitcoin, the potential for a similar pattern to repeat raises concerns about the sustainability of this rally.

The dangerous precedent set by historical cycles indicates that when retail sentiment becomes overwhelmingly optimistic without corresponding whale support, Bitcoin’s upward trajectory is often unsustainable. This imbalance can result in sharp market losses, and the possibility of a sudden downturn looms as larger investors take corrective actions. Retail traders must be mindful of these historical trends to avoid being swept up in a speculative frenzy that places their investments at risk. Understanding the market dynamics at play and retaining a balanced perspective on Bitcoin’s price trajectory is essential for navigating this increasingly complex trading environment.

The Tug-of-War for Bitcoin’s Future Direction

As the landscape of Bitcoin trading shifts, the contrasting strategies between retail and whale participants paint a vivid picture of the ongoing tension in the market. Retail traders, riding high on a wave of optimism, are rapidly expanding their long positions, confident in the potential for upward price movement. In stark contrast, whales are subtly indicating their concerns by reducing exposure and adopting more defensive trading positions. This tug-of-war illustrates the complex interplay of market sentiment and highlights the importance of understanding how both groups influence Bitcoin’s price trajectory.

Consequently, the future direction of Bitcoin remains uncertain as these two factions clash within the market. Retail traders fueled by optimism may find themselves on unstable ground without the assurances of whale participation. Conversely, whale caution presents a formidable check on retail exuberance, often leading to corrections following periods of intense speculation by smaller traders. This juxtaposition of sentiment mandates a careful analysis of market developments, as the outcome of this tug-of-war will likely determine the next significant move in Bitcoin’s price, shaping the future of cryptocurrency trading.

Frequently Asked Questions

What are the current Bitcoin market dynamics affecting price prediction?

The current Bitcoin market dynamics show a divergence between retail traders and whales, significantly impacting Bitcoin price predictions. Retail traders are increasing long positions in anticipation of a price recovery, while whales are pulling back or even shorting, suggesting a cautious outlook. This contrast in sentiment raises questions about future price movements and possible corrections.

How do retail vs whale trading trends influence Bitcoin investment strategies?

Retail vs whale trading trends play a crucial role in shaping effective Bitcoin investment strategies. Retail traders are currently bullish, accumulating long positions, while whales are cautious, which could signal potential market corrections. Understanding these dynamics helps investors strategize—whether to follow retail enthusiasm or heed the caution of larger players.

What risks are associated with Bitcoin overleveraging in the current market?

Bitcoin overleveraging poses significant risks, particularly for retail traders who are increasingly using borrowed capital to amplify their positions. This practice can create volatility and lead to severe liquidation events if the market shifts quickly. As liquidation pressures mount, Bitcoin’s price may experience sharp declines, underscoring the dangers of excessive leverage.

How does crypto market sentiment impact Bitcoin price predictions?

Crypto market sentiment is a key driver of Bitcoin price predictions, as the current split between optimistic retail traders and cautious whales creates uncertainty. When retail sentiment is overwhelmingly bullish without the support of whale buying, there’s a heightened risk of reversal. Market analysts closely watch these dynamics to gauge potential price movements.

What historical patterns can be observed in Bitcoin market dynamics during peak optimism?

Historical patterns in Bitcoin market dynamics reveal that during past peak optimism phases, retail traders often took on heavy long positions, only to see whales capitalize on subsequent downturns. This repetitive cycle highlights the vulnerability of retail traders against the strategic moves of whales, warning of potential corrections when sentiment becomes overly bullish.

| Key Points | Details |

|---|---|

| Retail Traders’ Sentiment | Retail traders are increasing long positions due to optimism for Bitcoin’s price recovery. |

| Whales’ Sentiment | Whales are reducing their positions or taking short positions, indicating caution. |

| Market Dynamics | The contrast between retail optimism and whale caution raises questions about Bitcoin’s future price direction. |

| Risk of Overleveraging | Many retail traders are using leverage for long positions, increasing vulnerability to market downturns. |

| Historical Patterns | Past cycles show that retail overconfidence without whale support often leads to corrections. |

Summary

Bitcoin market dynamics are currently marked by a significant divide between retail traders who are showing increased optimism and whales who are exercising caution. The growing number of retail long positions suggests confidence; however, with whales pullback from the market, there is a looming risk of corrections. Traders must remain vigilant as this tug-of-war between bullish sentiment and bearish caution could dictate the next major movement in Bitcoin’s price.