As Singapore grapples with the realities of inflation in 2024, many are questioning the narratives surrounding the easing inflation rate, which has reportedly dropped to 2.4%. Despite this statistic, the cost of living continues to rise, leading to widespread concern among households about their increasing expenses. The rising prices of essential goods, particularly food items, coupled with the recent Goods and Services Tax (GST) hikes, have left many feeling skeptical about the government’s portrayal of the inflation rate 2024. While some sectors have shown a decline in prices, the overarching trend reflects a continued burden on consumers, especially those in lower-income brackets, who reported increases in household expenses. As discussions swirl online, the impact of these economic changes on everyday life remains a pressing issue for citizens of Singapore.

In the context of Singapore’s economic landscape, the discussion about price dynamics in 2024 has become increasingly relevant. Many residents are expressing concerns about the impact of rising living expenses, which continue to strain household budgets despite claims of a lower inflation rate. The perceived disconnect between official statistics and the actual cost of essential goods fuels skepticism, particularly regarding the inflation rate 2024. As discussions on social media reveal, the influence of recent GST adjustments has intensified the scrutiny surrounding these financial forecasts. Ultimately, the concerns about rising prices and their implications for daily life underscore a significant challenge for Singaporean households navigating these economic shifts.

Understanding Singapore’s Inflation Rate in 2024

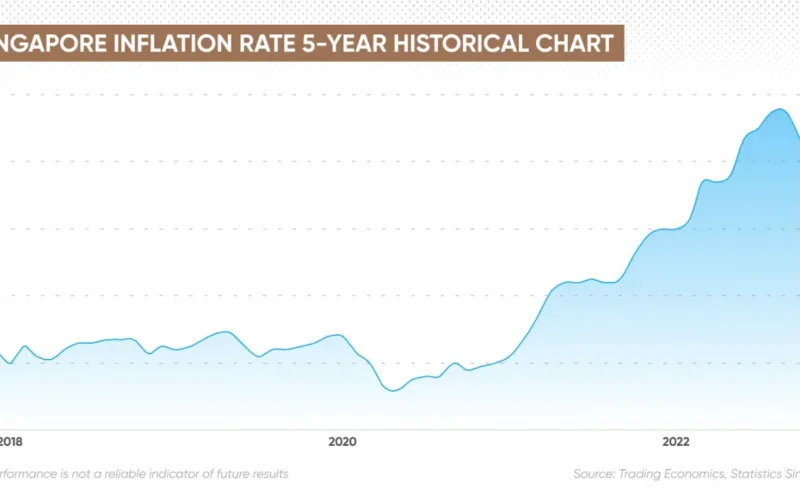

As Singapore navigates through the economic landscape of 2024, the reported inflation rate of 2.4% has sparked considerable debate among citizens. Many netizens have expressed skepticism regarding the authenticity of these figures, especially considering the stark contrast with the soaring inflation rates of previous years, which peaked at 6.1% in 2022. This skepticism is rooted in the everyday experiences of Singaporeans who continue to face rising prices, particularly in essential goods and services, leading to questions about the real impact of reported inflation rates on the cost of living.

The ongoing discourse around Singapore’s inflation rate has highlighted the disparity between statistical data and the lived experiences of residents. While the government reports a decline in inflation, many households are still grappling with increased costs related to necessities such as food and housing. The inflation rate of 2.4% may suggest a positive trend, yet for many, it feels like a mere illusion as they encounter ongoing financial strain. This situation exemplifies the complex relationship between reported economic indicators and actual household expenses in Singapore.

The rising costs of everyday items have become a focal point for many discussions on social media. Netizens have pointed out that despite the easing of inflation rates, the prices of staple foods, such as ‘cai png’, continue to climb, reflecting a troubling disconnect between the official narrative and the reality of consumer experiences. Furthermore, the increase in the Goods and Services Tax (GST) has been identified as a significant contributor to ongoing price hikes, raising concerns about the overall impact on the cost of living for families across various income brackets.

Critics of the reported inflation figures argue that even if the rate of price increases is slowing, it does not translate into lower prices for consumers. The reality is that while certain categories of goods may experience a decrease in prices, essential items that households depend on are still becoming more expensive. This phenomenon highlights the complexity of inflation as a concept, where the easing of rates can coexist with rising costs, complicating financial planning for many families.

Impact of GST and Rising Prices on Household Expenses

The recent hikes in Goods and Services Tax (GST) have significantly influenced the cost of living in Singapore, exacerbating the financial challenges faced by households. Many residents have pointed to the GST increase as a primary driver of rising prices, particularly for essential goods and services. As families budget their household expenses, the added tax burden often leads to difficult choices, especially for lower-income households that already struggle with financial constraints.

Further complicating this issue is the fact that while the GST hike was intended to support government initiatives and infrastructure improvements, its immediate effect has been felt in the form of increased costs for everyday necessities. This has led to frustration among citizens who feel that their financial realities are not being adequately addressed in media reports. Despite the government’s assurances regarding easing inflation rates, many households continue to experience significant financial strain, prompting calls for more transparency and accountability in how inflation data is reported.

Netizens have voiced their concerns over the rising prices of staple foods and household items, questioning the efficacy of current economic policies in alleviating the cost of living crisis. The ongoing debate reflects a broader concern about whether the government’s measures are sufficient to address the realities faced by ordinary Singaporeans. Many feel that despite statistical claims of easing inflation, the continuous rise in prices undermines the purchasing power of households, particularly for those in lower-income brackets.

The economic landscape in Singapore remains challenging, as rising prices and increasing household expenses create a sense of uncertainty for many families. As discussions unfold regarding the impact of GST and inflation, it is clear that residents are seeking more than just reassurances; they are looking for actionable solutions to the cost of living crisis that directly affects their daily lives.

Social Media Reactions to Inflation Claims

The power of social media has brought the ongoing discussions surrounding Singapore’s inflation rates to the forefront, allowing citizens to voice their frustrations and skepticism regarding government claims. Many netizens have taken to platforms like Reddit to express their disbelief at the reported easing of inflation, particularly when their daily experiences tell a different story. This collective skepticism has fueled a narrative questioning the accuracy of media reports and the motivations behind them, with some labeling them as overly optimistic or even propaganda.

Amidst these conversations, the disconnect between reported statistics and real-life experiences has become a source of contention. Netizens highlight that while official figures suggest a decrease in inflation, they still encounter rising prices for essential goods, making it difficult to reconcile these two perspectives. This situation reflects a broader concern about how economic data is communicated and the potential gap between government narratives and the lived realities of the populace.

The ongoing discourse on social media serves as a critical feedback mechanism for policymakers, as citizens demand greater accountability and transparency in how inflation data is presented. By voicing their concerns publicly, netizens are not only advocating for their interests but also shaping the dialogue around economic policy and its implications. This active engagement demonstrates the importance of public perception in shaping economic narratives, particularly in a context where many feel that their voices are not being heard.

As the conversation continues, it is evident that social media will play a crucial role in influencing public opinion and government response to the cost of living crisis. The collective voices of citizens expressing their dissatisfaction may lead to increased scrutiny of economic policies and a push for reforms that better align with the realities faced by everyday Singaporeans.

The Disconnect Between Statistics and Real-Life Experiences

The ongoing debate surrounding Singapore’s inflation rates reveals a significant disconnect between government statistics and the real-life experiences of residents. While the reported figures may indicate a decline in the inflation rate, many Singaporeans are questioning how this can be true when they continue to face rising prices for essential goods. This discrepancy has led to widespread frustration, particularly among lower-income households that are disproportionately affected by increasing costs.

One major concern is the perception that official inflation data does not accurately reflect the financial realities of average families. For instance, while some categories of goods may experience price reductions, essential items that households rely on, such as food and housing, continue to see increases. This situation creates a sense of disillusionment among citizens, who feel that their experiences are being overlooked in favor of a narrative that presents a more favorable economic outlook.

Moreover, this disconnect is further exacerbated by the complexities of inflation as a concept. The idea that inflation can decrease while prices continue to rise is difficult for many to grasp, leading to skepticism about the motives behind such reporting. As citizens seek to navigate their financial challenges, the perception that the government is out of touch with their realities only serves to deepen their frustration.

To bridge this gap, there needs to be a more comprehensive approach to communicating economic data that considers the diverse experiences of different income groups. By acknowledging the challenges faced by households and providing clearer insights into how inflation impacts their daily lives, policymakers can foster greater trust and understanding among the populace.

Economic Policies and Their Effect on Households

As Singapore grapples with economic challenges in 2024, the effectiveness of current economic policies is under scrutiny. Many citizens are questioning whether these policies adequately address the rising cost of living and the persistent inflation that continues to burden households. The government’s approach to managing inflation, including adjustments to the GST and other fiscal measures, has sparked debates about their real-life implications for everyday Singaporeans.

Critics argue that while policymakers may focus on macroeconomic indicators, they often overlook the struggles faced by lower-income households. These families are particularly vulnerable to rising prices, which can severely impact their financial stability. As discussions around economic policies evolve, there is a pressing need for a more inclusive approach that considers the needs and experiences of all citizens, particularly those most affected by inflation.

In response to these concerns, some advocates have called for more targeted measures aimed at alleviating the financial burden on households. This includes proposals for subsidies on essential goods and services, as well as enhanced support for low-income families navigating the complexities of rising costs. By prioritizing the needs of those most impacted by inflation, the government can work towards creating a more equitable economic environment.

Ultimately, the success of economic policies will hinge on their ability to resonate with the realities of everyday life in Singapore. As citizens continue to voice their concerns about the cost of living, it is crucial for policymakers to remain open to feedback and adapt their strategies accordingly. By fostering a collaborative approach to economic management, Singapore can strive to better support all its residents in navigating the challenges ahead.

The Role of Media in Shaping Economic Narratives

The media plays a pivotal role in shaping public perceptions of economic conditions, including inflation and the cost of living. As reports emerge highlighting declining inflation rates and easing pressures on households, citizens are increasingly skeptical about the narratives being presented. Many netizens have taken to social media to challenge these reports, arguing that they do not reflect the realities of rising prices for essential goods, thus calling into question the integrity of economic journalism.

This skepticism is fueled by the perceived disconnect between the statistics reported by the media and the experiences of everyday Singaporeans. As citizens face ongoing financial pressures, they find it difficult to reconcile positive economic reports with their personal experiences of increasing costs. This situation underscores the need for media outlets to provide a more nuanced and comprehensive view of the economic landscape, rather than solely focusing on aggregate statistics.

Moreover, the role of media in shaping economic narratives extends beyond reporting; it also influences public discourse and policy responses. As netizens share their opinions and experiences online, they contribute to a broader conversation that can impact decision-makers. This dynamic interaction between media narratives and public sentiment highlights the importance of responsible journalism that accurately represents the complexities of economic conditions.

As the dialogue around inflation and the cost of living continues to evolve, it is essential for media outlets to prioritize transparency and accountability in their reporting. By doing so, they can help foster a more informed public and contribute to constructive discussions about economic policies and their real-life implications for citizens.

The Future of Inflation in Singapore

Looking ahead to the future of inflation in Singapore, many analysts and citizens alike are pondering the potential trajectory of the economy. With the inflation rate reported at 2.4% in 2024, there are hopes for continued stabilization. However, the persistent rise in prices for essential goods raises questions about whether this rate will remain sustainable in the long term. As economic conditions shift, it is crucial for policymakers to remain vigilant and responsive to changing circumstances.

The outlook for inflation will depend on a myriad of factors, including global economic trends, domestic policies, and consumer behavior. As Singapore integrates itself within the global economy, fluctuations in international markets may influence local inflation rates. Additionally, ongoing discussions about the impact of GST and other fiscal measures will play a critical role in shaping consumer perceptions and spending habits.

For households, the future of inflation is a pressing concern, as rising prices continue to erode purchasing power. Many families are looking for assurances from the government regarding measures to mitigate the impact of inflation on their cost of living. As discussions unfold, it is vital for authorities to consider the voices of citizens and implement policies that prioritize economic stability and support for vulnerable populations.

Ultimately, the future of inflation in Singapore hinges on the ability of both the government and citizens to navigate the complexities of the economic landscape together. By fostering open dialogue and collaboration, Singapore can strive towards an economic environment that is resilient and responsive to the needs of all its residents.

Frequently Asked Questions

What is the inflation rate in Singapore for 2024 and how does it affect the cost of living?

In 2024, Singapore’s inflation rate is reported at 2.4%, a decrease from 6.1% in 2022. However, many households are still feeling the pinch as the cost of living remains high, particularly with rising prices for essential goods and services.

How are rising prices in Singapore impacting household expenses in 2024?

Despite the reported easing of inflation in 2024, many households in Singapore continue to face rising prices, especially for food and essential services. This ongoing increase in household expenses has led to concerns about the real impact of inflation on everyday life.

What role does GST play in the rising prices amid Singapore’s inflation in 2024?

The recent Goods and Services Tax (GST) hikes in Singapore are a significant factor contributing to the rising prices even as the inflation rate shows a decrease. Many believe that the GST increase exacerbates the cost of living, making essential goods more expensive.

Are lower-income households more affected by inflation in Singapore in 2024?

Yes, lower-income households in Singapore reported an inflation increase of 2.7% in 2024, which is higher than the overall inflation rate. This highlights the disproportionate impact of rising prices on those with limited financial resources.

What are netizens saying about the portrayal of inflation in Singapore’s media in 2024?

Many netizens are skeptical about media reports claiming easing inflation in Singapore for 2024. They argue that the disconnect between reported statistics and the reality of rising prices for staple goods indicates a potential bias in the portrayal of the economic situation.

How have essential goods prices changed despite the reported decrease in inflation for 2024?

Even with the inflation rate in Singapore reported at 2.4% in 2024, prices for essential goods, particularly food items, have continued to rise. This ongoing increase in prices has frustrated many households who feel the burden of higher costs.

What categories of goods have seen price decreases in Singapore in 2024?

In 2024, some categories such as vehicles and certain food items have seen price decreases, contributing to the overall lower inflation rate. However, essential services and goods still face price increases, affecting the cost of living.

Is the easing of inflation in Singapore indicative of lower prices for consumers?

No, the easing of inflation does not necessarily mean that prices are lower. It indicates a slower rate of price increases, meaning consumers may still experience higher costs for essential goods and services despite lower inflation rates.

| Key Points | Details |

|---|---|

| Inflation Rate Decrease | Singapore’s inflation rate reportedly decreased to 2.4% in 2024 from 6.1% in 2022. |

| Public Skepticism | Netizens express doubt over the reported decline, asserting that it disconnects from their cost of living experiences. |

| Essential Goods Prices | Prices for essential goods, particularly food, continue to rise despite claims of easing inflation. |

| Impact on Households | Lower-income households reported a 2.7% increase in inflation, adding to financial stress. |

| Social Media Reactions | Criticism of media portrayal of inflation as overly optimistic, with many taking to social platforms to voice concerns. |

| GST Hikes | Recent Goods and Services Tax hikes are cited as a contributor to rising prices despite decreasing inflation rates. |

| Housing Costs | Homeowners are struggling with loan repayments amidst claims of easing inflation. |

| Diverse Views | While some defend the media report, many emphasize that it does not reflect universal price decreases. |

Summary

Singapore inflation 2024 has sparked significant debate among citizens, who are questioning the reported decrease in the inflation rate amidst persistent increases in essential goods prices. While official statistics suggest a decline in inflation, the reality for many households remains challenging, with rising costs of living creating a noticeable disconnect. The ongoing discussions reflect a broader concern over the validity of reported figures, as many feel that despite slower inflation rates, their everyday expenses continue to climb. This scenario highlights the importance of aligning statistical data with real-life economic experiences to better understand the true state of inflation in Singapore.