The Dow Jones Industrial Average is a crucial benchmark in the world of finance, representing 30 of the largest and most influential companies in the United States. As traders analyze its movements, understanding the Dow 30 can unlock numerous trading opportunities and strategies, particularly in a bullish or bearish market. Recent market trends indicate that the Dow may be approaching significant resistance levels, prompting a fresh Dow 30 analysis among investors. With the potential for both upward and downward movements, savvy traders are keen to explore effective US30 trading strategies to capitalize on price fluctuations. By keeping a close eye on key metrics, including critical support and resistance zones, traders can make informed decisions that align with their investment goals.

The Dow Jones Index, often referred to as the DJIA, serves as a barometer for the overall health of the US stock market, encompassing a diverse range of industries. Investors frequently engage in thorough analysis of the Dow 30 stocks to uncover viable trading opportunities, particularly in the context of prevailing market trends. As the index approaches pivotal resistance points, traders must be vigilant in identifying bullish and bearish signals to navigate their strategies effectively. The dynamics of the US30 market can yield valuable insights, guiding traders toward informed decisions that align with their risk profiles and market predictions. By leveraging analytical tools and market indicators, participants in the financial landscape can optimize their approach to trading the DJIA.

Understanding Dow Jones Industrial Average Trading Opportunities

The Dow Jones Industrial Average (DJIA), commonly referred to as the Dow 30, serves as a crucial indicator of the US stock market’s health. As traders analyze the DJIA, they discover various trading opportunities that arise from its fluctuations. These opportunities can be capitalized on using effective US30 trading strategies that factor in both bullish and bearish market trends. For instance, as the index approaches resistance levels, traders might look to execute sell positions, while at support levels, bullish strategies might be employed to maximize returns.

Consequently, understanding the dynamics of the Dow 30 is vital for making informed trading decisions. The index’s movements are often influenced by economic news, corporate earnings reports, and geopolitical events. Therefore, traders should remain vigilant and continuously analyze market conditions to identify favorable trading opportunities within the DJIA. By focusing on critical price levels and patterns, traders can enhance their strategies and adapt quickly to changing market environments.

Bullish and Bearish Market Strategies for Dow 30

Navigating the Dow 30 requires a firm grasp of both bullish and bearish market strategies. In a bullish scenario, traders look for signs of upward momentum, often indicated by support levels and positive market sentiment. For example, if the DJIA retests a significant support level, traders may initiate long positions, anticipating a rise towards higher targets, such as the projected **50,000** mark. This approach relies on technical indicators like RSI and MACD to confirm the strength of the uptrend.

Conversely, in a bearish market, traders must be prepared to shift their strategies accordingly. The recent analysis suggests potential sell trades around **44,600**, where bearish patterns have emerged. Understanding these patterns is crucial for capitalizing on market corrections. By assessing resistance levels and market dynamics, traders can effectively navigate both bullish and bearish trends, ensuring they make the most of trading opportunities presented by the Dow 30.

Identifying Key Resistance and Support Levels in US30

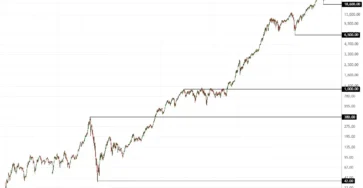

Identifying key resistance and support levels is essential for successful trading in the Dow Jones Industrial Average. Resistance levels, such as the critical threshold at **46,667.3**, act as barriers where price movements may reverse. Traders should watch for breakout patterns that indicate a sustained bullish movement beyond these levels. Recognizing these zones allows traders to set strategic entry and exit points, maximizing potential profits while minimizing risks.

On the flip side, support levels like **45,015.5** and **43,200** provide crucial insight during downward corrections. Traders can look for buying opportunities when the market approaches these support lines, especially if accompanied by bullish signals from technical indicators. By effectively identifying and analyzing these market zones, traders can enhance their trading strategies and respond to market fluctuations with confidence.

The Impact of Market Sentiment on Dow 30 Trading

Market sentiment plays a significant role in shaping trading strategies for the Dow Jones Industrial Average. Positive sentiment can lead to bullish trades, while negative sentiment may prompt traders to adopt bearish strategies. As the DJIA nears its all-time high, traders must gauge market sentiment accurately to make informed decisions. For instance, if the market sentiment shifts to bearish, it may be wise to consider selling positions, especially when approaching identified resistance levels.

Conversely, a strong positive sentiment can indicate potential buying opportunities as the index rises. Keeping a pulse on market news and economic indicators helps traders anticipate shifts in sentiment, allowing them to adjust their strategies accordingly. By understanding the impact of market sentiment on the Dow 30, traders can navigate the complexities of trading and optimize their approaches to take advantage of prevailing market conditions.

Utilizing Technical Analysis for Dow 30 Trading

Technical analysis is a powerful tool for traders looking to navigate the Dow Jones Industrial Average. By analyzing historical price movements, patterns, and technical indicators, traders can forecast potential future movements of the DJIA. For example, indicators like RSI and MACD provide insights into market momentum and can signal when to enter or exit trades. Utilizing these tools effectively can enhance trading strategies and increase the likelihood of capturing profitable trades.

Moreover, incorporating Fibonacci retracement levels can further refine trading decisions. These levels help traders identify potential reversal points in the market, particularly when the DJIA approaches significant resistance or support levels. By combining these technical analysis methods, traders can develop a comprehensive trading plan that aligns with current market conditions, ultimately leading to more informed and strategic trading in the Dow 30.

Risk Management Strategies for US30 Traders

Risk management is an essential component of trading the Dow Jones Industrial Average. Given the volatility of the US30, traders must implement strategies to protect their capital while maximizing potential returns. Setting stop-loss orders at strategic levels can help mitigate losses when trades do not go as anticipated. Additionally, diversifying trading positions across various sectors within the index can reduce overall risk.

Moreover, traders should continuously assess their risk tolerance and adjust their strategies accordingly. This includes determining the appropriate position size for each trade based on the risk involved. By prioritizing risk management, traders can navigate the ups and downs of the Dow 30 more effectively, ensuring they remain in the market for the long haul.

Market News and Its Influence on Dow 30 Trading

Staying updated with market news is crucial for traders dealing with the Dow Jones Industrial Average. Economic reports, corporate earnings, and geopolitical events can significantly impact the DJIA’s movements. For instance, positive economic data might lead to bullish market sentiment, encouraging traders to take long positions on the index. Conversely, negative news can prompt a shift towards bearish strategies, especially if it affects key companies within the Dow.

Traders should actively follow financial news platforms and market analysts to gauge the potential effects of news on the Dow 30. By being informed, traders can better anticipate market reactions and position themselves advantageously. Incorporating this knowledge into their trading strategies allows traders to make timely decisions that align with ongoing market developments.

Long-Term vs. Short-Term Trading Strategies for Dow 30

When trading the Dow Jones Industrial Average, it’s important to consider the difference between long-term and short-term strategies. Long-term traders focus on the overall trend and fundamental factors that influence the DJIA, often holding positions for extended periods. This approach requires patience and a deep understanding of the market’s long-term outlook, allowing traders to benefit from significant upward movements.

In contrast, short-term traders seek to capitalize on immediate market fluctuations, employing strategies that focus on quick trades and technical analysis. This can involve using tools like candlestick charts and momentum indicators to make rapid trading decisions. Understanding the differences between these approaches allows traders to choose the strategy that best fits their trading style and market conditions, optimizing their chances of success in the Dow 30.

Evaluating Historical Performance of the Dow Jones Industrial Average

Evaluating the historical performance of the Dow Jones Industrial Average can provide valuable insights for traders. Analyzing past trends, price movements, and market reactions to various economic events allows traders to identify patterns that may repeat in the future. For instance, understanding how the DJIA reacted during previous economic recessions can help traders anticipate potential market corrections and adjust their strategies accordingly.

Additionally, historical performance can guide traders in setting realistic profit targets and stop-loss levels. By studying previous support and resistance levels, traders can make more informed decisions about where to enter and exit trades. This historical context enhances a trader’s ability to navigate the current market landscape, especially in a volatile environment like the Dow 30.

Frequently Asked Questions

What are the best US30 trading strategies for maximizing returns on the Dow Jones Industrial Average?

To maximize returns on the Dow Jones Industrial Average (US30), traders should consider strategies like identifying bullish reversal levels and leveraging support zones for entry points. Monitoring market resistance levels, such as the critical threshold around 46,667.3, can also provide insights into potential breakout opportunities.

How does the Dow 30 analysis help in identifying trading opportunities in a bullish or bearish market?

The Dow 30 analysis aids traders by highlighting key resistance and support levels, alongside momentum indicators like RSI and MACD. This analysis allows traders to identify potential bullish and bearish trends, enabling them to make informed decisions on when to enter or exit trades.

What are the current resistance levels for the Dow Jones Industrial Average and how do they affect trading opportunities?

Current resistance levels for the Dow Jones Industrial Average are around 46,667.3. Monitoring these levels is crucial as they can indicate potential selling pressure. Traders can capitalize on these resistance points by planning sell trades if the market shows signs of reversal.

Are there any bullish signs in the current Dow Jones Industrial Average market that traders should watch for?

Yes, traders should watch for bullish signs such as a potential retest of support levels, particularly around 45,015.5. If the market holds above these support levels, it may signal a buying opportunity, with future price targets potentially reaching 50,000.

What bearish patterns are currently observed in the US30 and what should traders be aware of?

Currently, bearish patterns have been identified around the 44,600 mark, where RSI and MACD indicate weakening momentum. Traders should consider selling opportunities if the market approaches this level, taking advantage of possible corrections.

How can Fibonacci levels be used to enhance trading strategies for the Dow Jones Industrial Average?

Fibonacci levels can enhance trading strategies for the Dow Jones Industrial Average by providing critical levels of support and resistance. Traders can use these levels to identify potential reversal points, facilitating better entry and exit strategies based on market movements.

What should traders consider when developing US30 trading strategies in a volatile market?

In a volatile market, traders should prioritize risk management and stay informed about market updates. It’s essential to balance between bullish and bearish strategies, leveraging technical analysis to adapt to changing market conditions.

How can traders determine the best entry points for long trades in the Dow 30?

Traders can determine the best entry points for long trades in the Dow 30 by looking for bullish reversal levels and confirming these with the analysis of support lines. A retest of lower support levels could signal a favorable buying opportunity.

| Key Points | |

|---|---|

| Market Closing Price: US30 | 44,533.8 R USD |

| Market Movement: Change and Percentage | −349.8 (−0.78%) |

| Current Analysis | The Dow 30 nears its all-time high, suggesting potential trading opportunities with risk management strategies. |

| Bullish Reversal Level | 44,400 |

| Resistance Level | 46,667.3 |

| Support Level | 45,015.5, with targets down to 43,200 |

| Trading Sentiment | Mixed; some suggest selling while others predict upward movements. |

Summary

The Dow Jones Industrial Average is currently at a critical juncture, nearing its all-time high and creating various trading opportunities. This market behavior reflects the volatility and mixed sentiments among traders, prompting a careful approach to both bullish and bearish strategies. As the market evolves, maintaining a disciplined trading plan and being informed of the latest market conditions is essential for maximizing potential returns while managing risks.