The Singapore CPF Contribution system is a vital part of the nation’s social security framework, designed to promote financial stability among its citizens. As we approach the updates for 2025, it is crucial for both employees and employers to understand the implications of the new CPF contribution rates and account structures. With contributions calculated as a percentage of wages, these changes will directly impact how much individuals save for retirement, healthcare, and housing. The recent adjustments include a raised Ordinary Wage ceiling and revised interest rates that will benefit CPF account holders. Staying informed about CPF updates 2025 is essential for maximizing savings and ensuring compliance with the latest regulations.

In Singapore, the Central Provident Fund (CPF) serves as a mandatory savings scheme that supports the financial well-being of its workforce. The CPF system encompasses various elements, including employer-employee contributions, account structures tailored for specific financial needs, and the latest updates on contribution rates. As we look ahead to the forthcoming changes in 2025, understanding the dynamics of CPF contributions is crucial for both employees and employers alike. This initiative aims to bolster Singapore’s social security finances while enhancing the retirement savings landscape for all citizens. By grasping the nuances of these updates, stakeholders can navigate the evolving financial environment more effectively.

Understanding Singapore CPF Contribution Rates for 2025

In 2025, significant changes to the Singapore CPF contribution rates will come into effect, especially for Ordinary Wages (OW). The OW ceiling will be increased to SGD 7,400, allowing higher contributions from both employers and employees. This adjustment is part of the government’s initiative to enhance the social security framework, ensuring that employees benefit from increased savings for retirement, healthcare, and housing. With the new rates, employers will need to adjust their payroll systems to accommodate these changes, ensuring compliance with the updated CPF regulations.

The CPF contribution rates are crucial not just for individual savings, but also for the overall economic stability of Singapore. With gradual increases in contribution rates, employees will find themselves better prepared for retirement, allowing them to accumulate more savings over time. As the government aims for a sustainable social security system, both employees and employers must stay informed about these adjustments and understand their implications for financial planning.

2025 CPF Updates: Changes to Account Structures and Allocations

As of January 2025, the CPF account structure will see revised allocations, particularly for senior workers. The adjustments made to the Special Account (SA) will now see balances being transferred to the Retirement Account (RA) for those aged 55 and above. This strategic move is designed to enhance retirement payouts, ensuring that seniors have adequate resources as they transition into retirement. The changes reflect a growing recognition of the need for targeted support for older workers in Singapore.

In addition to the account transfers, the interest rates on CPF savings are set to increase, with the Special, MediSave, and Retirement Accounts offering an attractive 4.14% return starting in the fourth quarter of 2024. This enhancement is especially beneficial for those planning their retirement, as it encourages individuals to save more in their CPF accounts. Overall, the updates for 2025 aim to strengthen the CPF’s role in promoting financial security among Singaporeans.

Employer and Employee Responsibilities in CPF Contributions

Both employers and employees play crucial roles in the CPF contribution system in Singapore. Employers are mandated to contribute a percentage of their employees’ salaries to the CPF, with the recent updates for 2025 increasing the overall contribution rates. This shared responsibility not only benefits employees by bolstering their retirement savings but also reinforces the importance of social security within the workforce. Employers must ensure that they comply with the latest regulations to avoid penalties and provide their employees with the full benefits of their contributions.

The employee’s share of CPF contributions is automatically deducted from their salary, making it a seamless process. Employees should be aware of their contribution rates and how they impact their total CPF savings. Understanding the breakdown of contributions can empower employees to take charge of their financial future. With the increased contribution rates and updated account structures, both parties will need to engage actively in discussions about financial planning and the long-term benefits of the CPF system.

Key Changes in CPF Contribution Rates for 2025

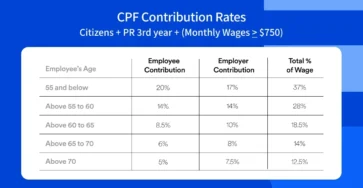

The 2025 CPF contribution rates reflect a comprehensive overhaul aimed at enhancing savings for Singaporeans. For employees earning above SGD 750 monthly, the contribution rates vary significantly across age groups. For instance, employees aged 55 and below will see a total contribution rate of 37%, split between employer and employee contributions. These strategic adjustments are designed to incentivize higher savings and reflect the government’s commitment to strengthening the CPF system.

Additionally, the contribution rates for older workers are also being adjusted, recognizing the changing needs of the workforce as employees age. For those above 60, the rates drop to 23.5%, which balances the need for employers to manage costs while still fulfilling their social responsibility. These changes underscore the importance of adapting to demographic shifts and ensuring that all workers, irrespective of age, are adequately supported through the CPF contributions.

Calculating CPF Contributions: A Step-by-Step Guide

Calculating CPF contributions accurately is essential for both employers and employees. The process begins with determining the total CPF contribution, which requires knowledge of both Ordinary Wages (OW) and Additional Wages (AW). Employers need to ensure that they are not exceeding the OW ceiling of SGD 7,400 per month when computing contributions. Following this, they should calculate the employee’s share, which is then deducted from their gross salary, ensuring clarity and transparency in payroll processing.

For mixed payments that include both OW and AW, it is vital to compute the contributions separately for each type of wage. This detailed calculation allows for a precise understanding of how much is being contributed to the CPF and helps employees appreciate the benefits accruing from their savings. Additionally, utilizing tools like the CPF Contribution Calculator can streamline this process, making it easier for employers to maintain compliance and for employees to track their contributions.

The Role of CPF in Singapore’s Social Security System

The CPF plays a pivotal role in Singapore’s social security landscape, serving as a comprehensive savings scheme that addresses retirement, healthcare, and housing needs. By mandating contributions from both employers and employees, the CPF system ensures that all citizens and permanent residents have a safety net to rely on during their later years. The updates for 2025 further reinforce this commitment, as the government continues to enhance the framework to provide adequate support for its citizens.

With the CPF’s structured approach to savings, individuals can build a robust financial foundation that is essential for long-term stability. The government’s focus on improving contribution rates and account allocations reflects a proactive stance towards managing social security finances in Singapore. As the population ages, the CPF system will be critical in ensuring that seniors have the necessary resources to maintain their quality of life.

Navigating CPF Updates: What Employers Need to Know

As the CPF regulations evolve, employers must stay informed about updates that affect their obligations. The increase in OW ceilings and adjustment of contribution rates require employers to reassess their payroll systems and ensure compliance with the latest guidelines. It is essential for employers to keep abreast of these changes to avoid any potential penalties and to ensure that their employees are receiving their rightful contributions.

Moreover, employers should be proactive in educating their workforce about these changes, including how the adjustments to the CPF account structures and interest rates will impact their savings. By fostering a culture of understanding and transparency, employers can enhance employee satisfaction and loyalty while contributing to a more financially literate workforce.

The Impact of CPF Contribution Changes on Retirement Planning

The adjustments to CPF contribution rates and account structures have significant implications for retirement planning in Singapore. As employees begin to see higher contributions to their CPF accounts, they can also expect more substantial savings over time. This is particularly crucial as retirement approaches, as adequate savings are essential to maintain a comfortable lifestyle post-retirement. Employees should take this opportunity to reassess their financial plans and consider how these changes can work in their favor.

Additionally, the increased interest rates on CPF accounts provide an added incentive for employees to maximize their contributions. Understanding how these contributions work in conjunction with other retirement savings options can empower individuals to create a comprehensive retirement strategy. By leveraging the CPF system effectively, Singaporeans can ensure they are well-prepared for their retirement years.

Future Outlook for CPF Contributions and Reforms

Looking ahead, the CPF system is likely to continue evolving in response to changing demographics and economic conditions. The government is committed to reviewing and adjusting contribution rates and policies to ensure that they meet the needs of all Singaporeans. As the population ages and the workforce dynamics shift, it is essential to adapt the CPF framework to provide sustainable support for future generations.

Furthermore, ongoing reforms will likely focus on enhancing financial literacy among citizens, ensuring they are well-informed about their CPF contributions and the benefits they can derive from the system. By fostering a culture of proactive financial planning and engagement, Singapore can maintain a robust social security system that effectively supports its population.

Frequently Asked Questions

What are the new CPF contribution rates for 2025 in Singapore?

In 2025, Singapore’s CPF contribution rates have been revised for employees earning above $750 monthly. For those aged 55 and below, the total contribution rate is 37%, with the employer contributing 17% and the employee contributing 20%. The rates decrease for older age groups, reflecting the phased retirement support.

How does the increase in the Ordinary Wage ceiling affect CPF contributions in 2025?

The Ordinary Wage ceiling has been raised to SGD 7,400 in 2025, impacting CPF contributions by ensuring that contributions are calculated only on the first SGD 7,400 of an employee’s monthly salary. This increase allows for higher contributions towards retirement and social security.

What changes have been made to the CPF account structure in 2025?

In 2025, the CPF account structure remains the same, consisting of four accounts: Ordinary Account (OA), MediSave Account (MA), Special Account (SA), and Retirement Account (RA). However, adjustments to the allocation of funds for senior workers will see balances from the SA transferred to the RA, enhancing retirement security.

How are CPF contributions calculated for employees in Singapore?

To calculate CPF contributions, first determine the total wages (Ordinary and Additional Wages) for the month. Apply the respective contribution rates based on age and wage type, rounding where necessary. Utilize the CPF Contribution Calculator for precise calculations, especially for mixed payments.

What are the implications of CPF updates in 2025 for employers in Singapore?

Employers in Singapore must adapt to the updated CPF contribution rates for 2025, including the increased Ordinary Wage ceiling of SGD 7,400. This change requires employers to adjust their payroll systems to ensure accurate contributions, which are mandatory for all employees earning above SGD 50 per month.

What benefits do CPF contributions provide for employees in Singapore?

CPF contributions help employees save for retirement, healthcare, and housing. The contributions are allocated to different accounts designed for specific purposes, allowing employees to build financial security and stability throughout their lives.

Are there any additional interest rates for CPF accounts in 2025?

Yes, in 2025, the interest rates for CPF accounts remain competitive. The interest rate for Special, MediSave, and Retirement Accounts has increased to 4.14%, with additional interest based on age and CPF balance: 1% for the first SGD 60,000 for those below 55, and 2% for the first SGD 30,000 for those aged 55 and above.

How do CPF contributions for Additional Wages work in Singapore?

CPF contributions for Additional Wages (AW) are calculated based on an annual ceiling, which is the difference between the CPF annual salary ceiling of SGD 102,000 and the total Ordinary Wages already subjected to CPF contributions for the year. This ensures that any bonuses or commissions are appropriately included in the CPF savings.

What is the purpose of the CPF Retirement Account in Singapore?

The CPF Retirement Account (RA) is designed to provide monthly payouts during retirement. It is created when a member turns 55 and combines funds from the Ordinary Account and Special Account to ensure financial support in old age.

Where can I find more information about the Singapore CPF Contribution updates?

For more information on CPF contribution updates, including the new rates and account structures for 2025, visit the official CPF website or follow relevant news channels for the latest announcements and detailed guidelines.

| Key Points | Details |

|---|---|

| CPF Contribution Overview | The Central Provident Fund (CPF) is a mandatory savings scheme in Singapore aimed at providing financial stability for retirement, healthcare, and housing. |

| Contribution Types | Ordinary Wages (OW) and Additional Wages (AW) are the two types of contributions, with OW capped at SGD 7,400 in 2025. |

| Account Structure | The CPF consists of four accounts: Ordinary Account (OA), MediSave Account (MA), Special Account (SA), and Retirement Account (RA), each serving different financial needs. |

| Employer/Employee Responsibilities | Both employers and employees must contribute to the CPF, with contributions compulsory for Singapore Citizens and PRs earning above SGD 50 monthly. |

| Updates for 2025 | The OW ceiling is raised to SGD 7,400, and interest rates for CPF accounts have been increased, along with adjustments for senior workers. |

| Contribution Rates | Total contribution rates vary by age group, with different percentages for employees earning above SGD 750 monthly. |

| Calculation Method | Accurate CPF contributions can be calculated by determining total contributions, employee’s share, and employer’s share using a calculator. |

Summary

Singapore CPF Contribution is crucial for ensuring financial security for employees in their retirement years. With updated contribution rates and new ceilings set for 2025, both employees and employers must stay informed about their responsibilities in contributing to the CPF. The structured accounts within the CPF system serve distinct purposes, helping individuals save for healthcare, housing, and retirement effectively. Understanding these changes will empower Singaporeans to optimize their savings and secure a more stable financial future.